Description

Copyright infringement not intended

Picture Courtesy: Down to Earth

Context:

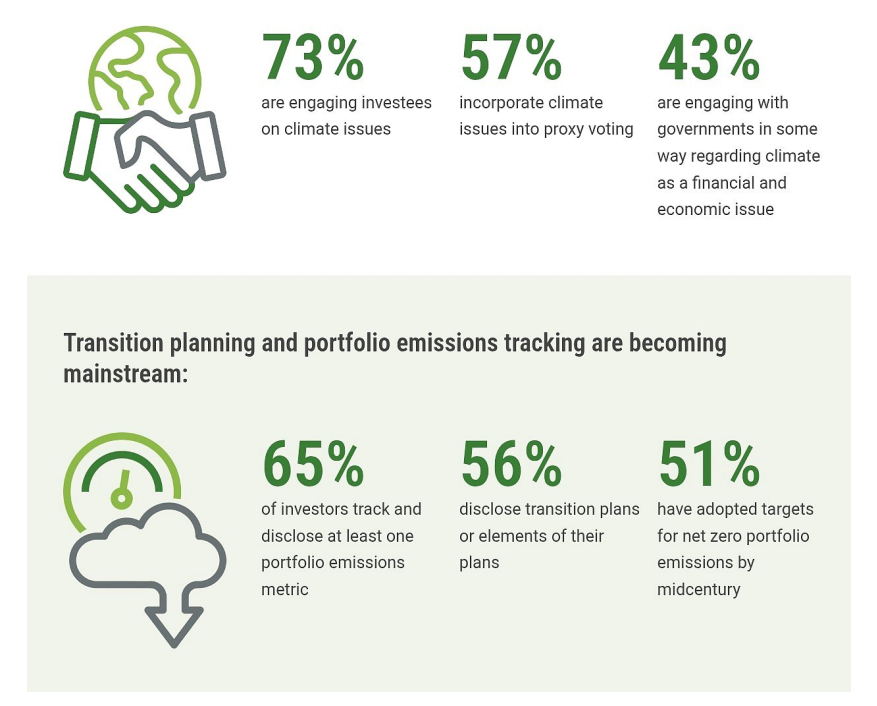

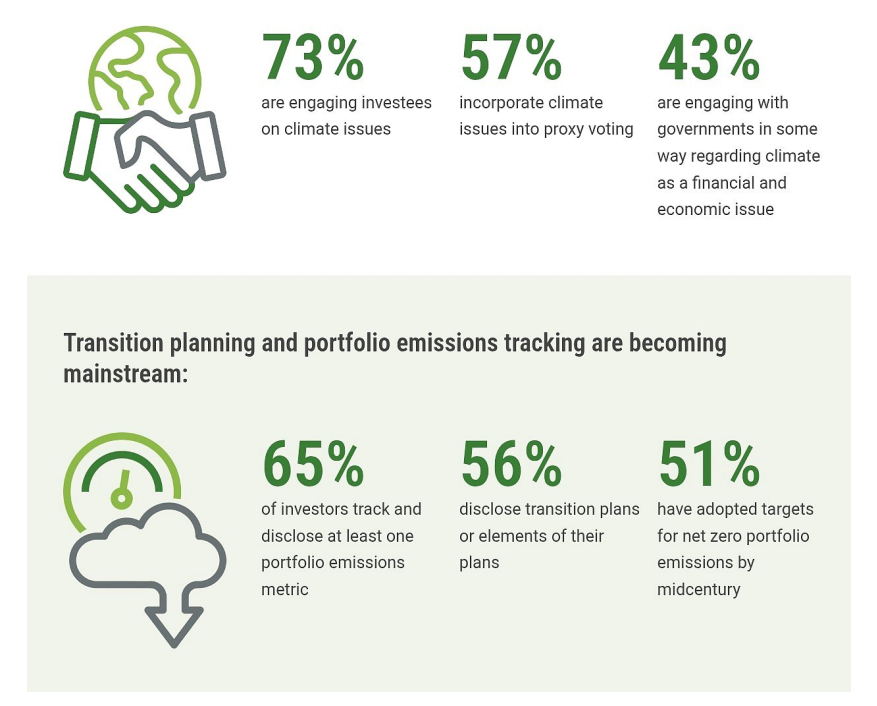

As the 30th Conference of Parties to the United Nations Framework Convention on Climate Change (COP30) nears, analysis of 220 major investors has shown growing climate awareness and board oversight — but warns of uneven ambition, limited transition plans and regional disparities.

Current status:

- A recent survey by MSCI institute found that 57 % of investors say extreme weather and other physical risks are creating economic falloutsooner than expected.

- According to World Economic Forum, asset losses for listed companies could reach US$560–610 billion annually by 2035, translating into a 6.6‒7.3 % drag on average earnings; for the most exposed sectors, risk is over 20 %.

- The number of companies globally disclosing climate risks in their financial statements nearly doubledfrom 18 % in 2021 to 38 % in 2024.

