Description

Disclaimer: Copyright infringement not intended.

Context

- Recently various Opposition-ruled States especially from south India have claimed that they have not been receiving their fair share as per the present scheme of financial devolution. They have raised issues about their less than proportionate share of receipt in tax revenue when compared to their contribution towards tax collection.

What constitutes the divisible pool of taxes?

- Article 270 of the Constitution outlines the framework for distributing the net tax proceeds collected by the Union government between the Centre and the States.

- Taxes eligible for sharing between the Centre and the States encompass corporation tax, personal income tax, Central GST, and the Centre’s portion of the Integrated Goods and Services Tax (IGST), among others.

- This allocation is determined by the Finance Commission (FC), which is appointed every five years in accordance with Article 280.

- In addition to tax shares, States also receive grants-in-aid based on the FC's recommendations. Notably, the divisible pool excludes cess and surcharge imposed by the Centre.

How is the Finance Commission formed?

- The Finance Commission (FC) is constituted every five years as a body exclusively appointed by the Union Government.

- It comprises a chairman and four other members appointed by the President.

- The Finance Commission (Miscellaneous Provisions) Act, 1951, lays down the qualifications for the chairman and other members of the commission.

- The Union government has announced the formation of the 16th Finance Commission, chaired by Dr. Arvind Panagariya, to make recommendations for the period 2026-31.

What is the basis for allocation?

- The share of States from the divisible pool (vertical devolution) stands at 41% as per the recommendation of the 15th FC.

