India launch first indigenous 32-bit microprocessor, Vikram 3201, marks a step toward semiconductor self-reliance. This achievement, driven by the India Semiconductor Mission, aims to reduce import dependency by promoting domestic manufacturing, design, and attracting global investment to tap into the future $1 trillion market.

Copyright infringement not intended

Picture Courtesy: THEHINDU

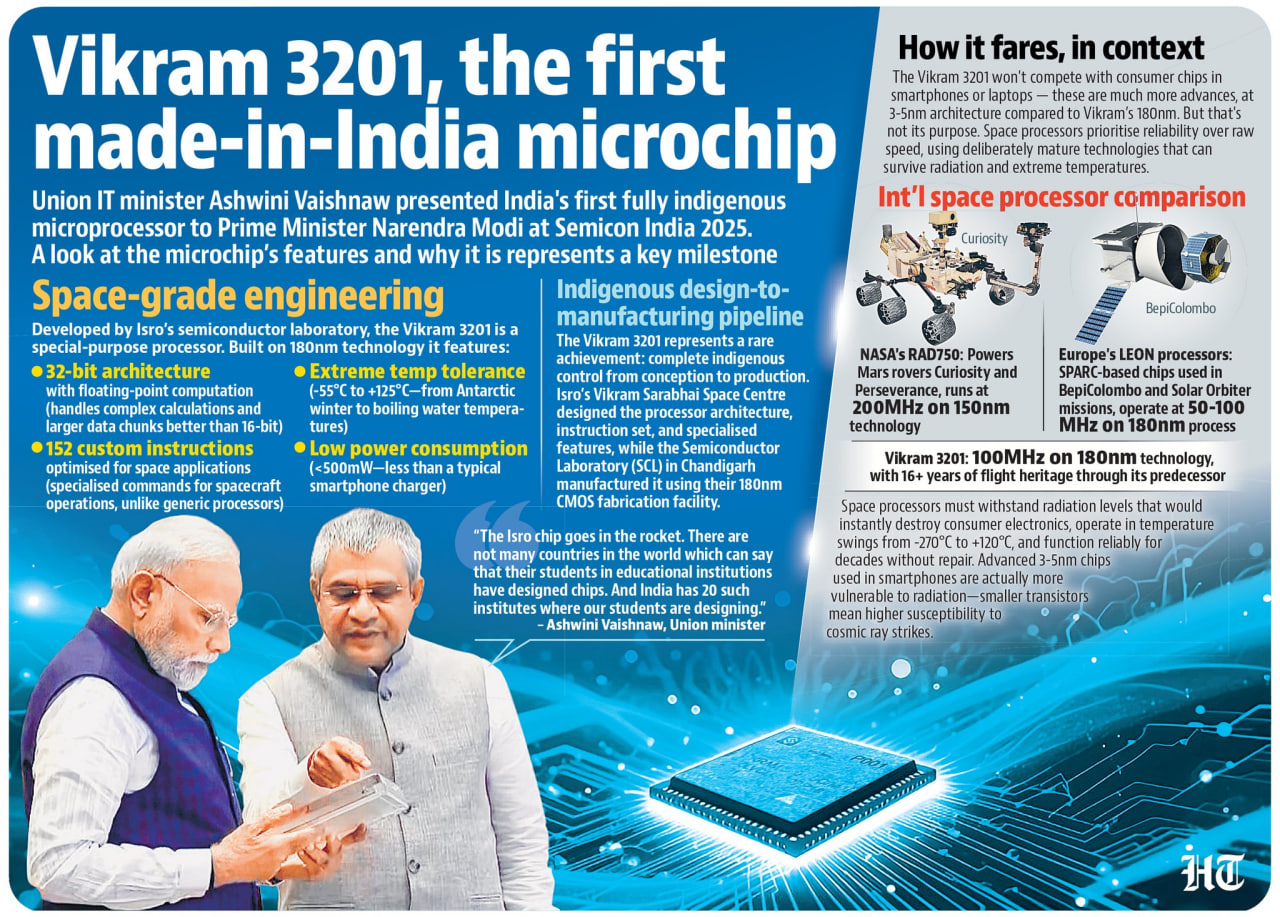

On September 2, 2025, Prime Minister received India’s first fully indigenous 32-bit microprocessor, Vikram 3201, at Semicon India 2025 in New Delhi.

