India’s National Green Hydrogen Mission targets 5 MMT production by 2030, driving decarbonization, reducing imports, and creating jobs. Supported by SIGHT and major investments, it advances energy independence, sustainability, and global leadership in climate action through innovation and green transition.

Copyright infringement not intended

Picture Courtesy: DOWNTOEARTH

The Global Hydrogen Review 2025 by the International Energy Agency (IEA) warns that global hydrogen deployment accelerates but falls short of net-zero needs without stronger policies and investments.

|

Read all about: NATIONAL GREEN HYDROGEN MISSION l GREEN FUELS l INDIA'S FIRST HYDROGEN-POWERED COACH |

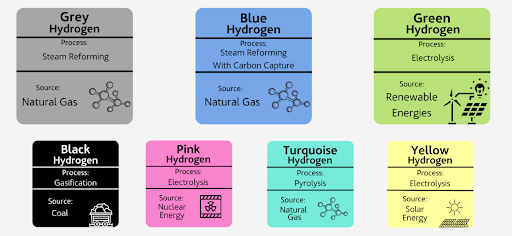

Hydrogen earns its "fuel of the future" title through its zero-emission profile and versatility in tackling climate challenges.

Green hydrogen, produced via electrolysis using renewables, emits no carbon during use, producing only water.

Zero-Carbon Edge: Electrolysis splits water with solar or wind power, cutting lifecycle emissions.

Versatility: It powers fuel cells for vehicles, feeds industries like steel and chemicals, and stores excess renewables for grid stability.

Hard-to-Abate Focus: It decarbonizes sectors like heavy transport and cement where batteries falter due to energy density limits.

Scalability: Tied to renewables, whose potential exceeds global demand, hydrogen scales infinitely for long-term storage and export.

Climate Urgency: Net-zero 2050 goals demand hydrogen energy needs; without it, emissions cuts stall in industry and transport.

Policy Momentum: Over 50 countries adopt hydrogen strategies, with $280 billion in public funding pledged through 2030. The US Inflation Reduction Act provides $3/kg incentives, while the EU's Hydrogen Bank funds imports.

Tech and Cost Drops: Electrolyser costs to fall to $1.5-2/kg by 2030; advancements boost efficiency.

Industrial Shift: Steel and shipping adopt hydrogen to meet carbon pricing like EU ETS, driving demand.

Geopolitical Stakes: Exporters like Australia and Saudi Arabia secure markets, while importers build corridors.

India leveraging cheap renewables to target 5 mt green hydrogen by 2030, making it a top global contender. National Green Hydrogen Mission (NGHM) launched in 2023, allocates ₹19,744 crore.

Capacity Milestones: India hits 50% non-fossil power, with 251.5 GW installed by September 2025. Solar tariffs drop to ₹2.5/kWh, enabling low-cost electrolysis.

Policy Framework: Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme offers ₹17,490 crore incentives, states like Gujarat create hydrogen hubs.

Corporate Push: Reliance has set a target of producing 3 million metric tonnes per annum (MMTPA) of green hydrogen by 2032.

Green hydrogen unlocks economic and environmental gains, aligning with India's growth trajectory. It could attract ₹8 lakh crore investments and 6 lakh jobs by 2030.

Energy Security: Cuts fossil imports; domestic production boosts self-reliance to 2047.

Economic Boost: Market hits $8 billion by 2030, $340 billion by 2050; PLI schemes build electrolyser capacity to 25 GW by 2028. (Source: NITI Aayog)

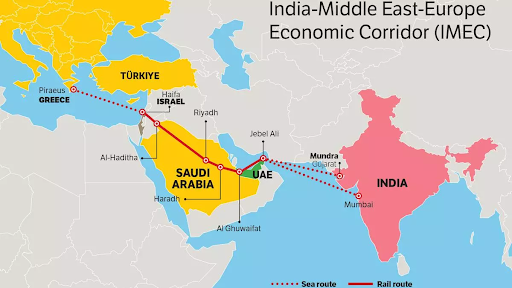

Export Potential: Low costs position India for 10% global supply by 2030; ammonia exports to Europe via India-Middle East-Europe Corridor (IMEC) corridor.

Decarbonization: Aiding Net Zero by 2070; supports renewables addition.

Industrial Revival: Enables green steel and fertilizers, creating value chains.

High Production Costs

Green hydrogen currently costs between $3 and $7 per kg, higher than grey hydrogen ($1–2 per kg) and blue hydrogen ($2–3 per kg).

Water Scarcity

Producing one kilogram of green hydrogen requires about nine liters of fresh water. India is a water-stressed country, and this demand will add to existing pressures. Innovations in direct seawater electrolysis are needed.

Infrastructure Limitations

Hydrogen's unique properties (flammable, smallest molecule) necessitate specialized infrastructure for safe storage, transport, and distribution.

Industry Retooling

Industries reliant on fossil fuels require "extensive retooling to incorporate hydrogen into their processes," incurring high costs for new equipment and re-engineering production lines.

Raw Material Dependence

Electrolyser technologies rely on expensive and scarce materials like platinum and iridium. India's initial position is limited by import dependence for these metals.

Financing

Capital-intensive nature of green hydrogen projects, coupled with longer payback periods, makes securing investment challenging.

Supply Chain Complexity

The varied production processes and diverse applications of hydrogen make its supply chain complicated compared to oil and gas.

Develop a Detailed Roadmap

Create a long-term roadmap with clear timelines and investment goals for green hydrogen across multiple sectors to improve investor confidence.

Reduce Production Costs

Implement supply-side interventions to achieve a cost target of $1/kg. This includes waiving transmission charges, reducing taxes, providing preferential tariffs, and exploring revenue recycling from a carbon tax.

Create Demand

Establish mandates for hydrogen blending in sectors like refining and ammonia to provide demand certainty for early projects. Use incentives like Viability Gap Funding (VGF) for products like green steel.

Boost Domestic Manufacturing

Incentivize domestic production of electrolyzers and other critical components through Make in India and Production-Linked Incentive (PLI) schemes.

Invest in R&D and Skills

Invest in research and development to commercialize low-cost technologies and reduce dependence on imported materials. Develop training and education programs to build a skilled workforce.

Establish Standards and Governance

Develop green hydrogen standards, a labeling program, and a robust certification mechanism. Create an inter-ministerial governance structure to coordinate efforts effectively.

Promote Exports and Alliances

India is pursuing "hydrogen diplomacy" forming partnerships with Japan, Australia, the EU, Gulf countries (Oman, UAE, Saudi Arabia), and Morocco, to secure export markets.

Collaborate on technology development, supply chain strengthening, and market access (e.g., EU-India Clean Energy and Climate Partnership, India-Middle East-Europe Economic Corridor).

India’s Green Hydrogen Mission, targeting 5 mt by 2030, positions the country as a potential clean energy leader despite cost, water, and infrastructure challenges, blending climate goals with economic growth.

Source: DOWNTOEARTH

|

PRACTICE QUESTION Q. Critically analyze the challenges and opportunities for India to emerge as a global hub for green hydrogen production and export. 150 words |

The mission aims to achieve an annual production of 5 million metric tons of green hydrogen by 2030.

SIGHT stands for Strategic Interventions for Green Hydrogen Transition. It provides financial incentives for domestic manufacturing of electrolyzers and the production of green hydrogen.

It is hydrogen produced by splitting water using renewable electricity, resulting in zero carbon emissions.

© 2026 iasgyan. All right reserved