Copyright infringement not intended

Picture Courtesy: THE DIPLOMAT

Context

China's increasing export controls, aimed at national security, foreign policy, and economic reasons, pose a threat to India, whose heavily reliant economy could be affected.

Evolution of China's Export Control Regime

Early Focus (Pre-2010): Initially controlled nuclear weapons and missile technologies.

Weaponizing Trade (2010): Used trade for strategic goals, an informal ban on rare earth exports to Japan during a dispute.

Formalization (2019-2020): The Export Control Law (2020) covers dual-use items (civilian and military uses) for national security.

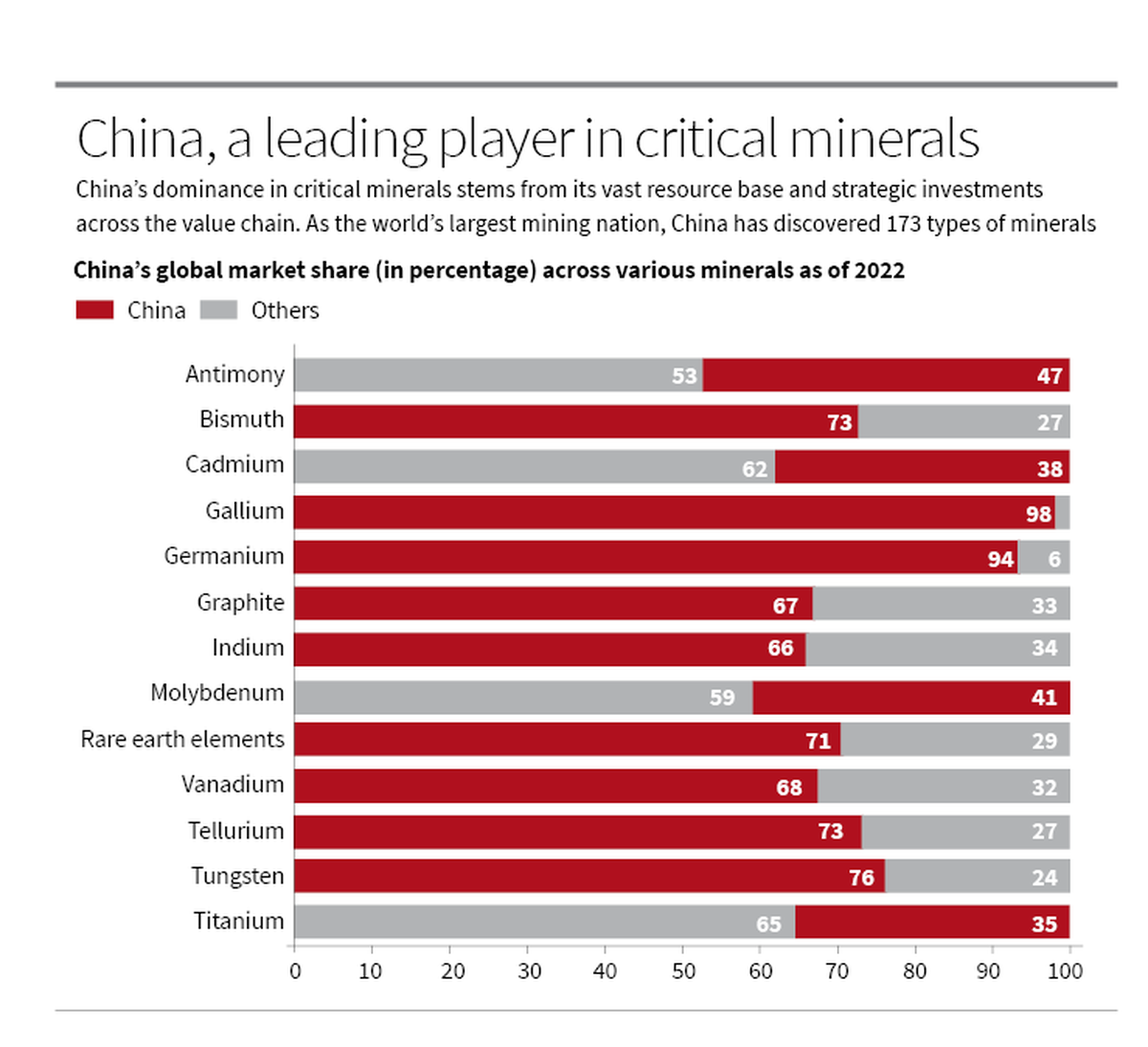

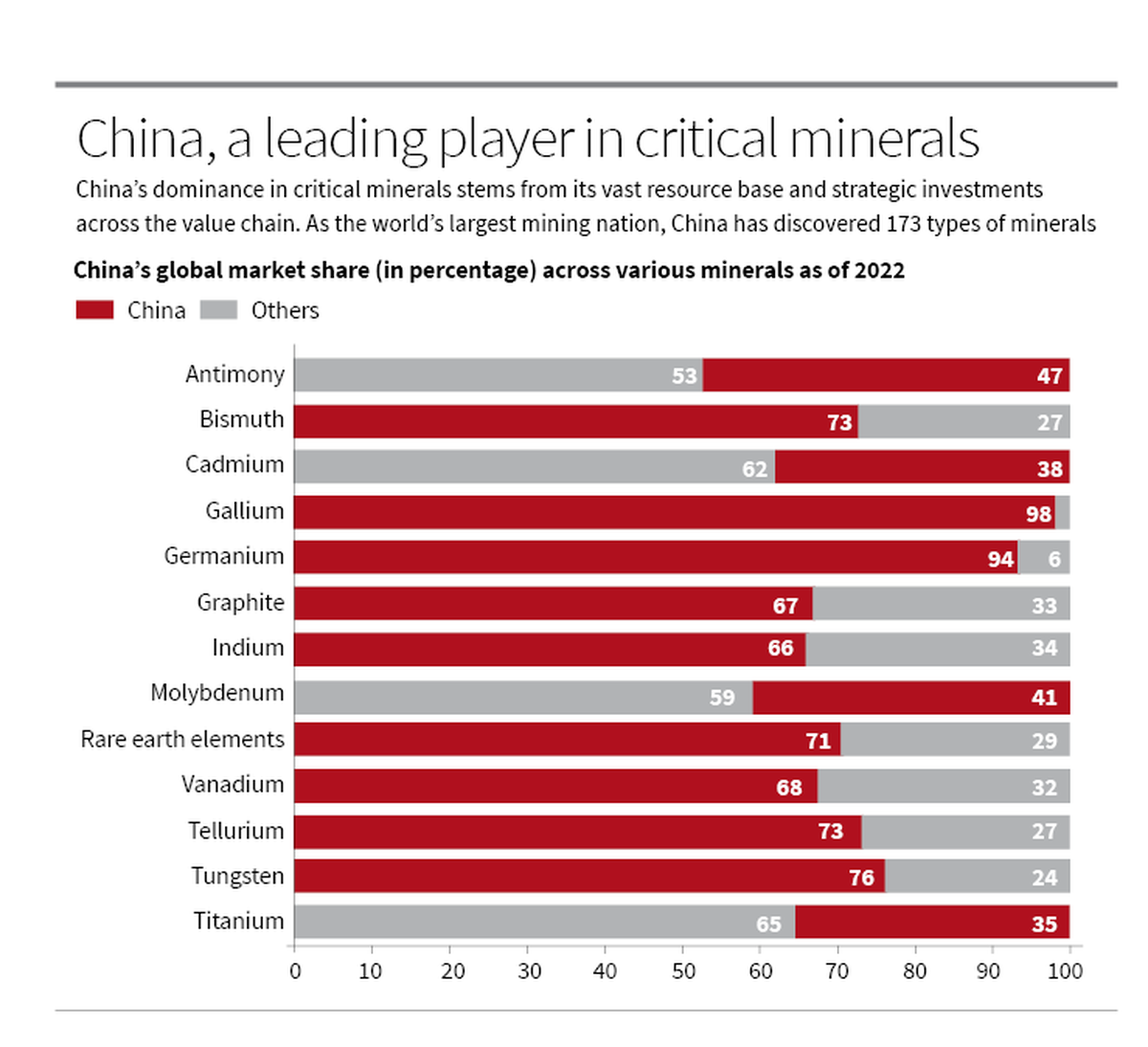

Expanding Scope (2023-2024): China increased restrictions on critical minerals like gallium, germanium, graphite, and antimony.

- It added technologies for rare earth extraction and EV batteries to controlled lists.

Stricter Implementation (2025): New regulations demand strict checks on who the items are going to (end-users) and what they will use them for (end-uses).

What are the Impacts of China's Export Controls?

Global impact

Supply Chain Disruptions: China controls 60% of global critical minerals production and 85% of rare earth processing.

