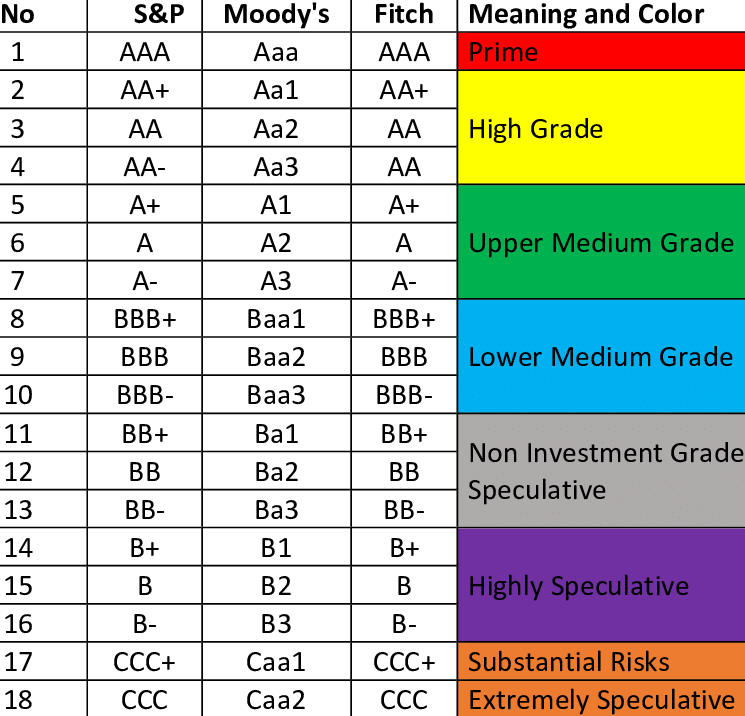

S&P Global Ratings has upgraded India's sovereign rating from 'BBB-' to 'BBB', marking the first upgrade in 18 years. The upgrade reflects India's strong economic fundamentals, including high GDP growth, fiscal consolidation, and RBI inflation management, aiming to lower borrowing costs and attract foreign capital inflows.

Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

S&P Global upgraded India's long-term sovereign credit rating to 'BBB' from 'BBB-', with a stable outlook, due to strong economic growth, fiscal discipline, and sound monetary policy, which is expected to lower borrowing costs and attract more foreign investment.

It serves as an independent assessment of a country's ability and willingness to meet its financial obligations.

Credit rating agencies, such as S&P Global Ratings, Moody's Investors Service, evaluate several factors including economic growth, fiscal policies, political stability, and external liquidity to finalize rating.

S&P Global Ratings upgraded India's long-term sovereign credit rating to 'BBB' from 'BBB-' with a stable outlook. Last time S&P upgraded its rating on India was in 2007.

Reasons for the Upgrade

Reasons for the Upgrade

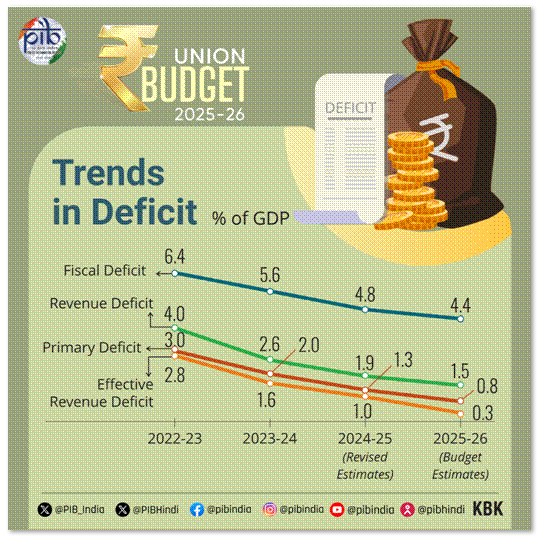

Steady Fiscal Consolidation: India’s fiscal deficit decline—from 9.2% of GDP during the 2020-21 Covid crisis to 4.4% targeted in FY 2025-26.

Strong economic growth: India remains one of the world's fastest-growing large economies. Average real GDP growth between FY 2022 and FY 2024 was 8.8%, the highest in the Asia-Pacific region.

Strong economic growth: India remains one of the world's fastest-growing large economies. Average real GDP growth between FY 2022 and FY 2024 was 8.8%, the highest in the Asia-Pacific region.

Effective inflation management: RBI maintained inflation within the 2-6% target range, fell to 1.55% in July 2025, low and stable inflation attracted foreign investment and maintaining macroeconomic stability.

Strengthened financial sector: Reforms, including the Insolvency and Bankruptcy Code (IBC), improved bad loan recovery and credit culture.

Improved Spending Quality Boosts Productivity: Capital expenditure increased to Rs Rs 11.21 lakh crore in FY 2025, focusing on infrastructure and productive assets. This strategic investment promote long-term growth and expands economic capacity.

Strong External Position Supports Resilience: India maintains a small current account deficit around 1.2% of GDP and a robust external balance sheet (foreign reserve around $ 700 billion).

Policy Predictability Fosters Confidence: Stable government, consistent policies, created predictability and attracted long-term investment, essential for sustained growth.

Lower borrowing costs: Reduces borrowing costs for the government and Indian corporate in international market.

Increased foreign investment: Boosts investor confidence, attract more FDI and portfolio investment. In FY 2024-25, India attracted over $50 billion in foreign direct investment (FDI).

Enhanced global standing: Highlights India's growing importance and credibility within the international financial system.

