The US's "Trumponomics" strategy, which includes tariffs, has significantly impacted the global economy, triggering trade wars and disrupting supply chains. India faces both challenges like potential export losses and currency devaluation, and opportunities to reposition itself in the global market. A strategic response focusing on diversification and competitiveness is crucial.

Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

President Trump imposed Tariffs, intended to boost US manufacturing and shrink trade deficits, have escalated trade disputes, raised consumer prices, disrupted global supply chains, and dampened economic growth prospects for both the US and its trading partners like India.

Tariffs are taxes that governments impose on imported goods.

It increase the cost of foreign goods, make domestic products more competitive.

It serve multiple purposes: generating government revenue, protecting domestic industries, and sometimes as a retaliatory measure in trade disputes.

Types and mechanisms

Specific tariffs: Set a fixed fee per unit of the imported good, regardless of its value (e.g., $15 per pair of shoes).

Ad valorem tariffs: Apply as a percentage of the imported good's value (e.g., a 15% tariff on a $40,000 car adds $6,000 to the cost).

Compound tariffs: Combine both specific and ad valorem tariffs.

Tariff-rate quotas: Involve a lower tariff rate for imports within a specific quantity, with a higher rate applied beyond that limit.

Economic Theory and Impact of Tariffs

Economic Theory and Impact of Tariffs

Free trade gains: Comparative-advantage theory says countries specialize and trade to maximize total output. Tariffs reverse that: they protect inefficient domestic producers at the expense of overall efficiency.

Winners and losers: In general, domestic producers of the imported good gain (they sell more at higher prices) but consumers lose more (they pay higher prices).

Global effects: Economists warn that if many countries use tariffs, it triggers a mutual “prisoner’s dilemma”: retaliation leads to a trade war that hurts everyone.

Rising inflation and monetary policy challenges: In mid-2025, core Personal Consumption Expenditures (PCE) inflation reached 2.8%, exceeding the Federal Reserve's 2% target.

Slowing economic growth: International Monetary Fund forecast US real gross domestic product will grow by 1.9% in 2025, a lower rate than the projected growth of 2.6% this year.

Other spillovers and challenges

|

Case study: US tariffs and the automotive sector in 2025 Increased Costs: Tariffs inflated imported components cost like steel and aluminum, raised production costs. Supply Chain Disruption: Manufacturers faced delays and challenges in sourcing parts, which encouraged some companies to explore regionalization and nearshoring strategies. Higher Car Prices: Increased costs translated into higher prices for both new and used cars in the US and Canada. Impact on Jobs: Some domestic steel and aluminum jobs saw a modest recovery, however, overall manufacturing employment in the auto sector stagnated or declined due to automation and decreased export competitiveness. Trade Relations Strain: Countries like Germany, heavily reliant on car exports to the US, experienced a decline in demand due to the tariffs. |

India and the US bilateral trade is around $212.3 billion (goods+services) in 2024. India runs a surplus: in 2024 it exported around $87.3 billion to the US vs $41.5 billion imported, reflecting strong demand in the US for items like textiles and jewelry.