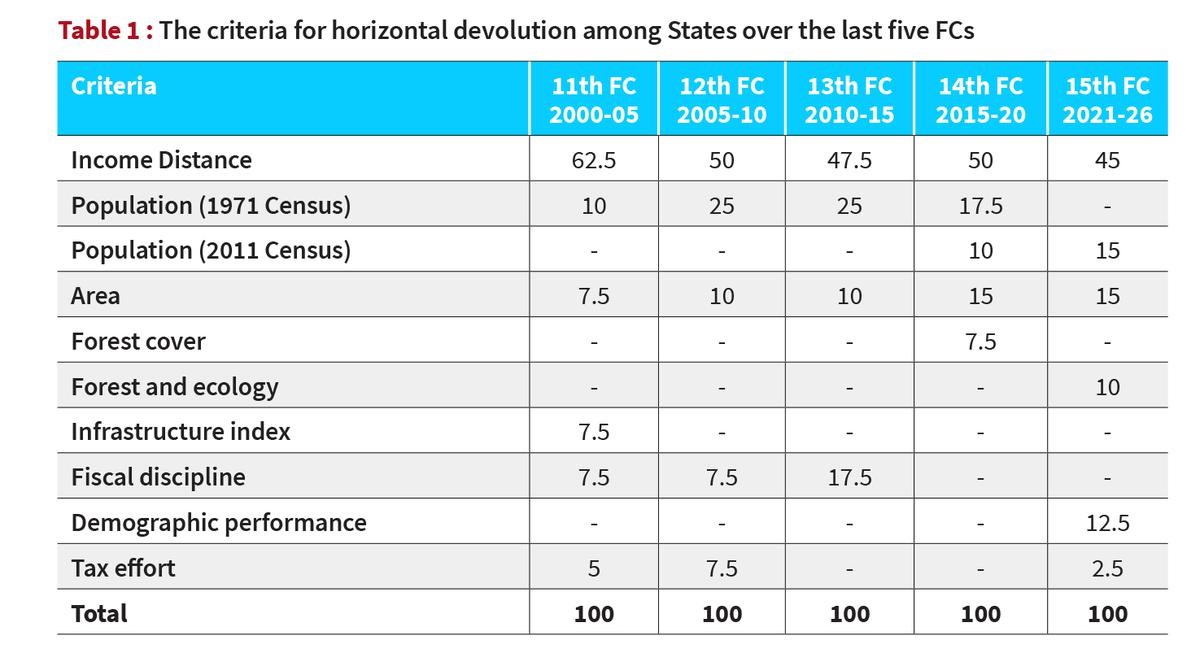

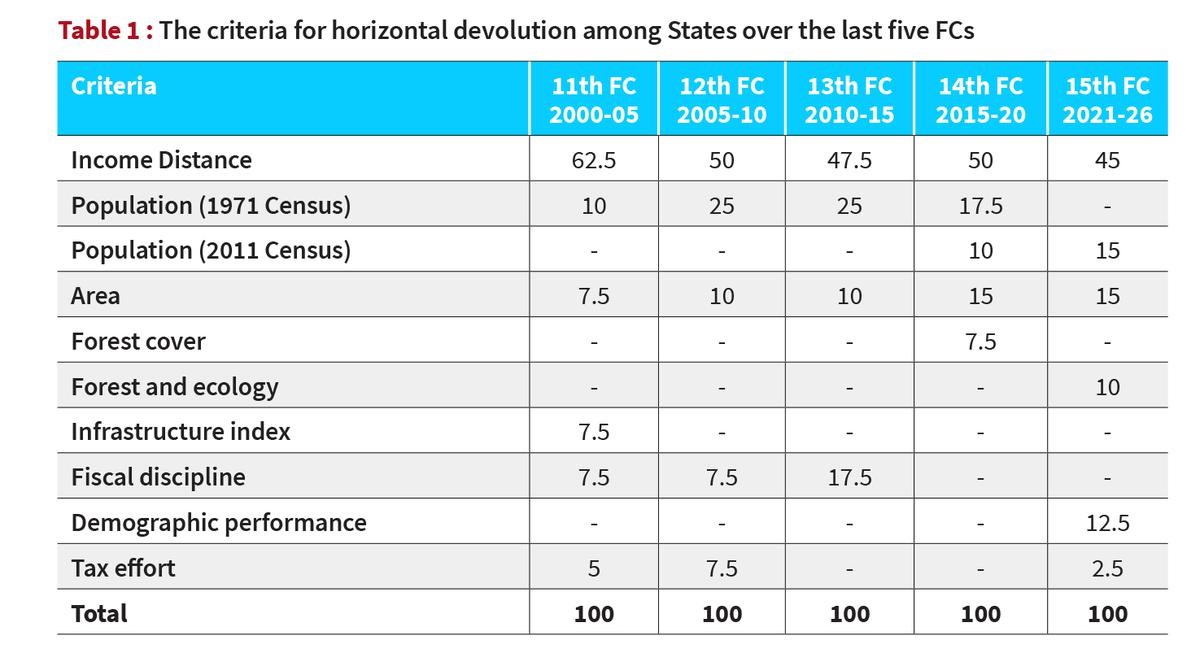

- The distribution among the States (horizontal devolution) is based on various criteria. Table 1 lists the criteria for horizontal devolution among the States from the 11th to 15th FC.

What is the basis for allocation?

- The 15th Finance Commission (FC) recommended a 41% share for States from the divisible pool for vertical devolution.

- Horizontal devolution, the distribution among States, is determined by various criteria.

- Table 1 outlines the criteria for horizontal devolution from the 11th to 15th FC.

The criteria under the 15th FC are explained as follows:

- "Income distance" measures a State's income compared to the State with the highest per capita income (Haryana). States with lower per capita income receive a higher share to ensure equity among States.

- "Population" is based on the 2011 Census. Previous FCs considered the 1971 Census, but the 15th FC shifted to the 2011 Census.

- "Forest and ecology" factor in the share of dense forest in each State compared to the aggregate dense forest of all States.

- The "Demographic Performance" criterion rewards States for efforts in controlling their population, with lower fertility ratios scoring higher.

- "Tax effort" rewards States with higher tax collection efficiency.

What are the concerns?

- The constitutional framework has historically favoured a strong central authority in legislative, administrative, and financial matters. However, federalism is a fundamental principle, and States should not feel disadvantaged in resource allocation. While political differences between the Union government and opposition-led States exacerbate this issue, there are genuine concerns that must be addressed.

- Firstly, the Union government's collection of cess and surcharge, estimated at around 23% of its gross tax receipts for 2024-25, does not form part of the divisible pool and is therefore not shared with the States.

- For perspective, the Union government's total tax revenue for 2022-23 (actual), 2023-24 (revised estimates), and 2024-25 (budget estimates) is ₹30.5, ₹34.4, and ₹38.8 lakh crore respectively. The States' share was/is ₹9.5, ₹11.0, and ₹12.2 lakh crore respectively, constituting around 32% of the Centre's total tax receipts, significantly less than the 41% recommended by the 15th Finance Commission.

- Cess such as the GST compensation cess is used to repay loans taken to compensate States for the shortfall in tax collection due to GST implementation from 2017 to 2022. Some of these funds are also used for centrally sponsored schemes that benefit the States. However, States have no control over these allocations.

