The Environment Ministry has established the National Designated Authority (NDA) to govern carbon trading, a requirement under Article 6 of the Paris Agreement. The new framework will incentivize industries to reduce emissions by allowing them to trade carbon credits, linking economic growth with environmental responsibility. This development demonstrates India's proactive stance on climate action.

Copyright infringement not intended

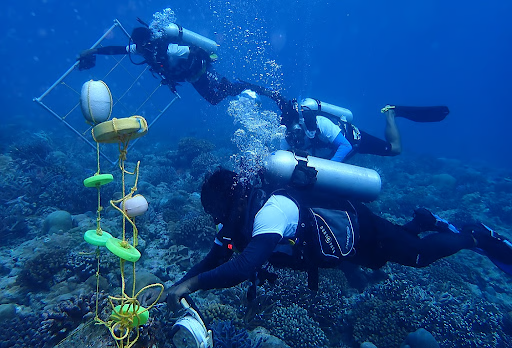

Picture Courtesy: THE HINDU

The Ministry of Environment, Forest and Climate Change has announced a ‘National Designated Authority (NDA),’ a mandatory requirement under the provisions of the 2015 Paris Agreement to enable a carbon emissions trading regime.

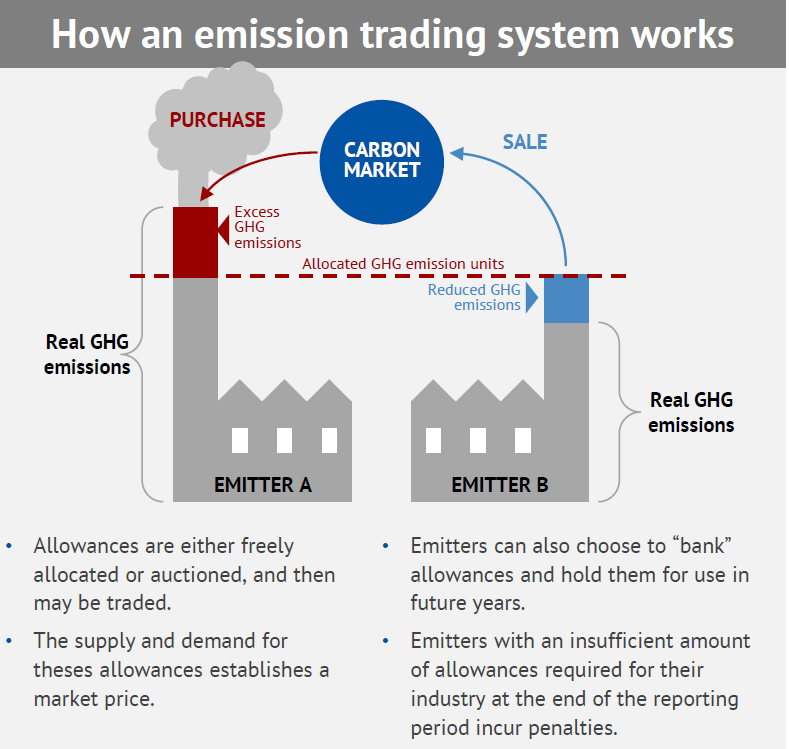

A carbon credits market is a trading system where standardized, certified units representing emissions reductions are bought and sold.

It provides a financial incentive for companies, governments, and individuals to reduce greenhouse gas (GHG) emissions.

By putting a price on carbon, the market encourages investment in cleaner technologies and sustainable practices.

| CARBON CREDITS MARKET |

Kyoto Protocol (1997): Introduced the first international market mechanisms, including the Clean Development Mechanism (CDM), Joint Implementation (JI), and Emissions Trading.

