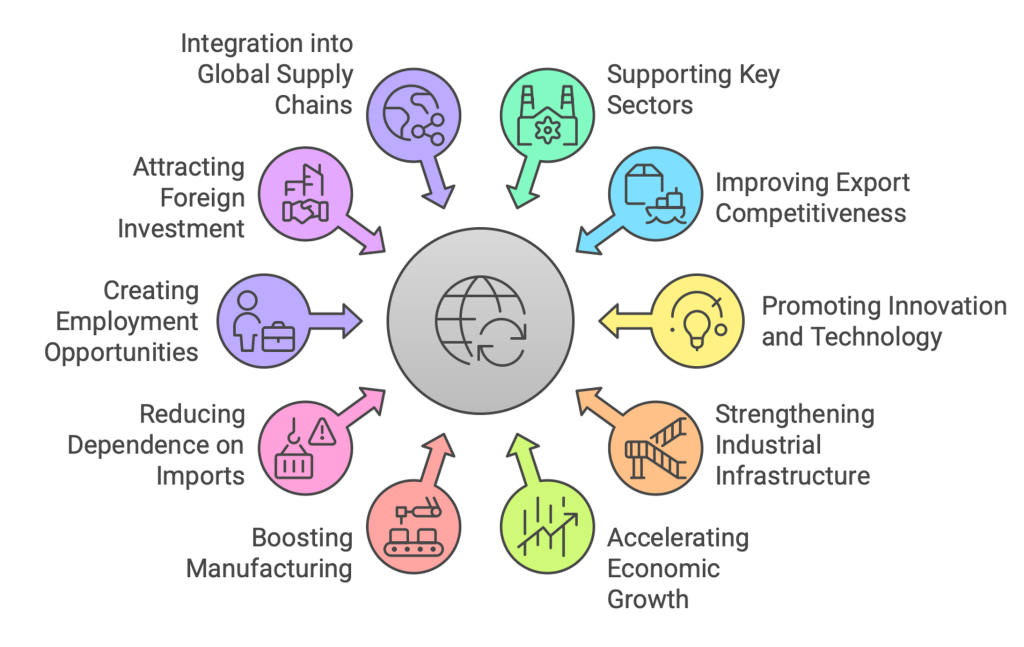

The Production-Linked Incentive (PLI) scheme is a strategic economic plan aiming to transform India into a global manufacturing hub. It encourages large-scale investment, boosts exports, and creates jobs. Despite facing implementation challenges, its sectoral approach and performance-based design are crucial for its potential success.

Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

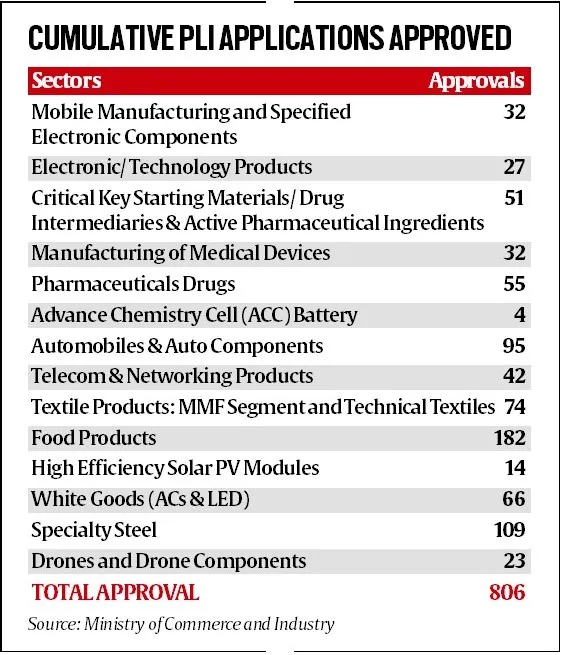

The Ministry of Commerce and Industry announced that the government has approved 806 applications under the Production Linked Incentive (PLI) schemes, resulting in Rs 1.90 lakh crore in investments across the 14 PLI sectors.

It is a performance-driven manufacturing boost strategy, launched in 2020, under the Atmanirbhar Bharat initiative, to incentivize domestic production and reduce import dependency.

It was initially targeted three sectors—mobile manufacturing, pharmaceutical ingredients, and medical devices, latter expanded to covers 14 strategic sectors with a committed outlay of ₹1.97 lakh crore.

Companies must meet specific criteria: minimum investment thresholds, incremental sales targets over a base year, and manufacturing within India.

The incentive rates range between 4% to 6% of incremental sales, though some sectors receive higher rates based on strategic importance.

Each sector’s PLI runs five years from a defined base year.

The scheme is a whole-of-government approach, but the Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce and Industry acts as the nodal agency.