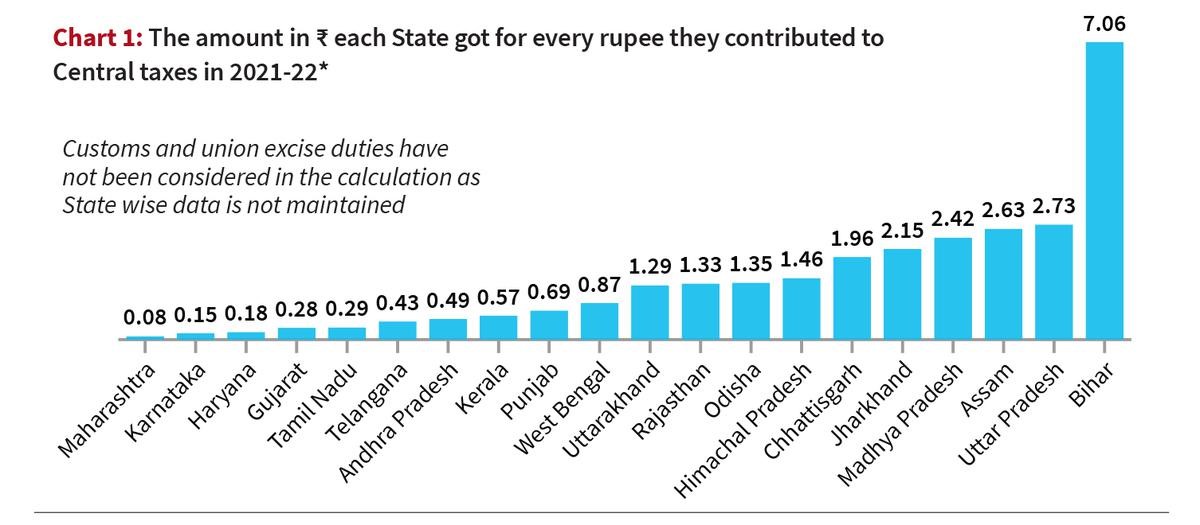

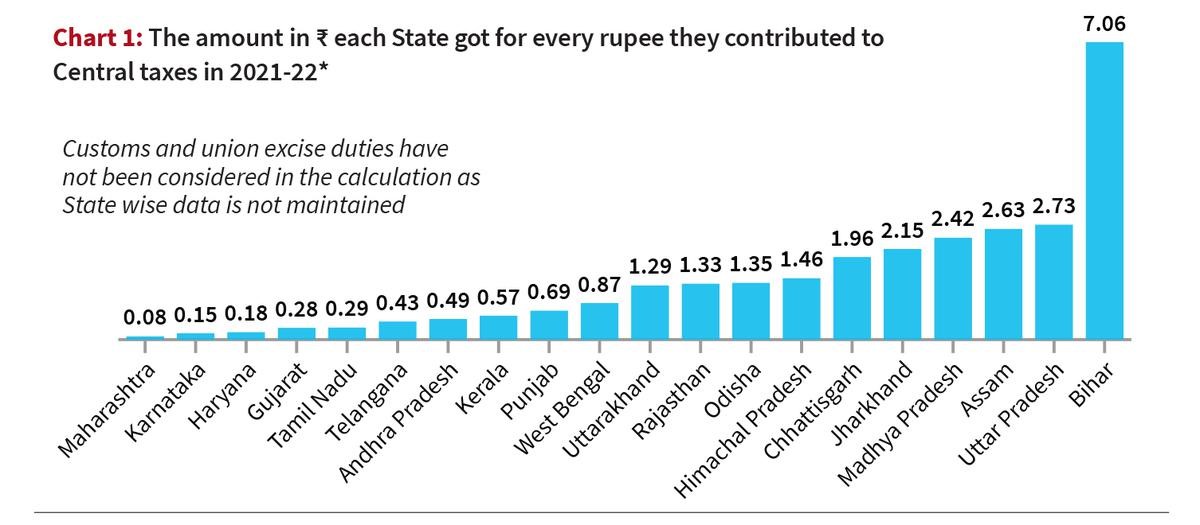

- Secondly, the variation in the amount each State receives for every rupee they contribute to Central taxes is significant. Chart 1 illustrates this disparity for the year 2021-22.

- Industrialized states receive less than a rupee for every rupee they contribute, unlike states like Uttar Pradesh and Bihar. This is due in part to many corporations being headquartered in these states' capitals, where they pay their direct taxes. However, the disparity can also be attributed to variations in GST collections among states.