Paris Agreement (2015): Countries now set their own Nationally Determined Contributions (NDCs), and carbon markets help them achieve these goals more flexibly. Article 6 establishes a framework for international cooperation, including:

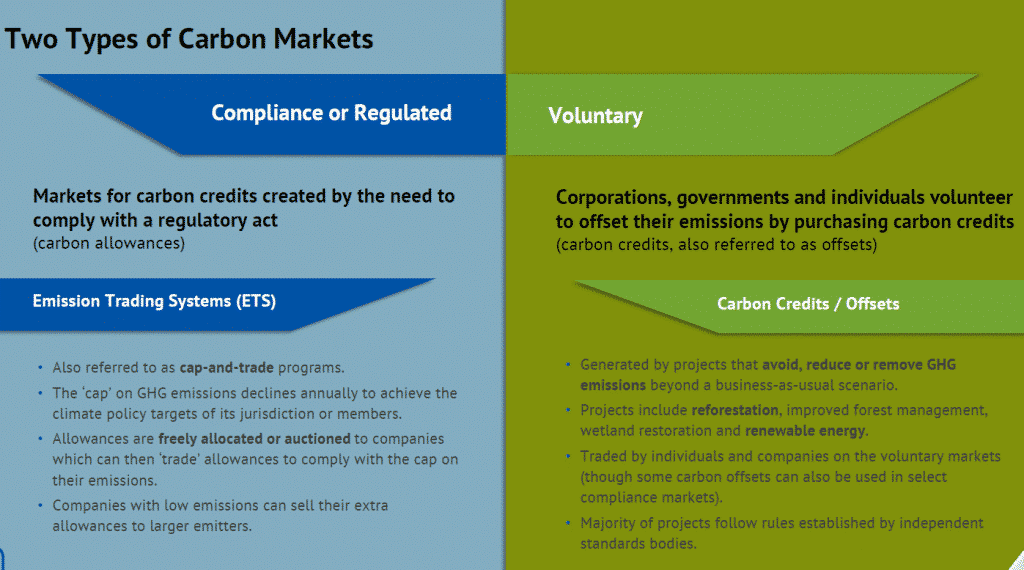

Voluntary Carbon Markets (VCMs): Companies and individuals voluntarily purchase credits to offset emissions.

Voluntary Carbon Markets (VCMs): Companies and individuals voluntarily purchase credits to offset emissions.

According to the World Bank's "State and Trends of Carbon Pricing 2025" report, Carbon pricing mechanisms, including taxes and emissions trading systems (ETSs), now cover nearly 28% of global GHG emissions and generate over $100 billion in revenue annually.

Indian carbon market

Indian carbon market

CDM Supplier: During the Kyoto Protocol era, India was a major supplier of CDM credits to international markets, but faced challenges similar to the CDM program globally.

Perform, Achieve, and Trade (PAT) Scheme: Operated by the Bureau of Energy Efficiency (BEE), under Ministry of Power, focus on energy efficiency in energy-intensive industries, using tradable Energy Saving Certificates (ESCerts).

Energy Conservation (Amendment) Act, 2022: Provided the legal basis for the Indian Carbon Market (ICM) by adding new clauses to the Energy Conservation Act 2001.

Carbon Credit Trading Scheme (CCTS), 2023: Notified under the 2022 Act, it replaced the PAT scheme, and establishes domestic carbon market.

Green Credit Programme (GCP): The Ministry of Environment launched the GCP in 2023. It rewards voluntary environmental actions, such as tree plantation and water conservation, with 'green credits'.

Ministry of Environment, Forest and Climate Change officially announced the NDA in August 2025. This step aligns India's institutional framework with the requirements of Article 6 of the Paris Agreement.

Composition: 21-member body, chaired by the Secretary of the Environment Ministry. It includes representatives from key ministries and NITI Aayog, to ensure comprehensive oversight.

Responsibilities:

The CCTS is a key instrument to drive the transition towards climate goals, including achieving net-zero emissions by 2070 and a 45% reduction in Greenhouse Gas (GHG) emissions by 2030 (from 2005 levels).

India’s carbon market creates new financial opportunities, with an estimated value of $1.2 billion, allowing industries to earn and sell carbon credits, supports decarbonization efforts and promotes investments in renewable energy.