Features of the PLI Scheme

Features of the PLI Scheme

Sector Coverage: Covers 14 priority sectors, including electronics (mobiles, IT hardware), auto/auto-components, pharmaceuticals (APIs, drugs), medical devices, specialty steel, food processing, textiles (MMF and technical), white goods (ACs, LEDs), solar PV modules, ACC batteries, drones, telecom equipment, and chemical APIs.

Incentive Structure: Incentives are performance-linked – a fixed percentage of incremental sales beyond a base year.

Eligibility Criteria: Firms must invest in new capacity and meet sales targets.

Monitoring & Compliance: Participants file periodic reports and claims, backed by audited accounts.

Government Oversight: Ministries approve applicants based on sector-specific criteria (e.g. local value addition, technology standards).

Success of the PLI Scheme

Success of the PLI Scheme

Investment and Production: By August 2025, 14 PLIs attracted ₹1.90 lakh crore in firm commitments.

Job Creation: The scheme has already created over 12.3 lakh jobs nationwide (both direct and indirect)."

Electronics (Mobiles & IT Hardware): Mobile Production value jumped from ₹2.14 lakh crore in 2020–21 to about ₹5.25 lakh crore in 2024–25.

Pharmaceuticals: Under PLI (APIs and drugs), domestic bulk drug sales reached ₹2.66 lakh crore with exports of ₹1.70 lakh crore in the first three scheme years.

Textiles (MMF & Tech Textiles): The Textile PLI (launched 2021) attracted 74 applications committing ₹28,711 crore of investments.

White Goods & Steel: India’s appliance and steel sectors have also grown. White goods (AC/LED) PLI saw 66 approvals; specialty steel had 109 approvals.

Challenges and Concerns Related to PLI Scheme

Challenges and Concerns Related to PLI Scheme

Slow Uptake in High-Tech Sectors: Some “sunrise” areas lag. Only 4 applications for ACC batteries and 14 for high-efficiency solar modules have cleared so far.

Low Incentive Disbursement: Overall PLI payouts remain a small fraction of the budgeted amount.

Global Competition: Cheaper imports or more advanced Chinese production (especially in EV batteries and solar cells) make it hard for Indian plants to compete, even with incentives.

Complex Requirements: Firms face a heavy compliance burden.

Sectoral Imbalance: Benefits have skewed toward sectors India was already strong in (food, auto, mobiles) rather than strategic new industries.

Legal and Policy Uncertainty: Frequent guideline changes (even if legal) can create mistrust.

Funding and Administrative Delays: Some PLIs still await final guidelines or implementation. Delays in issuing notifications or evaluating applications hold up actual investment decisions.

Review and Adjust Incentives: Authorities are revisiting lagging schemes. For example, the ACC battery PLI is under review to modify targets and extend timelines. Government should consider similar reviews for solar and other tough sectors.

Extend Timelines: Some projects (like batteries and solar) have very long gestation. Extending PLI durations beyond the current 5 years give firms breathing room.

Enhance Demand Support: Encourage demand for PLI products. For example, Government could tie domestic procurement (e.g. for public transport EVs, solar plants, medical equipment) to PLI manufacturers, to assure companies of a market and justify their investments.

Simplify Procedures: Streamlining the application and verification process would attract more applicants. A single-window clearance system, faster approvals, and digital compliance checks can reduce friction.

Focus on Linkages: Encourage development of upstream and downstream industries. E.g. ensure MSMEs supply components to PLI firms (subsidize tooling or skilling for cluster units). By creating ecosystems (electronics hubs, auto parks), PLI’s impact will multiply across the supply chain.

Align with Global Trends: Learn from other incentive programs. For example, the U.S. CHIPS Act offers subsidies plus research support for semiconductors, and Japan targets green tech with tax breaks.

Legal Certainty: Publish all scheme amendments transparently and before application windows. Clear guidelines will reduce litigation risk.

Periodic Evaluation: Continuously monitor PLI outcomes with an independent panel. Track metrics (investments, production, exports) and get industry feedback.

The PLI scheme has stimulated growth in manufacturing – attracting large investments and boosting exports in sectors like mobile phones, drugs and textiles. To maintain momentum, policymakers must address the execution gaps (as seen in batteries and solar) and streamline processes. With fine-tuning and sustained support, PLI can help India move closer to its Make-in-India and self-reliance goals.

Source: INDIAN EXPRESS

|

PRACTICE QUESTION Q. How does the Production-Linked Incentive (PLI) scheme align with the broader objectives of 'Atmanirbhar Bharat'? 150 words |

The core objective is to boost domestic manufacturing, create jobs, and make Indian industries globally competitive by offering incentives on incremental production.

The scheme is a whole-of-government approach, but the Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce and Industry acts as the nodal agency.

No, it is an 'incentivizing' measure that aims to boost competitiveness rather than protecting inefficient industries through tariffs and duties.

© 2026 iasgyan. All right reserved