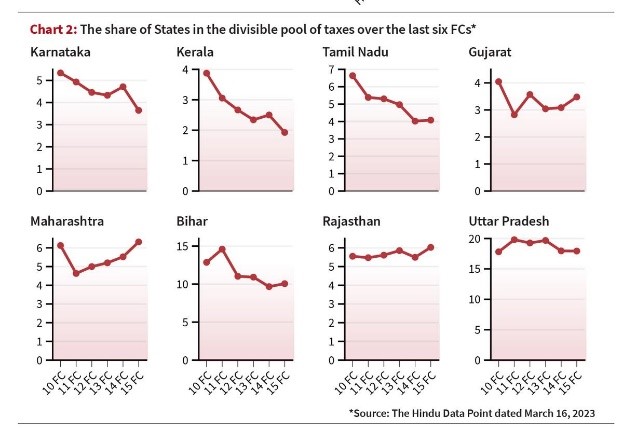

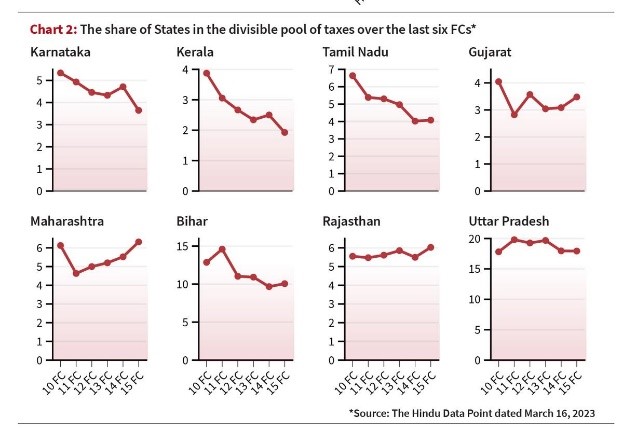

- The share of southern states in the divisible pool of taxes has decreased over the last six Finance Commissions, as shown in Chart 2. This trend is linked to greater emphasis on equity (income gap) and needs (population, area, and forest) over efficiency (demographic performance and tax effort).

- Grants-in-aid, according to the Finance Commission's recommendations, vary among states. The 15th Finance Commission provides revenue deficit, sector-specific, and state-specific grants to different states, as well as grants to local bodies based on states' population and area.

The Way Forward

- States contribute approximately 40% of the revenue and bear around 60% of the expenditure. The Finance Commission (FC) and its recommendations aim to address this imbalance and propose a fair revenue-sharing mechanism. It is the responsibility of all states to contribute to the equitable development of our country. However, three key reforms could help maintain the balance between equity and federalism in revenue sharing.

- Firstly, the divisible pool could be expanded by including a portion of cess and surcharge in it. The Centre should also gradually phase out various cesses and surcharges by rationalizing tax slabs.

- Secondly, the weightage for efficiency criteria in horizontal devolution should be increased. Since GST is a consumption-based destination tax equally divided between the Union and the States, the State GST accrual (including Integrated GST settlement on inter-state sales) should be the same as the Central GST accrual from a State.

- Therefore, the relative GST contribution from States could be included as a criterion by providing suitable weightage in future FCs.

- Finally, a more formal arrangement for the participation of States in the constitution and the functioning of the FC, similar to the GST council, should be considered.

- These measures should be implemented by the Centre after discussion with all States. It is also crucial for States to uphold the principles of fiscal federalism by devolving adequate resources to local bodies for vibrant and accountable development.

|

PRACTICE QUESTIONS

Q. What constitutes the divisible pool of taxes shared between the Centre and the States?

A. Income tax and property tax

B. Corporation tax and Central GST

C. Customs duty and excise duty

D. Stamp duty and entertainment tax

Answer: B. Corporation tax and Central GST

Q. Consider the following statements regarding the Finance Commission in India:

- The Finance Commission is a constitutional body.

- The Chairman of the Finance Commission is appointed by the Prime Minister of India.

- The Finance Commission is responsible for the implementation of GST in states.

Which of the statements above is/are incorrect?

A. 1 and 2

B. 1 and 3

C. 2 and 3

D. 1, 2, and 3

Answer: A. 1 and 2

The Finance Commission is indeed a constitutional body, and the Chairman of the Finance Commission is appointed by the President of India, not the Prime Minister. Therefore, statement 1 is correct, and statement 2 is incorrect. The Finance Commission is responsible for recommending the sharing of tax revenues between the Union government and the states, but it is not directly responsible for the implementation of GST in states. So, statement 3 is also incorrect. The correct answer is B. 2 and 3.

|