The Union Finance Ministry capped MGNREGA spending at 60% of its FY 2025-26 budget to manage funds and reduce pending dues. However, this undermines the MGNREGA’s statutory employment guarantee, ignoring fluctuating rural demand and legal obligations. The cap may lead to denied work or delayed wages, violating workers’ rights.

Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

The Union Finance Ministry has, for the first time, imposed a spending cap on the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS).

For the fiscal year 2025-26, the Finance Ministry has mandated that only 60% of the Rs 86,000 crore allocated to MGNREGS can be spent between April and September.

This brings the scheme under the Monthly Expenditure Plan/Quarterly Expenditure Plan (MEP/QEP), a mechanism the ministry uses to control cash flow and prevent excessive borrowing. Until now, MGNREGS was exempt from this rule because it is designed to provide work whenever a rural household demands it.

Chronic Fund Exhaustion => In recent years, over 70% of the MGNREGS budget has been spent by September, halfway through the financial year. This necessitates large supplementary allocations later in the year, which also tend to run out quickly.

Mounting Pending Dues => The cycle of overspending in the first half leads to massive pending dues at the end of each year, ranging from ₹15,000 crore to ₹25,000 crore over the last five years.

Clearing Backlogs => A significant portion of the new year's budget is used to clear the previous year's liabilities. For example, FY 2025-26 began with pending dues of ₹21,000 crore from the previous year. Clearing these dues alone will consume a large part of the H1 allocation.

Aim of the Cap => By enforcing a spending limit, the ministry aims to ensure that funds are available for the entire year, manage cash flow better, and avoid the need for large, unplanned supplementary grants.

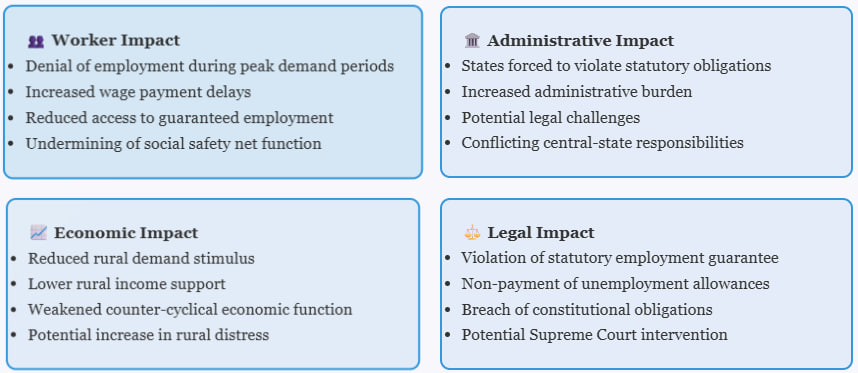

While aimed at fiscal prudence, the expenditure cap raises legal, economic, and social concerns, as it appears to undermine the core principles of the MGNREGA.

Ignores the Demand-Driven Nature of the Scheme

MGNREGS is designed as a safety net that responds to rural distress. Work demand is not uniform throughout the year; it fluctuates based on various factors.

Seasonal Peaks: Demand is generally highest between April and June, before the monsoon, when agricultural activity is low.

Unforeseen Events: The scheme acts as a crucial buffer during freak weather events. For example, in 2023, deficient rainfall and drought-like conditions in states like Karnataka led to a 20% higher-than-usual demand for work in July and August.

The Cap's Rigidity: A fixed expenditure ceiling does not account for such contingencies. It restricts the scheme's ability to act as an automatic stabilizer during times of sudden rural distress, such as droughts, floods, or poor harvests.

Undermines the Legal Guarantee of Employment

The spending cap conflicts with the legal architecture of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), 2005.

From Welfare to Right: The Act marked a paradigm shift by establishing employment as a statutory right, not just a government scheme. It places a positive legal obligation on the government to provide up to 100 days of employment on demand.

Violation of Statutory Rights: The spending cap could make it impossible for the government to fulfill its legal mandate. Once the 60% ceiling is reached, states may be forced to either deny work to people who demand it or make them work without timely payment. This would violate:

Supreme Court Precedents: Constitutional courts have repeatedly held that financial constraints cannot be an excuse for a government to disregard its statutory or constitutional duties. In cases like Swaraj Abhiyan v/s Union of India (2016), the Supreme Court has directed the government to ensure timely release of funds, payment of wages, and compensation for delays under MGNREGA.

Lack of Clarity and Potential for Chaos

There is currently no clarity on what happens when the expenditure limit is reached before the end of the six-month period.

Suppression of Demand: It could lead to an informal suppression of demand at the local level, where officials may stop registering work requests.

Increased Wage Delays: The scheme is already plagued by delays in wage payments. The cap could worsen this, as funds may not be available for processing payments even for work already completed.

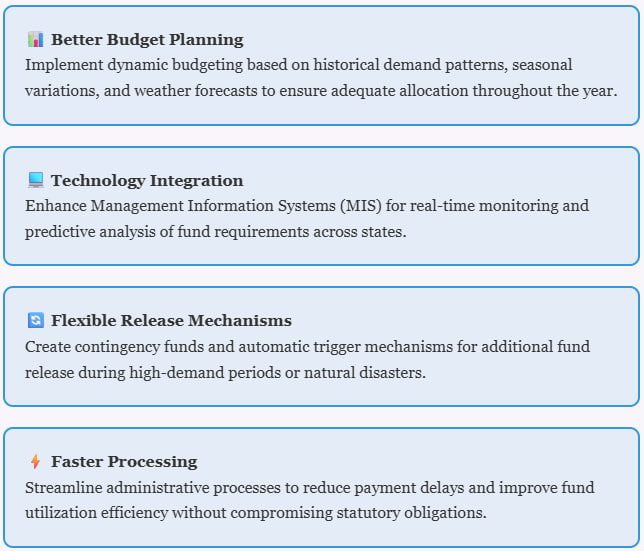

While fiscal discipline is important, the "one-size-fits-all" cap on a demand-driven social security program raises questions about good governance and its responsiveness to ground realities. A solution requires balancing fiscal responsibility with the legal and social commitments of the MGNREGA.

Instead of imposing spending caps that conflict with statutory obligations, several alternative approaches could address the financial management issues.

Must Read Articles:

Source:

|

PRACTICE QUESTION Q. Analyze how can MGNREGS be aligned with other government schemes to enhance rural development outcomes. 150 words |

© 2026 iasgyan. All right reserved