China’s dominance in REE processing creates a major strategic risk for green tech and defense. With Beijing able to weaponize supplies, countries are turning to friend-shoring through the MSP. India is reforming mining laws and strengthening KABIL to cut dependence and secure long-term strategic and industrial autonomy.

Copyright infringement not intended

Picture Courtesy: INDIANEXPRESS

China's temporary halt on rare earth export controls offers a narrow window for nations to diversify supply chains before Beijing reimposes restrictions and tightens its market dominance.

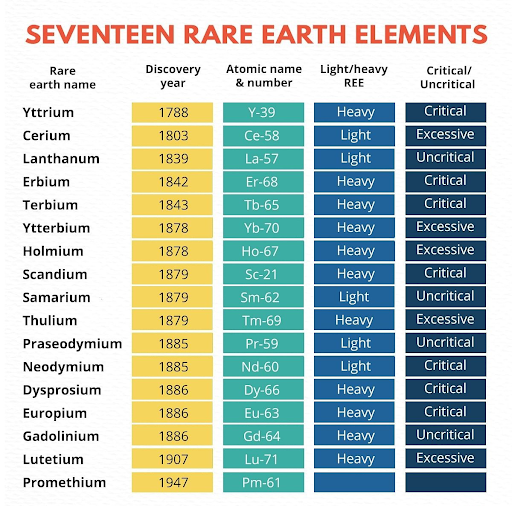

They are a group of 17 metallic elements, including the 15 lanthanides, scandium, and yttrium.

Despite their name, they are relatively abundant in the Earth's crust. However, their extraction and processing are complex, expensive, and environmentally intensive.

They are critical for modern technology, powering everything from smartphones, electric vehicles (EVs), and wind turbines to advanced defence systems like guided missiles and radar.

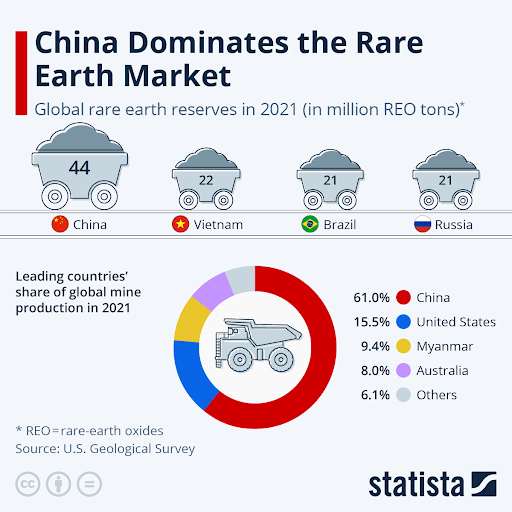

China's dominance of the REE value chain, built on low labor costs and lax environmental rules, poses a major global economic and national security challenge.

Mining Supremacy: China accounts for about 70% of the world's rare earth mining, producing 240,000 metric tons in 2023. (Source: U.S. Geological Survey).

Processing and Refining: China controls an estimated 90% of the global rare earth processing and refining capacity, including a near-total monopoly on Heavy REEs (HREEs) like dysprosium and terbium.

Permanent Magnet Production: China manufactures over 92% of the world's rare earth permanent magnets, which are essential for EVs and renewable energy technologies. (Source: BBC)

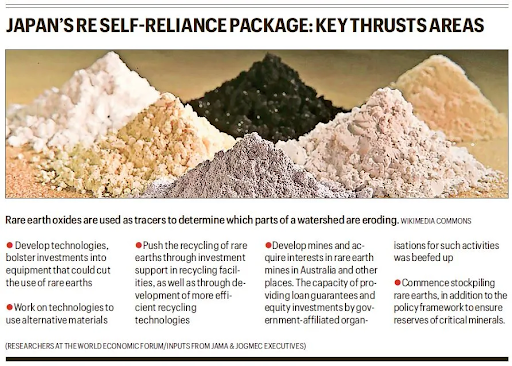

In 2010, following a territorial dispute, China halted REE exports to Japan. This act demonstrated China's willingness to use its supply chain dominance as a tool of economic statecraft.

It caused global REE prices to surge and served as a wake-up call for nations to diversify their sources and reduce dependence on China.

|

Strategy |

Details |

|

Diversifying Mining Sources |

|

|

Building Non-Chinese Processing Capacity |

|

|

Recycling and Urban Mining |

|

|

Substitution and R&D |

|

|

Strategic Stockpiling |

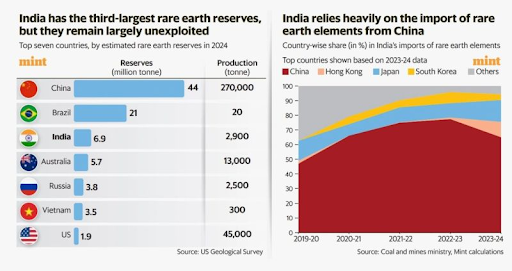

|

India holds the world's third-largest rare earth reserves (6.9 million tonnes) but remains a net importer, largely dependent on China.

Challenges for India

Government Initiatives

Policy Reforms: The offshore area mineral auction rules were amended in 2024 to allow private sector participation in mining, including for atomic minerals like monazite, which contains REEs.

IREL (India) Limited: As a PSU, IREL is the primary entity involved in mining and processing REEs. It produces mixed rare earth chloride and is working to enhance its capacity to separate individual high-purity REEs.

Khanij Bidesh India Ltd. (KABIL): A joint venture created to acquire critical mineral assets overseas. In 2024, KABIL signed an agreement with Argentina for lithium exploration and is seeking similar partnerships for other minerals, including cobalt and rare earths.

Research and Development: Government is funding R&D in areas like magnet development and alternative technologies to reduce REE consumption through schemes like the National Critical Mineral Mission (NCMM) and a Production Linked Incentive (PLI) Scheme for Rare Earth Magnets.

International Cooperation: A United Front

Recognizing that no single country can counter China's dominance alone, several international alliances have been formed.

Minerals Security Partnership (MSP): A US-led alliance of 14 countries plus the EU, aimed at catalysing public and private investment in critical mineral supply chains. India joined the MSP, gaining access to a global network for collaboration.

Quadrilateral Security Dialogue (Quad): The Quad (India, USA, Japan, Australia) has established a Critical and Emerging Technology Working Group which focuses on securing supply chains for critical minerals, including REEs.

Reducing dependence on China for rare earth elements requires a multi-pronged strategy that includes diversification of sources, technological innovation in processing and recycling, and robust international alliances.

Source: INDIANEXPRESS

|

PRACTICE QUESTION Q. China’s dominance in the rare earths value chain poses strategic risks. Discuss how India can reduce dependency and build self-reliance. 250 words |

China dominates the global rare earth supply chain, controlling about 70% of mining and nearly 90% of refining. This makes the world highly vulnerable to supply disruptions for critical technologies (EVs, wind turbines, defense, electronics) and allows Beijing geopolitical leverage.

The key hurdle is midstream (processing and refining) capacity. Though rare earth deposits are global, establishing environmentally sound and cost-effective processing plants demands major investment, technical skill, and time, largely due to China's price-depressing market dominance.

They are relatively common in the Earth's crust, making their name a misnomer. However, cost-effective mining and processing is challenging due to the need for high concentrations and complexity.

© 2026 iasgyan. All right reserved