China’s export restrictions on rare earth elements, affecting global defense, semiconductor, and green energy sectors. India must urgently build domestic processing capacity and secure resilient supply chains to protect its strategic autonomy, economic security, and technological independence.

Copyright infringement not intended

Picture Courtesy: BBC

China has tightened export controls on rare earths and other critical materials for advanced tech manufacturing.

|

Read all about: CHINA'S RARE EARTH EXPORT CURBS l CHINA'S EXPORT CONTROL: IMPACT ON INDIA l INDIA’S CRITICAL MINERALS DIPLOMACY |

Critical Minerals are elements essential for modern high-tech and green energy technologies. They are the building blocks for electric vehicles (EVs), solar panels, semiconductors, and advanced defense systems.

Rare Earth Elements (REEs) are a group of 17 specific metals (like neodymium and dysprosium) that, despite their name, are abundant but are difficult and hazardous to mine and refine. They are crucial for making powerful magnets used in smartphones, wind turbines, jet engines, and consumer electronics.

Market Control: China accounts for nearly 70% of the world's rare earths mining. It also controls roughly 90% of global rare earths processing. It also leads in refining nickel (68%), lithium (59%), and cobalt (73%). (Source: Oxfordenergy)

Weaponizing Trade: China has a history of using this dominance as leverage. In 2010, it informally banned rare earth exports to Japan during a territorial dispute.

Formalizing Controls: China's Export Control Law (2020) formalized its ability to restrict exports for national security reasons.

Maintaining Technological Leadership: Control also applies to the technology used for their mining, processing, and separation. This is a strategic move to prevent other countries, like the US, from developing their own independent processing capabilities and breaking China's monopoly.

Beijing's stated reason is to "safeguard national security," but these moves are widely seen as a response to US restrictions on semiconductor technology, targeting vulnerabilities in Western electronics and defense manufacturing.

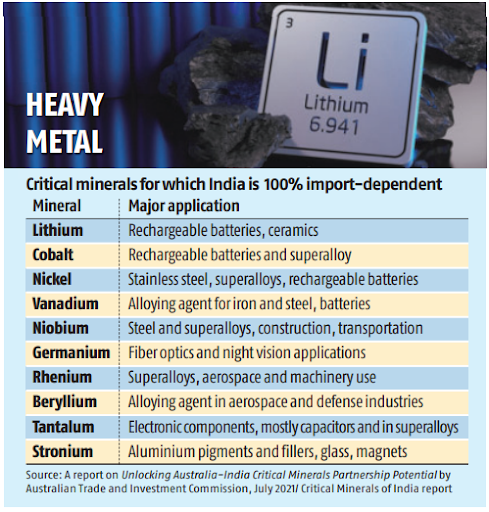

Trade Deficit and Dependence: India’s trade deficit with China reached nearly $100 billion in FY 2024-25. This is fueled by a deep import dependency:

Electronics & Mobile Manufacturing

China's informal restrictions have already disrupted India's goal of reaching a $32 billion smartphone export target by FY26. Incidents like stopping capital equipment shipments for iPhone manufacturing in India and recalling Chinese engineers from Foxconn's plant highlight this vulnerability. (Source: Economic Times)

Electric Vehicles (EVs)

Controls on lithium, graphite, and battery technology directly threaten to derail India’s FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme and climate goals.

Solar & Defence

Restrictions on minerals like gallium and germanium impact the production of solar panels, while curbs on rare earths affect critical defence technologies.

National Security Vulnerability

Being dependent on a primary geopolitical rival for materials critical to defence, aerospace, and technology fundamentally undermines India's goal of strategic autonomy and self-reliance.

Global Response:

India's Response

Prioritize Midstream Processing and Refining

Refinery Investment: Offer performance-linked incentives to establish large-scale refining plants for lithium, nickel, cobalt, and REEs within India.

Technology Acquisition: Joint ventures or technology transfers with non-Chinese partners (e.g., from USA) who possess advanced, low-cost processing technology.

Expand the Circular Economy

Mandatory EPR: Establish and enforce mandatory Extended Producer Responsibility (EPR) targets across all sectors (electronics, EVs, solar panels) to ensure a steady, high-volume flow of end-of-life products into the recycling chain.

Innovation Hubs: Leverage the NCMM Centres of Excellence (CoEs) to focus research specifically on cost-effective, sustainable mineral recovery from secondary sources like e-waste and mine tailings.

Strategic Diversification and De-risking

Resource Agreements: Expedite long-term, government-backed purchasing agreements for critical minerals from countries like Australia, Argentina, and Chile to provide stability for foreign investment.

FTA Linkage: Integrate critical mineral sourcing and processing commitments directly into ongoing Free Trade Agreement (FTA) negotiations with resource-rich blocs (e.g., EU, ASEAN).

Expand PLI Schemes for Component Self-Reliance

Component Localization: Introduce higher subsidy tiers for companies achieving minimum localization thresholds specifically for high-value electronic components, battery anodes/cathodes, and specialized magnets, rather than just final product assembly.

MSME Empowerment: Offer accessible credit and technical support to Indian Micro, Small, and Medium Enterprises (MSMEs) to enter the capital goods and component manufacturing space, reducing reliance on Chinese tooling and machinery.

Forge a Global "Processing Alliance"

Joint Investment Fund: Advocate for MSP-backed investment fund dedicated solely to establishing midstream processing facilities in member or third-party countries (e.g., in Southeast Asia or Africa) that are entirely outside of China's direct influence.

Technology Standardization: Collaborate with QUAD partners (US, Japan, Australia) to standardize technologies and quality control for critical components, creating a viable, interoperable, non-Chinese alternative market.

China’s rare earth export curbs highlight India’s urgent need to build domestic processing capacity, diversify supply chains, and strengthen technological self-reliance for strategic and economic security.

Source: BBC

|

PRACTICE QUESTION Q. The term 'weaponization of supply chains' is often seen in the news. It refers to: A) The process of arming transport vehicles to protect valuable goods. B) Using dominance over the supply of critical goods as a tool of foreign policy coercion. C) The development of military logistics and support systems in conflict zones. D) The practice of stockpiling essential commodities in anticipation of a war. Answer: B Explanation: 'Weaponization of supply chains' refers to the strategic use of a country's control over critical resources (like rare earths, semiconductors, or energy) to exert geopolitical leverage or pressure on other nations. |

Critical minerals are elements essential for a country's economic development and national security. Their limited availability or concentrated extraction in a few locations create supply chain vulnerabilities. For India, they are crucial for achieving "Net Zero" commitments by 2070, as they are foundational for clean energy technologies like solar panels, electric vehicles, and batteries.

India's heavy reliance on imports is due to several structural challenges. Many critical mineral deposits are deep-seated, requiring high-risk investments and advanced technology that are often lacking. India's processing and refining capabilities are underdeveloped, forcing the export of raw materials and import of finished products.

Launched in 2025, the NCMM is a comprehensive initiative by the Government of India to build a robust framework for self-reliance in the critical mineral sector. Its objectives include boosting domestic production, encouraging private sector participation, strengthening international partnerships, and promoting technology and recycling.

© 2026 iasgyan. All right reserved