The European Union's Carbon Border Adjustment Mechanism (CBAM) has pushed India to develop a national carbon market, for ensuring exports remain competitive by meeting international carbon standards, especially in high-emission sectors like steel and cement.

Carbon market incentivizes industries to invest in and adopt cleaner technologies. Supporting start-ups and Small and Medium-sized Enterprises (SMEs) focused on climate solutions can drive innovation and create new business opportunities.

When inclusively designed, carbon markets can be powerful tools for social equity and environmental justice.

Investing in education and training programs is crucial to develop a skilled workforce for the effective implementation and management of the CCTS.

Limited Effectiveness of PAT: According to the Centre for Science and Environment (CSE), the PAT scheme, while well-intentioned for energy efficiency, "faced several shortcomings in implementation" and "achieved marginal emissions reduction"

Exclusion of Major Emitters: Key sectors such as thermal power, which contributes nearly 40% of India’s GHG emissions,are excluded under the CCTS.

Weak and Unambitious Emission Reduction Targets: Targets for some sectors, like cement (3.4% reduction over two years), are considered insufficient to meet long-term climate goals, delaying necessary decarbonization efforts.

Inflated Claims and Overestimation of Reductions: Many carbon projects, particularly in forestry and agriculture, rely on predictions from satellite data or estimations that have significant errors, leading to an overestimation of actual emission reductions.

Uneven Benefits for Communities: Many carbon offset projects in India, such as afforestation, do not adequately benefit local communities.

Climate Risks: Carbon credits are not permanent if carbon-sequestering assets, like forests, are destroyed (e.g., by natural disasters like Cyclone Tauktae in 2021), leading to the release of stored carbon and invalidation of credits.

Social and Economic Impacts: Transition to a low-carbon economy must be equitable and inclusive, considering the social and economic impacts on workers, communities, and vulnerable populations.

Challenges for MSMEs: MSMEs face high compliance costs, inadequate financial support, and a lack of technical capacity, making their participation in the carbon market difficult and potentially exclusionary.

No Revenue Generation Mechanism: Unlike many global ETS schemes (eg EU) that auction allowances to fund decarbonization, the "Indian Carbon Market model does not currently propose any form of auctioning of allowances.