SEMICONDUCTOR SECTOR IN INDIA: CHALLENGES AND OPPORTUNITIES

It is a 32-bit indigenous microprocessor developed by ISRO’s Semiconductor Laboratory (SCL) in Chandigarh.

Floating-point support: Allows for complex mathematical calculations, essential for the real-time guidance and navigation of launch vehicles.

High-level language compatibility: Supports languages like Ada, which is widely used in safety-critical aerospace systems.

Robust design: Tested to endure the harsh conditions of space, including extreme temperatures from –55°C to +125°C.

Space-validated: Initial batch of the processors was successfully tested in space during the PSLV-C60 mission.

Developments Shaping India’s Semiconductor Journey

Developments Shaping India’s Semiconductor Journey

Early Efforts (1980s–2000s): India’s semiconductor journey started with the establishment of SCL in Chandigarh in 1976 under ISRO. Initial focus was on space-grade chips like Vikram 1601, but lack of investment and infrastructure limited progress.

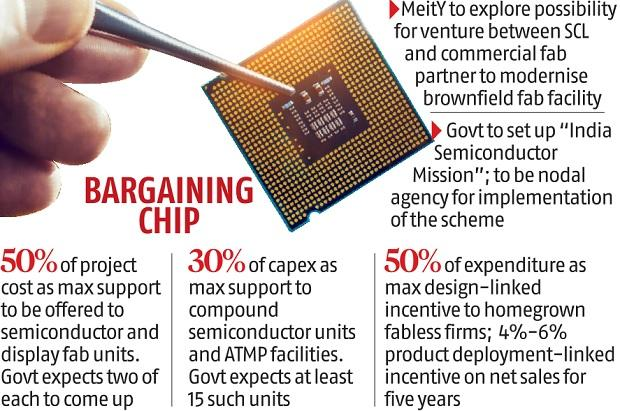

India Semiconductor Mission (ISM), 2021: Launched with ₹76,000 crore to develop fabrication, design, and assembly facilities, aiming for self-reliance. The ISM offers 50% fiscal support for semiconductor projects.

Production Linked Incentive (PLI) Scheme, 2020: Extended to electronics and semiconductors, it incentivizes domestic manufacturing with ₹6,903 crore allocated in the 2024 interim budget.

Production Linked Incentive (PLI) Scheme, 2020: Extended to electronics and semiconductors, it incentivizes domestic manufacturing with ₹6,903 crore allocated in the 2024 interim budget.

Vibrant Gujarat Summit, 2024: Announcements of major projects, including Tata’s $11 billion fab in Dholera with Taiwan’s Powerchip, marked a turning point.

India-US Partnership, 2024: A strategic collaboration under the US CHIPS Act to develop a national security semiconductor fab for infrared, gallium nitride, and silicon carbide chips.

India-Taiwan Partnership: Taiwan produces 60% of global chips. India’s partnerships with Taiwan’s Powerchip and US firms like Micron aim to replicate this model.

South Korea’s Model: South Korea’s success (Samsung) stems from government-backed R&D and private investment. India’s ISM and PLI schemes mirror this approach.

India-Singapore MoU, 2024: Agreements on semiconductor cluster development and talent cultivation enhance India’s global integration.

US-China Tensions: US export controls on China have prompted India’s semiconductor push, as global firms seek alternatives.

Historical Import Dependence: In 2021, only 9% of the country's semiconductor requirements were fulfilled locally. Global supply chain disruptions during COVID-19 exposed this vulnerability.

