The Union Budget 2026–27 stresses “Green Growth” with allocations for CCUS, PM Surya Ghar solar, and nuclear energy, linking climate strategy to EU CBAM pressures and industrial decarbonization; however, funding remains below Net Zero 2070 needs, demanding blended finance and stronger green procurement to close the intent–outcome gap.

Copyright infringement not intended

Picture Courtesy: cxodigitalpulse

The Union Budget 2026-27 prioritizes "Green Growth" with ambitious intent but cautious financial allocation, aiming to transition India towards a net-zero, "carbon-light" economy through pilot projects.

|

Read all about: Union Budget 2026 l Budget 2026 Shift Welfare Burden to States |

The budget outlines specific financial commitments and policy support for key green sectors, designed to initiate decarbonization in critical areas of the economy.

|

Focus Area |

Allocation / Policy Action |

Primary Objective |

|

Proposed 5-year outlay of ₹20,000 crore. |

To develop and demonstrate technology for capturing CO2 from industrial sources. |

|

|

Rooftop Solar (PM Surya Ghar) |

Increased allocation to ₹22,000 crore. |

To install rooftop solar systems in 1 crore households. |

|

Solar Irrigation (PM-KUSUM) |

Allocation of ₹5,000 crore. |

To promote solar-powered pumps in agriculture and reduce reliance on diesel. |

|

Nuclear Energy |

Extension of zero basic customs duty on equipment imports until 2035. |

To reduce the high capital cost of building new nuclear power plants. |

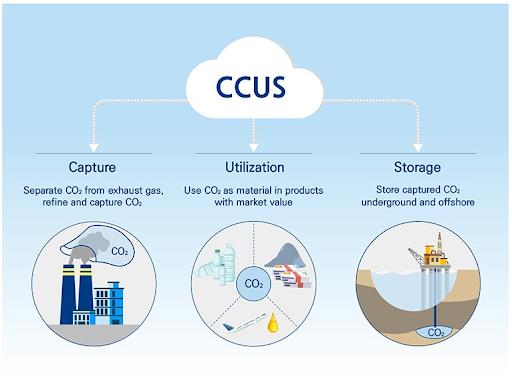

Carbon Capture, Utilisation, and Storage (CCUS) is a suite of technologies designed to prevent large amounts of Carbon Dioxide from being released into the atmosphere.

It is considered a critical tool for meeting global "Net Zero" targets, especially for industries that are hard to decarbonize.

The outlay for CCUS is driven by two critical factors: protecting India's export competitiveness and addressing emissions from industries that cannot be easily electrified.

Countering the CBAM Threat: The European Union’s Carbon Border Adjustment Mechanism (CBAM), fully effective from 2026, will impose a tax on carbon-intensive imports like steel and aluminum.

Decarbonizing Hard-to-Abate Sectors: Industries such as cement and steel, which need extremely high temperatures and have process emissions, currently rely on CCUS as the most viable technology to manage these emissions

Despite policy support, these two critical sectors face "intent vs. execution" gaps that hinder their growth.

Nuclear Energy: The Capital and Liability Trap

High Cost: Nuclear power projects are extremely capital-intensive and have long gestation periods of 10-15 years.

Legal Barriers: The Civil Liability for Nuclear Damage Act, 2010, imposes strict and unlimited liability on suppliers for accidents, which has discouraged foreign private companies from investing and transferring technology to India.

Green Hydrogen: The Cost-Viability Gap

Cost Challenge

Green Hydrogen produced via electrolysis costs around $4-$5 per kg, which is higher than Grey Hydrogen (from natural gas) at $1.5 per kg. (Source: NITI Aayog Report)

Weak Demand

National Green Hydrogen Mission's 5 MMT 2030 goal is ambitious, but meeting demand is difficult without stronger viability gap funding (VGF) or mandatory consumption for key sectors like oil refining and fertilizers.

Inadequate Scale of Finance

India needs an estimated $10.1 trillion to achieve Net Zero target by 2070 (Source: CEEW-CEF Report). Current budget allocations, while significant, are a fraction of the required investment.

Dependency on Private Capital

Private sector investment in green technology is challenged by the high "Green Premium" and interest rates, necessitating robust de-risking mechanisms from the government.

Implementation Federalism

Success of central climate action schemes in areas like electricity, transport, and agriculture, which are state subjects, relies heavily on the financial health and implementation capacity of state-level bodies such as DISCOMs and Pollution Control Boards.

Mandating Green Public Procurement: Create assured domestic demand by mandating the use of "Green Steel" and "Green Cement" in all government infrastructure projects.

De-risking Private Investment: Move beyond grants to instruments like Blended Finance, where public funds are used to provide guarantees or first-loss cover, thereby attracting private capital for high-risk green projects.

Standardizing Green Taxonomy: Introduce a clear, legally-backed classification system for what qualifies as a "green" investment. This will prevent greenwashing and attract global Environment, Social, and Governance (ESG) funds.

Lessons from Global Best Practices

United States (Inflation Reduction Act - IRA)

The US provides a direct, production-linked tax credit of up to $85 per tonne of CO2 captured. This predictable incentive gives long-term certainty to investors, encouraging large-scale private investment.

Norway (Longship Project)

Norway is developing a full-scale CCUS value chain. The key lesson for India is the "Hub and Cluster" model, where multiple industrial emitters in a zone share common CO2 transport and storage infrastructure, reducing costs for individual companies.

The Budget 2026-27 acknowledges essential decarbonization technologies, but requires substantial funding and targeted implementation to achieve economic and trade-related decarbonization targets.

Source: THEHINDU

|

PRACTICE QUESTION Q. “The allocation for Carbon Capture, Utilisation and Storage (CCUS) in the Union Budget 2026-27 is less about environmental altruism and more about trade defense." Discuss. 150 words |

The Carbon Border Adjustment Mechanism (CBAM) is an EU policy applying a carbon tax-like fee on imported carbon-intensive goods (steel, cement, aluminum, fertilizers, electricity, and hydrogen) to prevent "carbon leakage," ensure fair competition, and encourage global decarbonization.

The PM Surya Ghar: Muft Bijli Yojana is a major central government initiative launched in February 2024 to provide free electricity to one crore households by installing rooftop solar panels. With a total budget of ₹75,021 crore, it targets adding 30 GW of solar capacity by FY 2026-27.

The PM Surya Ghar: Muft Bijli Yojana is a central government scheme launched on February 15, 2024, aiming to provide up to 300 units of free monthly electricity to 1 crore households by installing rooftop solar systems. It offers subsidies (up to 60% for 2kW, 40% for additional capacity up to 3kW) and low-interest loans, with a total outlay of ₹75,021 crore.

© 2026 iasgyan. All right reserved