Miniratna status is a government classification granted to profit-making Central Public Sector Enterprises with a positive net worth to provide them limited financial and operational autonomy. It enables faster decision-making, improves efficiency, supports regional and sectoral development, and serves as a stepping stone towards Navratna status, thereby strengthening the overall PSU reform framework in India.

Copyright infringement not intended

Picture Courtesy: DD News

Defence Minister Rajnath Singh has approved the grant of Miniratna Category-I status to Yantra India Limited (YIL), marking a significant milestone in the company’s transformation into a profit-making defence public sector undertaking.

|

Must Read: Maharatna, Navratna, and Miniratna | |

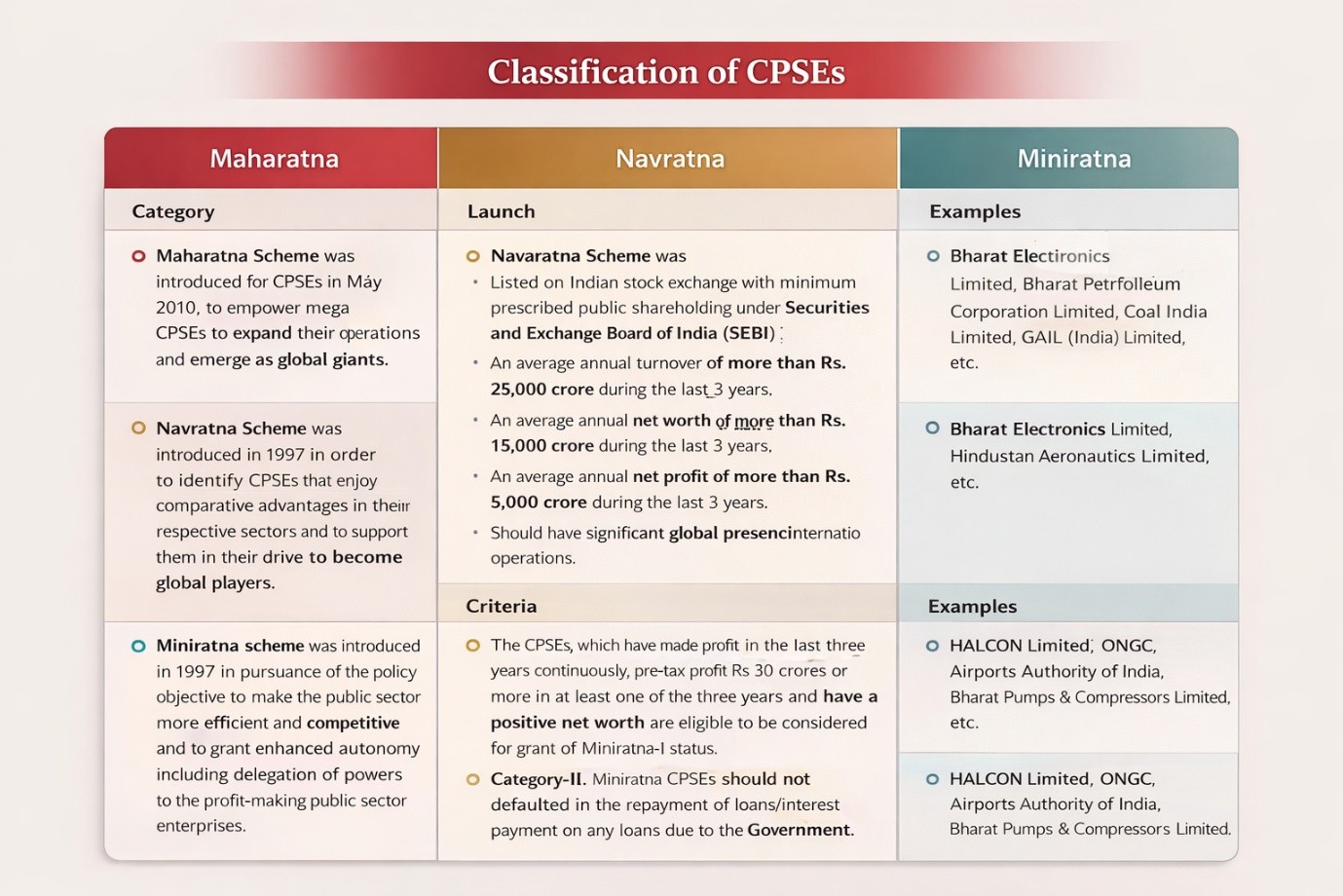

Miniratna CPSEs are profit-making public enterprises that are financially stable but relatively smaller in scale. They are divided into Category I and Category II, based on profitability and net worth. Miniratnas form the base of the PSU hierarchy and play an important role in regional development and sector-specific growth.

Miniratna Eligibility

Category I

Category II

Miniratna Benefits

Category I enterprises can invest up to ₹500 crore or an amount equal to their net worth, while

Category II enterprises can invest up to ₹300 crore.

Both categories gain flexibility in operational decision-making, helping them improve efficiency and scale up gradually.

Significance of Mini Ratna status:

Miniratna status plays a crucial role in strengthening the base of India’s public sector ecosystem by empowering smaller yet profitable CPSEs with limited financial and operational autonomy. Its significance can be understood as follows:

Maharatna: Maharatna is the highest status accorded to CPSEs that are financially strong, strategically vital, and internationally competitive. These enterprises operate on a very large scale, generate substantial profits, and play a critical role in national development. Maharatna companies enjoy extensive financial autonomy, enabling them to make major investment decisions without prior government approval. They are central to sectors such as energy, minerals, infrastructure, transportation and heavy industries.

Navratna: Navratna status is awarded to high-performing CPSEs that demonstrate strong financial health and managerial capability. These enterprises enjoy moderate autonomy and can make investment decisions within prescribed limits. Navratna companies often act as growth engines within their sectors and serve as potential candidates for future Maharatna status.