- According to World Economic Forum study, reported damage from extreme weather has nearly tripled(from US$149 billion in 200004 to US$435 billion in 202024).

Picture Courtesy: Down to Earth

Picture Courtesy: Down to Earth

What are the financial risk associated with climate change?

According to the Task Force on Climaterelated Financial Disclosures (TCFD) by Financial Stability Board of International Financial group, climate change gives rise to several distinct risk categories for businesses and financial institutions.

Physical risks:

- Acuterisks from extreme weather events (storms, floods, wildfires) that damage assets or disrupt operations.

- Chronicrisks from longerterm shifts (sealevel rise, changing rainfall patterns, increased heat) that erode asset values or affect business viability.

Transition risks:

- Risks arising from shifts to a lowcarbon economy: regulatory changes (carbon taxes, new emissions standards), technological changes (clean energy adoption, obsolescence of highcarbon assets), changing market preferences and reputational shifts.

Liability risks:

- Risks of legal actions, compensation demands or liabilities for companies/institutions that fail to adapt or are found responsible for climaterelated damage.

Systemic/financialinstitution risks:

- The aggregation of many climaterelated risks threatens financial system stability: credit risk (borrower default), market risk (asset repricing), liquidity risk, insurance risk.

How the above risks translate into financial consequences;

- Asset impairment and writedowns: Physical damage or transition shifts can reduce the value of assets (plants, realestate, infrastructure).

- Increased costs of operations / business disruption: Storms, floods, heat waves can interrupt supply chains, increase insurance premiums, raise maintenance and safeguarding costs.

- Stranded assets / obsolescence: Companies with highcarbon assets may see those assets devalued or become unviable as regulations/markets change.

- Higher financing costs / credit risk: Firms exposed to climate risk may face higher cost of debt, increased default risk, or reduced access to capital.

- Reputational and litigation costs: Failure to manage climate risk can lead to reputational harm, regulatory fines, lawsuits — all of which have financial impact.

- Marketwide instability: If many firms/institutions face climaterelated losses at once, there can be knockon effects to banks, insurers, investors, increasing systemic risk.

RBI’s framework for climaterelated financial risks:

Purpose

- Recognises climate change as a financial stability riskaffecting banks, Non Banking Financial Corporation, and financial institutions.

- Aims to promote transparent disclosureof climate-related risks and opportunities, enabling informed decision-making and market discipline.

Scope

- Applies to banks, large NBFCs, urban co-operative banks, and all-India financial institutionsunder RBI supervision.

- Covers physical risks(extreme weather, natural disasters) and transition risks (policy, technology, market shifts).

Key Pillars of Disclosure

- Governance– Board and management oversight of climate risks.

- Strategy– Impact of climate risks/opportunities on business models and planning.

- Risk Management– Identification, monitoring, and mitigation of climate-related risks.

- Metrics & Targets– Quantitative measures (e.g., emissions, exposure) and progress tracking.

What are the way forward to deal with climate change on financial stability?

- Move beyond disclosure toward embedding climate riskin credit appraisal, stress testing, and capital planning.

- Develop sector-specific guidelinesfor high-exposure industries (energy, infrastructure, agriculture).

- Strengthen coordination among regulators, ministries, and financial institutionsfor coherent green finance policies.

- Align disclosure standards with global frameworks(TCFD, ISSB, NGFS) to ensure comparability and investor confidence.

- Train bank boards, risk managers, and analysts to understand and act on climate-related financial risks.

- Encourage knowledge-sharing and best-practice exchangewithin the financial ecosystem

- Promote green lending, sustainability-linked bonds, and climate-aligned investments.

Conclusion:

Climate change is no longer just an environmental issue—it is a material financial risk. RBI’s framework pushes financial institutions to identify, disclose, and manage these risks, promoting transparency, resilience, and alignment with global standards. The real test lies in turning awareness into action, enabling India’s financial system to support a sustainable, low-carbon, and climate-resilient economy.

Source: Down to Earth

|

Practice Question

Climate change is increasingly recognised as a financial risk by regulators and investors. Discuss how the Reserve Bank of India’s draft framework on climate-related financial risks addresses this challenge. (250 words)

|

Frequently Asked Questions (FAQs)

It is a draft disclosure framework by the Reserve Bank of India requiring banks, NBFCs, and other financial institutions to identify, assess, and disclose climate-related financial risks to improve transparency and strengthen financial stability.

- Physical risks:Extreme weather events (floods, cyclones) can damage assets, disrupt supply chains, and create loan defaults.

- Transition risks:Policy shifts, carbon pricing, or technology changes can reduce asset values and affect business models.

- Both risks can impact banks, insurers, and capital markets, threatening overall financial system stability.

- Central banks and regulators, including the RBI, are introducing frameworks for climate-related risk disclosure.

Global initiatives like TCFD, NGFS, and ISSB guide institutions on risk assessment, reporting, and scenario analysis.

Picture Courtesy: Down to Earth

Picture Courtesy: Down to Earth