Deeper bond markets: Increased foreign participation in government securities and high-grade corporate bonds will improve liquidity and deepen India's debt market.

Stimulated investment: Lower borrowing costs encourage greater public and private investment, encouraging long-term growth and job creation.

Boost for MSMEs and startups: Stronger credit profile, benefiting from the overall economic uplift, enhances access to affordable credit.

Fiscal Consolidation: TCentre is targeting a 4.4% fiscal deficit for FY26, but the combined national and state deficit remains too high, projected to fall 6.6% of GDP by fiscal 2029.

State-Level Fiscal Issues: The Reserve Bank of India reported that DISCOM losses reached Rs 6.5 lakh crore, impacting state finances.

Shallow Bond Markets: India's bond market has grown to $2.66 trillion, as of December 2024.

Global Headwinds: While strong domestic demand provides a cushion, the economy is exposed to global trade risks. The threat of protectionist tariffs, particularly from the U.S. on key exports like electronics, remains a challenges.

Growth-Jobs Paradox: High GDP growth is not creating enough quality jobs, leading to rising unemployment.

Make in India initiative: Launched in 2014, to transform India into a global manufacturing hub by promoting innovation, attracting domestic and foreign investment, and improving infrastructure.

Promoting domestic manufacturing: Initiatives like the Production Linked Incentive (PLI) Scheme incentivize companies to promote domestic production and enhance India's manufacturing competitiveness.

Goods and services tax (GST): Introduction of GST in 2017 streamlined indirect tax system, creating a unified market, led to consistent growth in revenue collection, with monthly collections over Rs. 1. 95 lakh crore in July 2025.

Banking reforms: Government's 4R strategy (Recognition, Resolution, Recapitalisation, and Reform) has improved the health of Public Sector Banks (PSBs). The Gross Non-Performing Asset (GNPA) ratio of PSBs declined to 2.58% in March 2025 from a peak of 14.58% in March 2018.

The Capital to Risk (Weighted) Assets Ratio (CRAR) for PSBs increased to 16.15% in March 2025, well above the RBI's minimum requirement of 11.5%.

Targeted social programs

Pradhan Mantri Mudra Yojana (PMMY): Facilitates micro-credit (loans up to Rs 20 lakhs) to income-generating micro-enterprises in non-farm sectors, including manufacturing, trading, services, and allied agriculture activities.

Pradhan Mantri Jan Dhan Yojana (PMJDY): Launched in 2014, provides zero balance accounts, RuPay debit cards with built-in insurance, and overdraft facilities.

Execute next-gen reforms: Replicate the Production Linked Incentive (PLI) scheme's success by launching major semiconductor fabrication plants.

Strategic privatize: Use the successful Air India sale as a blueprint to divest non-strategic state-owned companies, unlocking capital and driving efficiency.

Drive state-level accountability: Link central government funds directly to state performance on reforms.

Boost digital leadership: Export the "Digital Public Infrastructure (DPI)" globally, turning UPI into a tool of economic diplomacy and a new revenue stream.

Build a future-ready workforce: Shift from generic education to targeted, industry-led skilling through partnerships with tech giants, equipping the workforce for high-demand jobs.

Global leadership and economic diplomacy: Leverage growing economic influence and digital prowess to strengthen international partnerships and advocate for a rules-based global order.

Focus on research and development: Invest in research and development, increase budget from 0.7% of GDP to minimum 1%, to encourage innovation and technological self-reliance.

Regulatory streamlining: Review and reform regulations to enhance the ease of doing business and encourage investment.

Source: INDIAN EXPRESS

|

PRACTICE QUESTION Q. Consider the following statements : Statement-I: The S&P Global Ratings upgrade of India's sovereign credit rating from 'BBB-' to 'BBB' moves India higher within the 'investment grade' category. Statement-II: A sovereign credit rating is an assessment of a government's ability and willingness to repay its public debt. Which one of the following is correct in respect of the above statements ? A) Both Statement-I and Statement-II are correct and Statement-II explains Statement-I B) Both Statement-I and Statement-II are correct, but Statement-II does not explain Statement-I C) Statement-I is correct, but Statement-II is incorrect D) Statement-I is incorrect, but Statement-II is correct Answer: B Explanation: Statement-I is Correct: S&P Global's long-term credit rating scale uses 'BBB-', 'BBB', and 'BBB+' within the investment-grade category. An upgrade from 'BBB-' to 'BBB' means India has moved up from the lowest rung of the investment grade to a higher position, indicating improved creditworthiness. Statement-II is Correct: A sovereign credit rating assesses a country's creditworthiness, specifically its ability and willingness to meet its financial obligations on time. This includes both the capacity to generate sufficient revenue to service debt (ability) and the commitment to honor those obligations even in challenging circumstances (willingness). Agencies like S&P evaluate various factors like economic growth, fiscal policies (debt and deficits), political stability, inflation, and external balances to determine this assessment. Both statements are correct, however, Statement I describes the upgrade and India's position within the S&P rating system. The upgrade (Statement I) results from an assessment (consistent with Statement II's purpose), but Statement II does not explain the specific upgrade in Statement I. |

It is an independent assessment of a country's ability and willingness to meet its financial obligations and repay its public debt.

India's bond market is around 70% of its GDP, smaller than in the U.S. and U.K. (around 225%) or Japan (around 260%).

It refers to the situation where high GDP growth is not creating enough quality jobs, primarily due to a severe skills mismatch where only 8.25% of graduates find work aligned with their qualifications.

© 2026 iasgyan. All right reserved