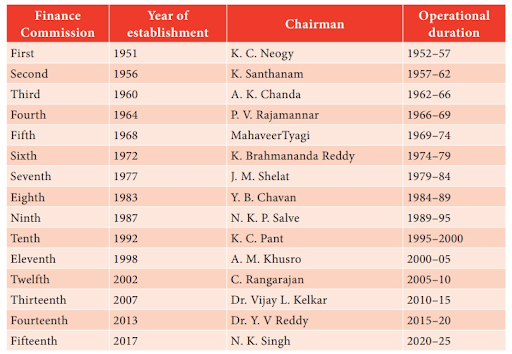

The Sixteenth Finance Commission, chaired by Arvind Panagariya, submitted its 2026–31 report to the President after wide consultations. Formed under Article 280, it reviews Union and State finances, recommends devolution, grants, and disaster funding. It will be in public, once presented in the Parliament under Article 281.

Copyright infringement not intended

Picture Courtesy: PIB

The Sixteenth Finance Commission submitted its report, covering the award period from 2026-27 to 2030-31, to the President of India, and this report will be made public once the Union Finance Minister tables it in Parliament under Article 281.

It is a constitutional body established under Article 280 of the Constitution, to recommend the distribution of financial resources between the Union government and the State governments.

It is constituted by the President of India every five years, or earlier if required, and functions as a quasi-judicial body.

The recommendations are submitted to the President, who tables them in Parliament along with an 'Explanatory Memorandum' detailing the action taken by the government.

The 16th Finance Commission was constituted via a notification in December 2023, under the chairmanship of Dr. Arvind Panagariya (Former Vice-Chairman, NITI Aayog).

The Constitution empowers Parliament to decide the qualifications, and the 5 members are chosen based on the following expertise:

Vertical Devolution: The distribution of net tax proceeds between the Centre and the States.

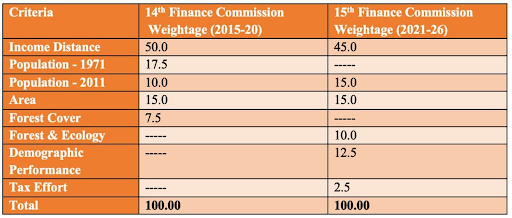

Horizontal Devolution: The allocation of these proceeds among the States themselves. This is based on a formula considering factors like population, area, demographic performance, and forest cover.

Grants-in-Aid: The principles that should govern the grants-in-aid to States from the Consolidated Fund of India, especially under Article 275.

Augmenting State Funds: Measures needed to supplement the resources of Panchayats and Municipalities, based on the recommendations of the State Finance Commissions.

Disaster Management Financing: The recent commissions have also been tasked to review the financing structures for disaster management initiatives.

Other Matters: Any other issue referred by the President in the interest of sound finance.

The recommendations made by the Finance Commission are advisory in nature and are not legally binding on the Union Government. However, they are given significant weight, and the government generally accepts them.

The government must table the report in Parliament along with an 'Explanatory Memorandum' detailing the action taken on the recommendations.

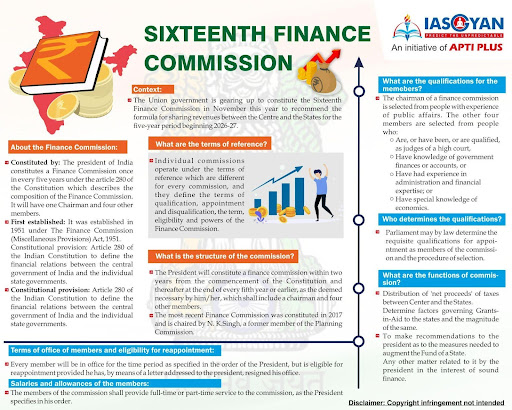

The 15th Finance Commission, chaired by Shri. N. K. Singh, had made recommendations for the 2021-26 period:

Source: PIB

|

PRACTICE QUESTION Q. Critically analyze the role of the Finance Commission in strengthening the financial autonomy of local self-governments. 150 words |

The Finance Commission is a constitutional body under Article 280 that recommends the formula for distributing the net tax revenues between the Union and the States (vertical devolution) and among the States themselves (horizontal devolution). It also suggests principles for grants-in-aid and measures to augment the resources of local bodies.

The Chairman of the Sixteenth Finance Commission is Dr. Arvind Panagariya, an eminent economist and former Vice-Chairman of NITI Aayog.

A major challenge is the increasing reliance of the Union government on cesses and surcharges. Since this revenue is not part of the divisible pool of taxes, it is not shared with states, which effectively reduces the states' actual share of the Centre's total tax revenue and impacts their fiscal stability.

© 2026 iasgyan. All right reserved