Description

New Insurance bill, 2025

https://indianexpress.com/article/explained/explained-economics/new-insurance-bill-whats-in-whats-left-out-10418356/

Copyright infringement not intended

Picture Courtesy: Indian Express

Context:

The Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025, approved by the Union Cabinet on December 12, marks the most significant overhaul of India’s insurance framework in decades. By amending the Insurance Act, 1938, the LIC Act, 1956, and the IRDAI Act, 1999, the Bill seeks to modernise regulation, attract capital, widen coverage, and strengthen consumer protection.

Key Highlights of the bill:

- The most significant reform is the increase in the FDI limit from 74% to 100%, which is expected to bring in long-term foreign capital, global best practices, advanced technology, and stronger competition, thereby supporting the vision of Insurance for All by 2047.

- To strengthen reinsurance capacity, the Bill reduces the Net Owned Funds requirement for foreign reinsurers from ₹5,000 crore to ₹1,000 crore, facilitating the entry of more global players and reducing dependence on GIC Re.

- The Bill also enhances IRDAI’s powers by allowing it to disgorge wrongful gains, introducing clearer and more transparent penalty norms, enabling one-time registration for intermediaries, and raising the threshold for regulatory approval of equity transfers from 1% to 5%.

- Despite these reforms, the Bill does not introduce composite licences, thereby continuing the rigid separation between life and non-life insurance and limiting the scope for integrated and bundled insurance products.

- It also retains high minimum capital requirements for insurers, keeping entry barriers intact and constraining the growth of niche, regional, and micro-insurers that could have improved insurance penetration.

Current Status of Insurance sector in India:

- Global Position: India is among the top 10 insurance markets globally in terms of total premium volume, reflecting its growing importance in the world insurance industry.

- Life Insurance Segment: India also ranks around 10th globally in life insurance, with life policies continuing to dominate the domestic insurance market.

- Market Size: The Indian insurance market was valued at approximately USD 303 billion (₹25 lakh crore) in 2024 and is expected to expand significantly over the next decade.

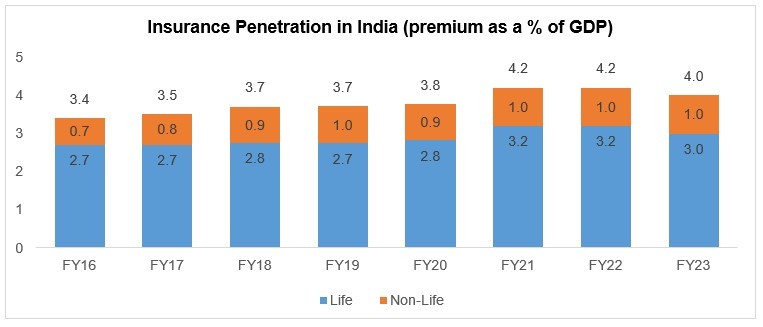

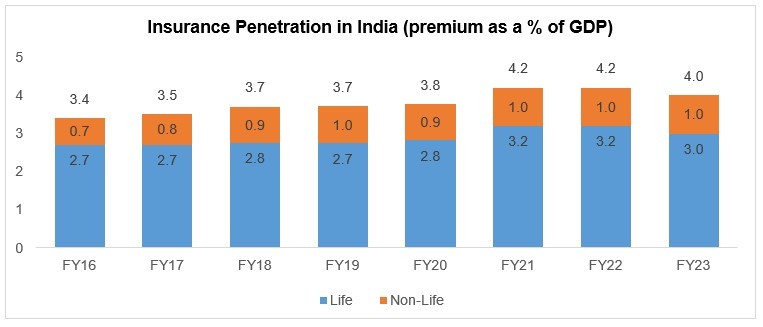

- Insurance Penetration: Insurance penetration remains relatively low at around 7% of GDP in FY24, with life insurance contributing about 2.8% and non-life insurance around 0.9%, indicating substantial untapped growth potential.

Picture Courtesy: IBEF

Importance of this bill:

- Modernisation of insurance framework: Updates colonial-era insurance laws to suit a growing, digital, and globally integrated Indian economy.

- Boost to Capital Inflows: Allows 100% FDI, attracting long-term foreign capital, improving insurers’ balance sheets, and enabling technology and best-practice transfer.

- Strengthening reinsurance capacity: Eases entry norms for foreign reinsurers, enhancing risk-absorption capacity and reducing over-dependence on public sector GIC Re.

- Stronger policyholder protection: Empowers IRDAI with enhanced enforcement powers, including disgorgement of wrongful gains, improving accountability and consumer trust.

- Ease of doing business: Simplifies regulatory processes through one-time registration for intermediaries and relaxed norms for equity transfers.

- Greater autonomy for LIC: Grants operational flexibility to LIC, enabling faster expansion and more efficient management of overseas operations.

- Support for insurance penetration goals: Facilitates innovation, competition, and outreach, supporting the vision of Insurance for All by 2047.

What are the issues in the bill?

- Absence of Composite Licensing: The Bill does not allow insurers to offer both life and non-life products under a single licence, thereby continuing the rigid segmentation of the insurance market and limiting integrated, customer-friendly insurance solutions. In India, insurance penetration is only 7% of GDP (FY24), compared to 8–12% in many developed markets where composite insurers operate.

- High Entry Barriers Remain: Minimum capital requirements for insurers and reinsurers have not been reduced, restricting the entry of niche, regional, and micro-insurers that could have expanded coverage in underserved areas.

- Limited Boost to Competition: While higher FDI is allowed, the lack of reforms for new domestic entrants may result in market expansion being driven mainly by large and foreign-backed players, potentially constraining competitive diversity.

- Missed Financial Integration: Proposals allowing insurers to distribute other financial products such as mutual funds, loans, and credit cards have been left out, reducing opportunities for integrated financial services and cross-selling efficiencies.

- Agent-Level Constraints: The Bill does not permit individual agents to sell policies of multiple insurers, limiting consumer choice and competition at the distribution level.

- No Framework for Captive Insurers: The absence of provisions for captive insurance companies restricts advanced risk management options for large corporates and keeps India behind global practices.

- Regulatory Concentration of Power: Enhanced powers for IRDAI, while improving enforcement, raise concerns about regulatory overreach in the absence of stronger checks and accountability mechanisms.

Conclusion:

The Insurance Laws (Amendment) Bill, 2025 marks a significant step toward liberalising and strengthening India’s insurance sector through higher FDI and stronger regulation, but its failure to address key structural issues such as composite licensing, entry barriers, and inclusive market expansion limits its transformative potential, making it an important yet incomplete reform.

Source: Indian Express

|

Practice Question

“The Insurance Laws (Amendment) Bill, 2025 seeks to modernise India’s insurance sector but falls short of addressing its structural constraints.” Discuss. (250 words)

|

Frequently Asked Questions (FAQs)

It is a legislative reform that amends the Insurance Act, 1938, the LIC Act, 1956, and the IRDAI Act, 1999 to modernise India’s insurance sector, attract capital, and strengthen regulatory oversight.

It enables full foreign ownership, bringing long-term capital, global best practices, advanced technology, and stronger competition, which can improve insurance penetration and service quality.

The Bill reduces the Net Owned Funds requirement from ₹5,000 crore to ₹1,000 crore, making it easier for global reinsurers to enter India and expand domestic risk capacity.