- China leads in refining various minerals, including 68% of nickel, 40% of copper, 59% of lithium, and 73% of cobalt.

- Recent curbs on items like gallium, germanium, graphite, rare earths, and EV battery technologies disrupted global flows.

Economic Impact: Restrictions create uncertainty and slow economic growth globally.

- Production slowdowns in sectors like semiconductors, electronics, and automotive.

- Supply chain disruptions, leading to higher production costs and delayed deliveries.

- Increased operational costs due to reliance on expensive suppliers from other regions.

Technological Competition: China uses controls to maintain its tech leadership and slow rivals' progress.

Geopolitical Friction: United countries like the US, Europe, India, Japan, and Australia to reduce dependence on Chinese markets and diversify supply chains.

Impact on India

Impact on India

Deepening Trade Deficit: India’s trade deficit with China, reached nearly $100 billion in FY 2024-25.

Supply Chain Vulnerability: India depends heavily on China for critical imports, making it vulnerable to disruptions. India's dependence.

Disruption of Key Indian Industries:

- Electronics & Mobile Manufacturing: China's informal restrictions (e.g., stopping capital equipment shipments for iPhone manufacturing in India, recalling Chinese engineers from Foxconn's Chennai plant in July 2025) disrupt India's $32 billion smartphone export target for FY26.

- Electric Vehicles (EVs): Controls on lithium and battery technology hinder India's EV market growth, challenge renewable energy goals.

- Solar & Defence: Restrictions on minerals like gallium, germanium, graphite, and rare earths impact solar panel production and defense technologies.

- Agrochemicals & Infrastructure: Halt on fertilizer shipments and delays in Tunnel Boring Machines (TBMs) affect agriculture and infrastructure projects.

Increased Costs and Delays: Rerouting imports adds 10-15% to costs and extends delivery times.

National Security: Dependence on a geopolitical rival for critical inputs raises national security concerns and hinders India's goal of technological self-reliance.

How has the global community and India responded to China's export controls?

Global community response

- Diplomatic Pressure & Negotiations: Major economies like the US, EU, and Japan engage with China through diplomacy and trade talks.

- Diversification of Supply Chains: Nations are seeking alternative sources for critical minerals and components, under China+1 strategy.

- Strengthening bilateral and multilateral partnerships with resource-rich countries to secure long-term supply agreements.

- International Partnerships: Countries are forming alliances to secure critical mineral supply chains.

- National Self-Reliance Initiatives: Countries are launching domestic programs to boost local exploration, mining, and processing of critical minerals.

- Increased Scrutiny & Counter-Measures: Some countries are imposing their own export controls (e.g., Dutch and Japanese restrictions on semiconductor equipment exports to China).

India's response

- Boosting Domestic Production:

- Diversifying Supply Chains:

- Strategic Measures:

- R&D Investment: Boost research and development (R&D) for extracting, processing, and recycling critical minerals.

- Stockpiling: Build strategic reserves of critical minerals to manage supply shocks.

- Trade Diplomacy: India engages in talks with China, seeking predictability in trade flows.

What is the Way Forward for India to Build Resilience and Strategic Autonomy?

- Expand and Optimize PLI Schemes to more sectors and ensure efficient implementation, attracting both domestic and foreign investment.

- The electronics manufacturing sector has seen success under PLI, becoming the world's second-largest mobile phone manufacturer.

- Boost R&D and Technology Adoption, especially in high-tech industries and critical components like semiconductors.

- Providing affordable credit, skill development, and market access for MSMEs, especially in sectors like textiles, apparel, and toys, where local production can replace a Chinese imports.

- Expedite negotiations for Free Trade Agreements (FTAs) with regions like the European Union and ASEAN to expand market access.

- Explore Alternative Import Sources for critical imports like Active Pharmaceutical Ingredients (APIs), electronics, and machinery from countries like Vietnam, South Korea, Japan, and Taiwan.

Source: THE DIPLOMAT

|

PRACTICE QUESTION

Q. India's ambition for self-reliance is challenged by its import dependence on China. Critically analyze. 150 words

|

Frequently Asked Questions (FAQs)

China controls 60% of global critical minerals production and 85% of rare earth processing, leading in refining nickel (68%), copper (40%), lithium (59%), and cobalt (73%).

India’s trade deficit with China reached nearly $100 billion in FY 2024-25.

A US-led group of 14 countries, including India, aiming to strengthen critical mineral supply chains and catalyze investment in mining, processing, and recycling.

Impact on India

Impact on India