The deletion of 2.7 million MGNREGS workers, linked to mandatory Aadhaar-based payments, has raised concerns of wrongful exclusion and erosion of the Act’s demand-driven rights. Critics argue technical errors removed genuine workers and call for optional technology, stronger audits and an inclusive, worker-centric approach.

Copyright infringement not intended

Picture Courtesy: THEHINDU

The Central government removed over 2.7 million workers from the MGNREGS database between October and November 2025 through its e-KYC verification.

|

Read all about: The Right to Work Under MGNREGA l Centre's spending cap on MGNREGA l National Initiative on Water Security under MGNREGA l Supreme Court Orders on MGNREGA |

The Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) is a social safety net, guaranteeing the legal "Right to Work".

Objective: To provide at least 100 days of guaranteed unskilled manual wage employment per financial year to enhance livelihood security for every volunteering rural household.

Legal Framework: Enacted through the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), 2005.

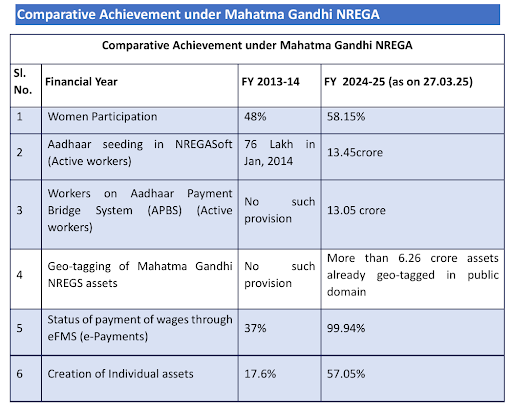

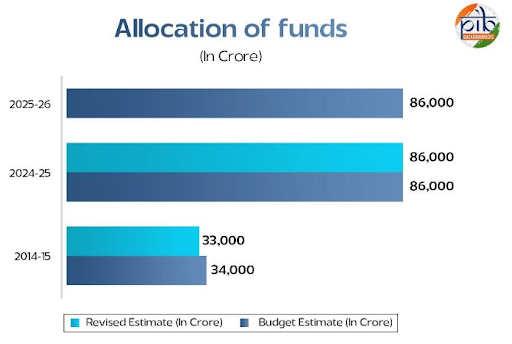

Budget Allocation: In FY 2025-26 Budget, ₹86,000 crore has been allocated for the scheme, which is same as the budget allocation for 2024-25.

|

Key Features of MGNREGA

|

ABPS requires a worker's Aadhaar to be linked with both their job card and bank account, and mapped with the National Payments Corporation of India (NPCI).

While intended to ensure direct benefit transfer and reduce leakages, its mandatory nature has become a major tool of exclusion.

|

Government's Rationale |

Concerns |

|

Weeding out Fake Beneficiaries: To remove fake and duplicate job cards and prevent fund leakage. |

Exclusion of Genuine Workers: Wrongful deletions occur due to technical errors such as name mismatches (Aadhaar/job cards), biometric failures, and incorrect bank account mapping. |

|

Enhanced Transparency: ABPS ensures direct wage transfers to the correct bank accounts, reducing corruption. |

Violation of the Act: Making the "Right to Work" conditional on fulfilling technical requirements (like 100% ABPS compliance) violates the demand-driven spirit of the MGNREGA law. |

|

Administrative Efficiency: To remove inactive workers (permanently migrated or deceased). |

Increased Bureaucratic Hurdles: Ineffective grievance mechanisms make it hard for deleted workers to re-register, leading to lost wages and employment. |

Erosion of Social Safety Net

Deletions and technical issues have weakened MGNREGS's economic role, causing a 16.6% year-on-year drop in person-days generated between April and September 2024. (Source: LibTech India).

Inadequate Funding

The Parliamentary Standing Committee on Rural Development criticized the inadequate ₹86,000 crore budget allocation in 2025-26, which is unchanged from the previous year and ignored inflation and pending liabilities.

Weak Accountability

Technology is being imposed through top-down mandates, while essential bottom-up accountability mechanisms, like social audits, are being neglected.

MGNREGS reform needs technology balanced with inclusivity, shifting focus from rigid compliance to worker empowerment.

Review and Reinstate

Review deletions and reinstate those wrongfully removed. The government's new Standard Operating Procedure (SOP) for deletions and restorations is positive, but requires effective implementation.

Make ABPS Optional

The Parliamentary Standing Committee has recommended against mandatory Aadhaar compliance until the system is foolproof. Both ABPS and traditional account-based payments should be available to ensure no one is excluded due to technical issues.

Strengthen Local Governance

Empower Gram Sabhas to verify job cards and oversee deletions, as mandated by the Act. Strengthen social audits to ensure transparency and community oversight.

Increase Funding and Wages

The Parliamentary Committee recommended a demand-driven budget sufficient to clear all pending wage and material liabilities, increasing guaranteed workdays from 100 to 150 and revising wage rates to match the current cost of living.

The technology-first, top-down approach to curb MGNREGS corruption is excluding many and undermining the right to work. A change is needed to keep the scheme a strong social safety net, removing digital barriers for rural households.

Source: THEHINDU

|

PRACTICE QUESTION Q. ‘The recent removal of MGNREGS workers due to non-compliance with the ABPS highlights a conflict between technological efficiency and the right to work.’ Discuss. 150 words |

The government states that the deletions are part of a regular exercise to cleanse the system of fraudulent, duplicate, and inactive job cards. This is aimed at improving transparency and preventing leakage of funds by ensuring that wages are transferred only to genuine beneficiaries through systems like ABPS.

The Aadhaar-Based Payment System (ABPS) for the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) is a method for disbursing workers' wages directly into their bank accounts using their unique 12-digit Aadhaar number as their financial identifier.

The key recommendations include:

- Placing an immediate moratorium on deletions and reviewing wrongful removals.

- Making technology like ABPS optional, allowing workers to choose between Aadhaar-based and traditional account-based payments.

- Strengthening grassroots accountability mechanisms like social audits.

- Increasing the scheme's budget and revising wage rates to match inflation.

© 2026 iasgyan. All right reserved