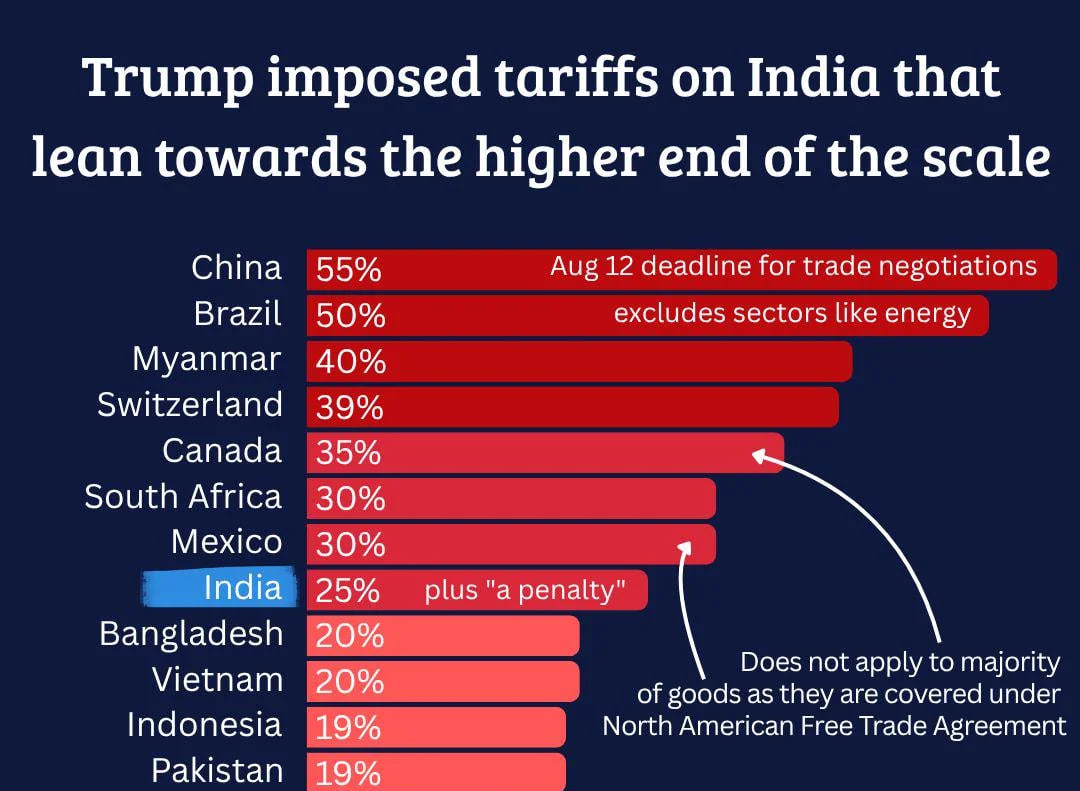

In July–Aug 2025 the US imposed 25% tariffs on many Indian imports, with another 25% penalty planned from August 27.

Indian government condemned the tariffs as “unfortunate” and stressed safeguarding domestic producers, and India officials signaled readiness to negotiate on Russian oil and other items rather than escalate conflict.

The dispute has strained relations: trade negotiations hit an deadlock over U.S. demands (dairy, agri market access) that India has resisted.

Exports at risk: Labour‑intensive exports (textiles, garments, gems, jewelry, leather, footwear, chemicals) account for 25–30% of India’s exports to the US. Most of those sectors are dominated by small and medium firms (MSMEs).

Sectoral impacts: Pharmaceuticals and IT services are largely exempt, so they remain unaffected. The US gets over 40% of generic medicines from India, including vital treatments for cancer, chronic illnesses, and infectious diseases.

Macroeconomic outlook: India’s overall economy is resilient, exports to all countries grew in 2024–25, and according to report by the National Stock Exchange (NSE), India's share in global merchandise exports rose from 0.9% in 2005 to 1.8% in 2023, in services 2% to 4.3%.

The WTO framework requires members to use agreed rules, not unilateral tariffs, to settle trade disputes. Under WTO law, a country raising trade barriers should first consult and arbitrate, not impose retaliatory tariffs.

In August, 2025 Brazil asked the WTO to review the US “reciprocal tariffs,” highlights the tension between Washington’s bilateral pressure tactics and the WTO’s rulebook.

WTO economists warn that the recent wave of U.S. trade measures is dragging down global trade. The 2025 WTO Global Trade Outlook projects merchandise trade volume to decline (–0.2%) because of such policies.

India and other members have argued that only a cooperative, multilateral approach can sustain world trade.

Rising U.S. tariffs (on China, India, allies) are slowing down world economy. The WTO forecasts that World GDP is now expected to grow at 2.2% instead of the baseline 2.8% in 2025. The impact varies by region: Asia and Europe grow more slowly than expected.

Chinese exporters increase shipments to markets outside North America as U.S. import of Chinese textiles and electronics declined. This trade diversion may help some developing exporters, but it also fragment supply chains.

Services trade is hurt too: weaker goods trade dampens logistics, travel and business services.

Economists warn that tariff wars have unintended costs (higher inflation, reduced competitiveness, geopolitical frictions).

Diversify export markets: Push existing and new FTAs to reduce dependence on the U.S. The UK–India trade pact (signed July 2025) and talks with the EU and ASEAN should be accelerated. Expanding ties with East Asian and African markets can help absorb displaced exports.

Boost competitiveness at home: Continue domestic reforms to lower costs. Recently announced GST rate cuts (moving many items from 12%/28% into 5%/18%) will stimulate consumer demand.

Negotiate skillfully: Keep diplomatic channels open with the U.S. Experts suggest the U.S. left room for negotiation (the tariffs take effect after 21 days, giving time for talks).

Leverage multilateralism: Work with partners to uphold rules. India can advocate for consensus statements at forums (G20, WTO) urging rule-based trade.

Attract global supply chains: India should accelerate “Make in India” to attract shifting investments. The current geopolitical shift has pushed companies to diversify out of China; India can capitalize by offering stable policy, skilled labor and improved infrastructure.

India’s way forward is to combine domestic reforms and diversification with continued dialogue and rule-based pressure internationally. This dual approach — strengthening domestic demand and competitiveness while addressing trade grievances through negotiation and WTO channels — will help India maintain high growth despite external tariff shocks.

Source: INDIAN EXPRESS

|

PRACTICE QUESTION Q. The recent US imposition of tariffs on Indian goods is a double-edged sword, presenting both a challenge to our export-led growth and an opportunity for the 'Aatmanirbhar Bharat' mission." Critically analyze. 250 words |

A tariff is a tax on imported goods, which raises their cost and makes them more expensive for consumers.

A trade war is an escalation of protectionist measures where one country's tariffs trigger retaliatory tariffs from its trading partner, leading to a cycle of escalating trade barriers.

US tariffs make Indian exports, particularly in sectors like textiles and gems & jewellery, less competitive in the US market, potentially hurting export volumes and jobs.

© 2026 iasgyan. All right reserved