The Union Cabinet has approved a ₹1,500 crore incentive scheme to promote the recycling of critical minerals like lithium and cobalt from e-waste. This initiative, part of the National Critical Mineral Mission, aims to boost domestic capacity, reduce import dependency, and support India's climate and circular economy goals.

Copyright infringement not intended

Picture Courtesy: FORTUNEINDIA

The Union Cabinet approved a ₹1,500 crore Incentive Scheme to boost critical mineral recycling, under the National Critical Mineral Mission (NCMM).

| Read all About: INDIA'S CRITICAL MINERAL STRATEGY |

The scheme tenure is six years 2025-26 to 2030-31, targets the recycling of critical minerals like lithium, cobalt, nickel, copper, and neodymium from secondary sources such as e-waste, lithium-ion battery (LIB) scrap, and catalytic converters.

Objectives

Build domestic recycling capacity to extract critical minerals from secondary sources.

Enhance supply chain resilience amid global disruptions, such as China’s 2025 export bans on gallium and rare earths.

Support India’s climate goals, including reducing emissions intensity by 45% by 2030 and achieving net-zero by 2070.

Address e-waste management, with India generating 1.6 million tonnes annually, and recycle only 33%.

Incentive Structure

Capital Expenditure (Capex) Subsidy: Offers a 20% subsidy on plant and machinery for units starting production on time, with reduced rates for delays.

Operational Expenditure (Opex) Subsidy: Provides 40% of eligible Opex in the second year, increasing to 60% by the fifth year, tied to incremental sales over FY 2025-26.

Subsidy Caps: Large entities can claim up to ₹50 crore (Capex + Opex), while smaller firms, including startups, are capped at ₹25 crore, with one-third of the outlay reserved for smaller entities.

Expected Outcomes by 2030-31

Develop 270 kilotons of annual recycling capacity.

Produce 40 kilotons of critical minerals annually.

Attract ₹8,000 crore in investments.

Create 70,000 direct and indirect jobs.

Critical minerals, including lithium, cobalt, nickel, and rare earth elements (REEs), are essential for clean energy technologies, defense, and electronics.

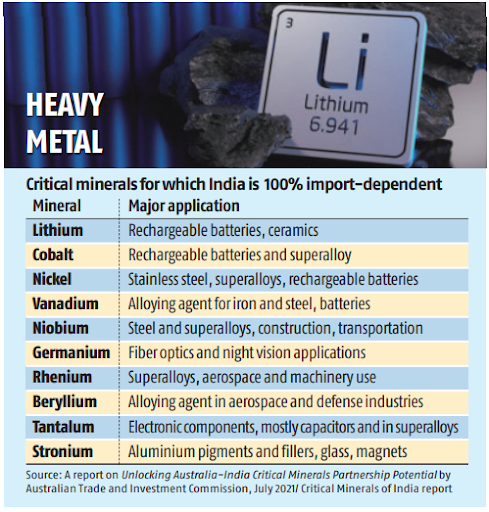

India’s heavy import dependence—100% for lithium, cobalt, and nickel—exposes it to geopolitical risks, particularly China’s dominance (70% of global REE production and 90% of refining).

Recent export restrictions by China (e.g., gallium, germanium in 2024) and resource nationalism in countries like Indonesia (nickel export ban) have disrupted global supply chains, impacting India’s EV and battery production ambitions.

Mines and Minerals (Development and Regulation) Act, 1957 (Amended 2023): Enabled auctions of 24 critical mineral blocks, empowering the central government to prioritize strategic minerals.

Khanij Bidesh India Ltd (KABIL), 2019: A joint venture to acquire overseas mineral assets, notably securing 15,703 hectares in Argentina for lithium exploration in 2024.

Union Budget 2024-25: Announced the National Critical Mineral Mission (NCMM) and eliminated customs duties on critical mineral scrap to boost recycling and domestic processing.

Global Partnerships: India joined the Mineral Security Partnership (MSP) in 2023 and signed MoUs with Australia, Chile, and Argentina for lithium and cobalt projects, aligning with the Indo-Pacific Economic Framework (IPEF) and Quad.

Launched in January 2025 with a ₹34,300 crore outlay (₹16,300 crore from the government and ₹18,000 crore from PSUs), to secure critical mineral supply chain across exploration, mining, processing, and recycling.