Capital-Intensive Industry: Semiconductor fabrication requires massive investments ($5–15 billion per fab) and ultra-specialized infrastructure (clean rooms, high energy). India lacked such facilities until recently.

Policy Gaps: Pre-2021, India had no comprehensive semiconductor policy. Unlike Taiwan and South Korea, which invested heavily in the 1980s–90s, India prioritized IT services over hardware.

Skilled Workforce Shortage: Despite 20% of global chip design engineers being in India, fabrication expertise was limited due to lack of domestic facilities.

Global Competition: Taiwan, South Korea, and China dominate 70% of global semiconductor production, backed by decades of subsidies and infrastructure.

Market Size: India’s semiconductor market was valued at $52 billion in 2024–25, projected to reach $103.4 billion by 2030.

Investment: Over ₹1.60 lakh crore committed across 10 projects in Gujarat, Assam, Uttar Pradesh, Punjab, Odisha, and Andhra Pradesh.

Job Creation: The sector is expected to generate 1 million jobs by 2026, with Tata’s Dholera fab alone creating 20,000 jobs.

Domestic Demand: India is the second-largest market for 5G smartphones after China, driving chip demand.

Global Share: India aims for a 10% share in the $1 trillion global semiconductor market by 2030.

High Capital Costs: A single fab costs $5–15 billion, straining public finances, need for private sector investment.

Technology Lag: India focuses on mature nodes (28nm+), while global leaders produce 3–5nm chips, limiting competitiveness in advanced applications.

Infrastructure Gaps: Fabs require ultra-clean rooms and stable power (169 MW annually). Delays in operationalizing facilities like Micron’s Sanand plant highlight logistical challenges.

Skilled Workforce: Fabrication requires specialized skills, and India’s talent pool, while strong in design, lacks fab experience.

Global Competition: China’s $150 billion semiconductor push and Taiwan’s dominance pose stiff competition. US export controls may redirect investments but also raise costs.

Geopolitical Risks: US-China tensions, potential trade wars, 50% USA tarrifs on India could disrupt supply chains, affecting India’s access to equipment and technology.

Strengthen ISM and PLI: Expand fiscal incentives and streamline approvals to attract more global players. The Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) and state policies (e.g., UP Semiconductor Policy 2024) should be scaled up.

Focus on Niche Technologies: Prioritize MEMS (Micro-Electro-Mechanical Systems), sensors, and compound semiconductors (e.g., gallium nitride) to carve a global niche.

Chip Diplomacy: Deepen partnerships with the US, Japan, and Singapore to access technology and markets. The India-US fab for national security chips is a model.

Private Sector Push: Encourage startups like Mindgrove and Signalchip, and scale collaborations with global giants like Qualcomm and Nvidia.

Skill Development: Invest in training programs for fab engineers, leveraging tie-ups with institutions like IITs and NITs, as seen in Semicon India 2025.

Geopolitical Leverage: Use US-China tensions to attract investments, as India emerges as a stable alternative. Moody’s highlights India’s edge alongside Malaysia and Singapore.

The launch of India’s first indigenous Vikram 3201 processor marks an foundational step towards semiconductor self-reliance, aligning with the Aatmanirbhar Bharat vision. This achievement, driven by ISRO’s Semiconductor Laboratory and supported by the India Semiconductor Mission, positions India to reduce its import dependence and contribute to the $1 trillion global semiconductor market by 2030.

Source: THE HINDU

|

PRACTICE QUESTION Q. Discuss the importance of the semiconductor industry in India’s economic and strategic growth. 150 words |

A semiconductor processor is the "brain" of an electronic device, a tiny chip that performs calculations and carries out instructions.

ISM is a government program offering financial support to attract investments and build a complete semiconductor ecosystem in India.

A 'fab' (fabrication plant) is a highly expensive, dust-free facility where semiconductor chips are manufactured.

© 2026 iasgyan. All right reserved