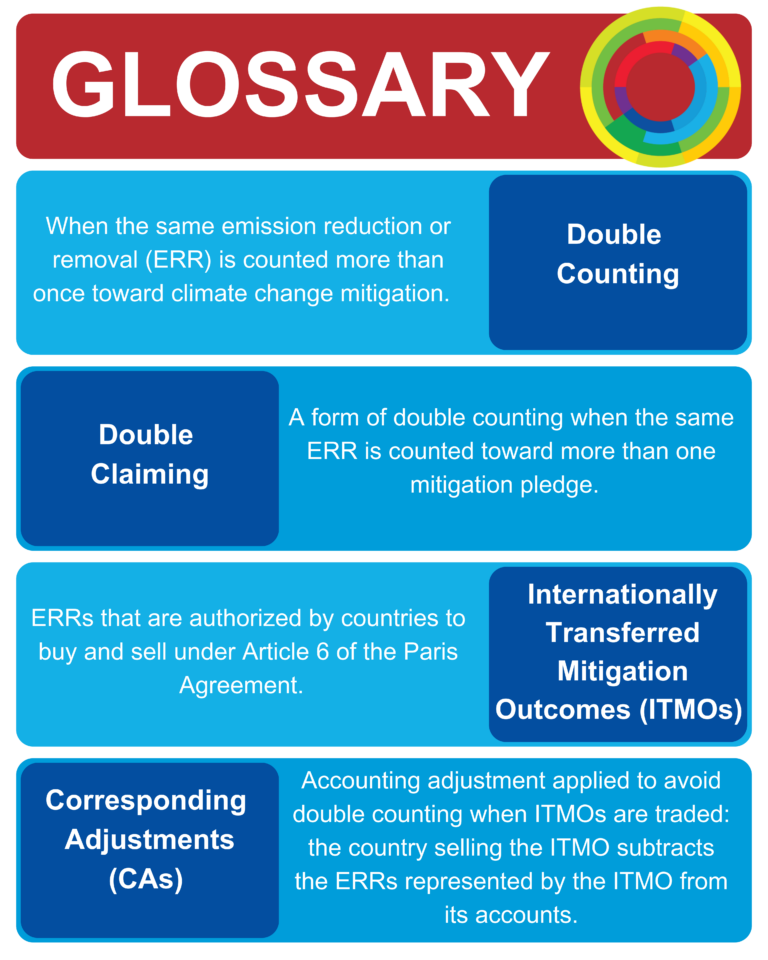

Offset Credits and Integrity: While CCTS include offset market credits, concerns exist regarding "offset surges and integrity issues," as seen in the EU-ETS. The potential for "double counting among different upcoming credit systems" also poses risks.

Institutional Coordination: Involvement of multiple ministries (Environment, Power) and agencies (BEE, CERC, Grid-India) create complexity, requires strong coordination to avoid bureaucratic delays and ensure consistent policy implementation.

Environmental Integrity: Ensuring genuine, additional emission reductions remains a challenging task. Robust rules are necessary to prevent double-counting of credits and greenwashing.

Environmental Responsibility: Carbon credits should be promoted as a duty to the planet rather than just a tradable commodity, to prevent industries from delaying their transition to renewable energy sources.

Inclusion of Thermal Power Sector: Include the thermal power sector, which contributes nearly 40% of India’s GHG emissions, in the carbon market scheme, to ensure progress towards India's Nationally Determined Contributions (NDCs).

Market Integrity and Transparency: Strengthen MRV systems to ensure the credibility of carbon credit projects through real-time tracking, to expose inflated baselines and improve market transparency.

Adopt emerging Technology: Blockchain technology can enhance transparency and security in carbon credit trading.

Data Integrity and Transparency: Develop robust methodologies to accurately measure and report emissions.

Addressing Social and Environmental Impacts: Transition to a low-carbon economy "should be equitable and inclusive," considering impacts on workers, communities, and vulnerable populations.

Encouraging Innovation and Entrepreneurship: Supporting climate-focused start-ups and SMEs can "drive innovation and create new business opportunities."

Green Financial Instruments: Developing instruments like green bonds and climate-focused venture capital funds, can mobilise capital for low-carbon projects.

Role of Civil Society: Civil society organisations can play a crucial role in monitoring and advocating for the integrity of the carbon market, providing data, educating communities, and enhancing accountability.

Regulatory Frameworks for MSMEs: SEBI’s Business Responsibility and Sustainability Report (BRSR) Core framework ensures sustainability within corporate strategies, mandating Environmental, Social, and Governance (ESG) disclosures, encourage MSMEs to adopt a similar sustainable framework.

Strategic International Engagement: By aligning with global standards and participating in international carbon markets, India can attract foreign investment, promote technology transfer, and contribute to global climate action.

Establishment of the National Designated Authority is an important step towards operationalising the carbon market under the Paris Agreement. By setting up this institutional framework, India positions itself to leverage both domestic and international markets for climate finance and decarbonization.

Source: THE HINDU

|

PRACTICE QUESTION Q. Carbon markets are a double-edged sword, offering economic incentives while posing challenges of greenwashing and equitable benefit sharing. Critically analyze. 250 words |

It is a system where companies can buy and sell 'carbon credits' to meet their emission reduction targets.

A carbon credit is a permit allowing the emission of one tonne of carbon dioxide equivalent, earned by reducing or removing a similar amount of greenhouse gases from the atmosphere.

It's a high-level committee in India that oversees and approves carbon market activities under the Paris Agreement.

© 2026 iasgyan. All right reserved