Exploration: Targets 1,200 domestic exploration projects by 2030-31, with the Geological Survey of India (GSI) undertaking 195 projects in 2024-25 and 227 planned for 2025-26.

Overseas Acquisition: Supports KABIL’s efforts to acquire 50 mining assets globally, including lithium in Argentina and cobalt in Australia.

Recycling: The Incentive Scheme to recover 400 kilotons of recycled materials by 2030-31.

Stockpiling: Plans a National Critical Minerals Stockpile for five key minerals to mitigate supply disruptions.

Research and Innovation: Establishes Centres of Excellence (CoE) and funds 1,000 patents for critical mineral technologies by 2031.

Mitigates supply risk: Recycling creates a secondary supply that reduces dependence on new mining, resilient to geopolitical tensions and market volatility.

Reduces environmental impacts: International Energy Agency (IEA) reports that producing battery metals from recycled sources can reduce greenhouse gas emissions by up to 80% compared to virgin material extraction.

Supports clean energy initiatives: Critical minerals are the building blocks of clean energy technologies, but their production also carries a carbon footprint. Recycling ensure that the overall transition to clean energy is truly sustainable and low-carbon.

Encourage innovation: Need for efficient, large-scale critical mineral recycling is driving innovation, creating new economic opportunities, attracts investment, and develops new jobs in the collection, sorting, and processing of e-waste.

Prevents toxic leaching: Recycling diverts waste from landfills, preventing toxic substances like heavy metals from contaminating soil and water.

High upfront investment: Building the necessary infrastructure and developing new technologies requires significant capital investment, deter potential recyclers.

Limited Secondary Feedstock: With EVs and batteries still in early adoption, secondary feedstock won’t be available for decades.

Technical Barriers: Recycling rare earths has a global rate of only 1% due to complex separation processes requiring hazardous chemicals. Lithium extraction from batteries is labor-intensive and costly.

Economic Viability: Primary raw materials are often cheaper than recycled ones, deterring investment.

Infrastructure Gaps: India’s recycling sector is largely unorganized, with only 20% of e-waste formally processed.

Geopolitical Risks: Dependence on China for 80% of global LIB refining and export restrictions (e.g., 2024 bans on gallium) exacerbate supply vulnerabilities.

What India Can learn from other countriesNorway: Achieves high battery recycling rates through comprehensive collection systems and second-life applications. Germany: Mandates battery recycling and invests in R&D for hydrometallurgical processes. Japan: Reduced reliance on Chinese REEs from 90% to 58% through recycling, stockpiling, and overseas investments. |

Strengthen Policy Framework: Amend the MMDR Act to fund overseas exploration and introduce comprehensive policy to recover minerals from waste.

Boost Technological Innovation: Provide incentives to firms, which recycles sustainably, and invest in AI-based diagnostics and hydrometallurgical processes.

Enhance Public-Private Partnerships: Offer tax breaks and PLI schemes to attract private investment in recycling hubs and Special Economic Zones (SEZs) for mineral processing.

Expand International Collaboration: Deepen engagement in MSP, IPEF, Quad, and iCET to secure mineral assets and technology transfers. Strengthen MoUs with Australia, Chile, and Argentina for lithium and cobalt.

Promote Circular Economy: Launch a “Recycle for Resources” campaign to boost e-waste collection and incentivize second-life battery applications.

Eco-design: Designing products for durability, repair, and easy disassembly at the end of their life makes material recovery more efficient.

Reuse and remanufacturing: Products like EV batteries can be given a "second life" for stationary energy storage, delaying the need for recycling and retaining more of their embedded value.

Innovative business models: Companies can adopt models like "Product-as-a-Service," which incentivizes them to maintain, repair, and recover their products, keeping valuable minerals in circulation longer.

The Critical Mineral Recycling Incentive Scheme, marks a strategic step towards securing India’s critical mineral supply chain and advancing its clean energy goals.

Source: PIB

|

PRACTICE QUESTION Q. Discuss the significance of the Critical Mineral Recycling Incentive Scheme in achieving India’s clean energy and self-reliance goals. 150 words |

Critical minerals are a select group of elements essential for high-tech industries, and India needs them for its green and digital transitions.

The lack of a formal, organised collection and processing system for e-waste is the biggest challenge.

A circular economy is an economic model that focuses on reusing and recycling resources, which is vital for securing a sustainable supply of critical minerals.

© 2026 iasgyan. All right reserved