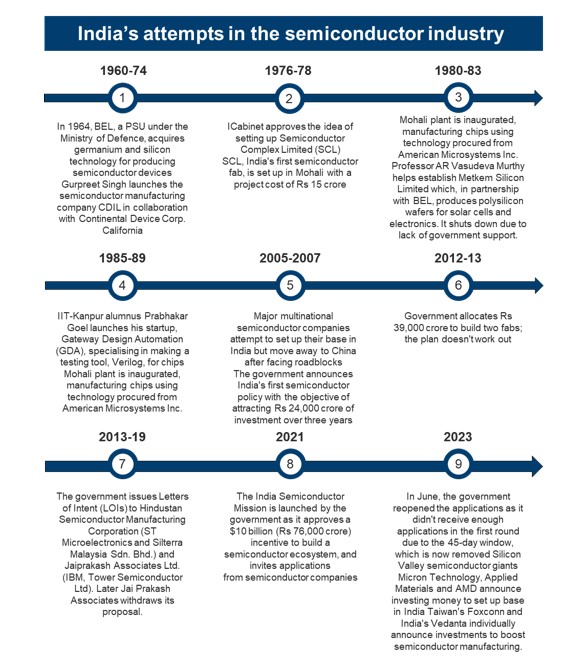

Semiconductor sector driven by the India Semiconductor Mission, aims to achieve technological sovereignty, strengthening national security, and boost economic growth. India excels in chip design, however, it faces challenges including capital requirements, infrastructure deficits, and geopolitical risks. Government support and international partnerships are vital to become a major global semiconductor player.

Copyright infringement not intended

Picture Courtesy: THE HINDU

The Union Government approved four new semiconductor manufacturing projects in Odisha, Punjab, and Andhra Pradesh, with a total investment of ₹4,594 crore, under the India Semiconductor Mission to boost domestic chip production.

It is a material, most commonly silicon, that has electrical conductivity between that of a conductor and an insulator. Manufacturers control its conductivity by introducing impurities, this property makes semiconductors the foundational components of all modern electronics.

Process of creating a semiconductor chip occurs in a specialized facility known as a fabrication plant, or "fab." Key manufacturing stages include:

Global Semiconductor Ecosystem

Global Semiconductor Ecosystem

The global semiconductor market holds a value of approximately $681.05 billion in 2024 and is projected to exceed $2 trillion by 2032.

Market Concentration: Taiwan leads the world in advanced semiconductor manufacturing, holding 68% market share in 2024. It is followed by South Korea (12%), the United States (12%), and China (8%).

Industry Leaders: U.S. firms lead in high-value areas like chip design, intellectual property (IP), and electronic design automation (EDA) software.

India's semiconductor market is expanding rapidly, fueled by powerful demand from the mobile, IT, industrial, and automotive sectors. The domestic market is estimated at $39.5 billion in 2024 and is forecasted to surpass $82.96 billion by 2029 (Research and Markets).

Currently, India imports nearly all its semiconductors, however, initiatives taken to develop manufacturing capabilities, aligning with "AtmaNirbhar Bharat".

Key approved projects

Initiatives Taken by Indian Government

Initiatives Taken by Indian Government

India Semiconductor Mission (ISM): Launched in 2021 with a Rs 76,000 crore budget, to provide financial support for companies investing in semiconductor and display manufacturing.

Production Linked Incentive (PLI) Schemes: Existing PLI schemes for Large Scale Electronics Manufacturing and IT Hardware incentivize domestic production and attract investment across the electronics supply chain.

High Capital Investment: A modern semiconductor fab costs between $10 billion and $20 billion to build and requires a long gestation period with high financial risk. India needs to attract and sustain funding over the next decade to build and operate these expensive facilities.

Infrastructure and Supply Chain: Chip fabrication demands an uninterrupted supply of ultra-pure water and a highly stable power grid, which remain infrastructure challenges. India also lacks a domestic supply chain for essential raw materials, specialty chemicals, and gases.

Talent Shortage: India faces a shortage of professionals with specialized skills in semiconductor fabrication, design, and advanced packaging. Projections indicate a shortfall of 250,000 to 300,000 skilled professionals by 2027.

Intense Global Competition: India must compete with established and heavily subsidized industries in Taiwan, South Korea, the U.S., and China.

Technology Access: Access to advanced, proprietary manufacturing technology from global leaders is a major hurdle. India's R&D ecosystem for semiconductor manufacturing is still in its early stages.

Weak R&D ecosystem: India lags in robust research and development, for developing indigenous chip technology and staying up-to-date of rapid technological advancements. Currently, India invests only 0.65% of its GDP in R&D, compared to South Korea's 4.8%.

Geopolitical dependencies and supply chain vulnerability: India heavily depends on imports for critical semiconductor equipment and raw materials like silicon wafers, vulnerable to global supply chain disruptions and geopolitical tensions.

Competition from established players: Countries like Taiwan, South Korea, and China possess decades of experience, advanced technology, and well-established supply chains, which make it challenging for India to compete in the advanced manufacturing space.

Focus on Niche Markets: Rather than competing immediately in leading-edge logic chips (below 28nm), target mature process nodes (28nm and above). These chips are in high demand for the automotive, industrial, and power management sectors, aligning perfectly with domestic needs.

Address infrastructure bottlenecks: Prioritize development of infrastructure, including uninterrupted power and ultra-pure water supply, essential for fabs.

Develop the OSAT/ATMP Sector: Streamline and expedite the approvals for setting up semiconductor fabrication (fab) units and Assembly, Testing, Marking, and Packaging (ATMP) facilities.

Accelerate Talent Development: Invest in creating a skilled workforce through industry-academia partnerships, specialized university curricula, and collaborations with global training institutions.

Strengthen the Design Ecosystem: Continue to build on India's existing strength in chip design via the DLI scheme. Strengthening indigenous intellectual property (IP) will move the country up the value chain beyond contract manufacturing.

Ensure Policy Stability: A stable, long-term policy environment is critical to give global investors the confidence required for such massive, long-term projects.

Encourage domestic demand and industry growth: Encourage domestic procurement by government and private sectors, assuring minimum domestic demand for chips produced in India.

Navigate geopolitical dynamics and global supply chains: Diversify sources for raw materials like silicon wafers, rare earth elements, and specialty chemicals.

What India Can Learn from Other Countries?

India strategically positions itself in the global semiconductor value chain by focusing on design, encouraging a competitive OSAT sector, and learning from established leaders like Taiwan and South Korea.

|

For Mains: Semiconductor Manufacturing in India: Current Status & Challenges l India's Chip Manufacturing Plan and its Strategic Importance l INDIA SEMICONDUCTOR MISSION (ISM) |

Source: THE HINDU

|

PRACTICE QUESTION Q. India's push for "Atmanirbhar Bharat" in electronics is heavily dependent on a successful semiconductor policy. Critically analyze. 250 words |

A semiconductor is a material, like silicon, that has electrical conductivity between a conductor (like copper) and an insulator (like glass), making it the fundamental building block of all modern electronics.

The ISM is a comprehensive government program with a ₹76,000 crore outlay to provide financial incentives and support for companies to set up semiconductor and display manufacturing ecosystems in India.

A fabrication plant where chips are made. They are extremely difficult to build due to their massive capital cost (billions of dollars), requirement for a reliable infrastructure (water, power), and need for a highly specialised ecosystem.

© 2026 iasgyan. All right reserved