Maharatna Eligibility

A CPSE must already have Navratna status and satisfy at least one of the following conditions for three consecutive years:

In addition, the enterprise should demonstrate sectoral leadership and a significant global presence.

Navratna Eligibility

To qualify for Navratna status, a CPSE must:

Maharatna Benefits:

Maharatna CPSEs can invest up to ₹5,000 crore or 15% of their net worth in a single project without government approval. They enjoy greater freedom in forming joint ventures, mergers and overseas investments, allowing faster execution of large-scale projects and global expansion.

Navratna Benefits:

Navratna enterprises can invest up to ₹1,000 crore or 15% of net worth in a project. This autonomy enhances their ability to expand operations, enter strategic partnerships, and remain competitive in domestic and international markets.

Miniratna status is a foundational reform in India’s PSU framework, providing profitable yet smaller CPSEs with essential financial and operational autonomy. It promotes efficiency, strengthens regional and sectoral development, and creates a pipeline for future Navratna enterprises, while maintaining accountability and fiscal discipline.

Source: DD News

|

Practice Question Q. With reference to Miniratna Central Public Sector Enterprises (CPSEs), consider the following statements: 1.Miniratna status is granted to profit-making CPSEs with a positive net worth. 2.Miniratna Category-I CPSEs can invest up to ₹500 crore or an amount equal to their net worth without prior government approval. 3.Miniratna Category-II CPSEs are eligible to receive government budgetary support and sovereign guarantees. Which of the statements given above is/are correct? (a) 1 and 2 only Answer: (a) Explanation:

|

Miniratna status is a classification given by the Government of India to profit-making Central Public Sector Enterprises (CPSEs) that have a positive net worth, granting them limited financial and operational autonomy.

The Miniratna scheme was introduced in 1997 as part of PSU reforms to improve efficiency, competitiveness, and managerial autonomy.

Category I CPSEs have higher financial strength and can invest up to ₹500 crore or their net worth, while Category II CPSEs have lower investment limits of ₹300 crore.

© 2026 iasgyan. All right reserved