The solar manufacturing sector in India has grown significantly due to strategic policies like the Production Linked Incentive Scheme and the Approved List of Models and Manufacturers. This has pushed India's solar module capacity past 100 GW, demonstrating its commitment to energy security and the 'Atmanirbhar Bharat' vision.

Copyright infringement not intended

Picture Courtesy: DOWNTOEARTH

The Union Ministry of New and Renewable Energy (MNRE) has set a 2028 target to achieve a fully indigenous solar manufacturing ecosystem.

Installed Capacity: As of August 2025, solar PV (Photovoltaic) capacity is 119.02 GW, with non-fossil capacity at 251.5 GW, over halfway to the 2030 target.

Manufacturing Capacity: Over 100 GW of solar PV module manufacturing capacity enlisted under the Approved List of Models and Manufacturers (ALMM) for Solar PV Modules.

Import Trends: Imports dropped from $3.36 billion (FY 2021-22) to $2.15 billion (FY 2024-25), yet upstream components like polysilicon remain a bottleneck.

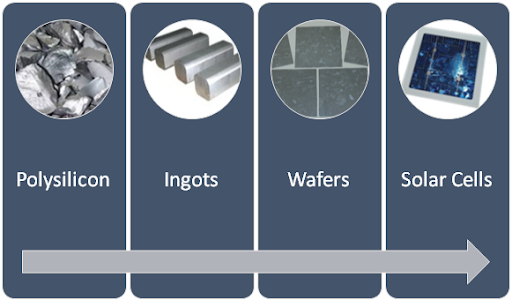

Ecosystem Gap: Strong module assembly but weak upstream production (polysilicon, ingots, wafers), limiting self-reliance.

What Are Wafers and Ingots? Ingots are purified silicon blocks; wafers are thin slices used to make solar cells, forming the core of PV modules.

Government Plan: Achieve swadeshi solar cells by 2028, with trajectories for wafers, ingots, and polysilicon being finalized.

India, the world’s third-largest producer, faces rising energy demand amid global supply chain uncertainties. Solar manufacturing is critical for:

Domestic production reduces import dependence, lowers costs, and strengthens resilience against global supply disruptions (e.g., during COVID-19).

Production-Linked Incentive (PLI) Scheme

Customs duties and fiscal measures

Market and procurement support

Demand creation

Infrastructure and research

Import Dependence: Negligible polysilicon production; reliance on imported silica, silver paste, and wafers.

Technology Gap: Indian production costs are higher than China’s due to smaller scale, outdated technology, and limited R&D.

Capital Costs: Investment required for setting up polysilicon and wafer manufacturing facilities is a major financial hurdle.

Policy Execution: Delays in land acquisition, transmission limitations, and project approvals hinder progress.

DISCOM Financial Health: Weak distribution companies limit demand growth, impacting solar adoption.

Environmental Concerns: Solar waste, water-intensive processes, and land use pose sustainability challenges.

Strengthen the supply chain

Advance technology and innovation

Develop a supportive ecosystem

India aims to achieve a swadeshi solar value chain by 2028, aligning energy security, economic growth, and sustainability. With robust policies, innovation, and collective action, India can become the "Solar Manufacturing Hub of the Global South."

Source: DOWNTOEARTH

|

PRACTICE QUESTION Q. Analyze India’s push for indigenous solar manufacturing by 2028 and its significance for energy security and economic growth. 150 words |

Launched in 2019, the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) promotes solar energy in agriculture.

The PM Surya Ghar: Muft Bijli Yojana launched to install solar panels in 100 million homes, providing up to 300 units of free electricity monthly and subsidies up to ₹78,000.

The scheme offers 60% subsidy for systems up to 2 kW (₹30,000 for 1 kW, ₹60,000 for 2 kW) and 40% for additional capacity between 2-3 kW, capped at ₹78,000 for 3 kW or higher

© 2026 iasgyan. All right reserved