China could become de facto dominant supplier for many global electrolyser needs, especially alkaline types, for the next decade. But certain segments (e.g. PEM, high‑efficiency, low cost but high quality, or electrolysers designed for variable renewables, or those with specific environmental / safety / standard requirements) may be supplied by other regions that focus on innovation, quality, regulatory alignment.

Copyright infringement not intended

Picture Courtesy: Getty images

China has come to dominate nearly 85% of global manufacturing capacity of Alkaline Electrolyser.

An electrolyser is a device that uses electricity to split water molecules into hydrogen and oxygen through the process of electrolysis. It's a key component for producing green hydrogen, a clean and sustainable fuel source with applications in transportation, industry, and energy storage.

Source : The Hindu and IAS Gyan

|

Practice Question China’s growing dominance in electrolyser manufacturing is threatening India’s energy security. Discuss (150 WORDS) |

Alkaline Electrolysers (ALK): A mature technology with lower costs but less efficient under fluctuating loads, making them less suited for renewables.

Proton Exchange Membrane (PEM) Electrolysers: More efficient at variable loads and capable of producing high-purity hydrogen, though significantly costlier due to reliance on rare metals like platinum and iridium.

Green hydrogen is hydrogen gas that is produced using renewable energy sources (like solar, wind, or hydropower) through a process called electrolysis.

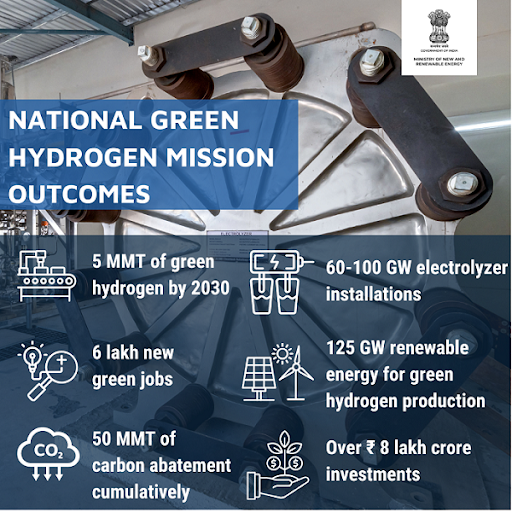

India aims to produce 5 million metric tonnes (MMT) of green hydrogen annually by 2030, with a potential to reach 10 MMT for exports.

© 2026 iasgyan. All right reserved