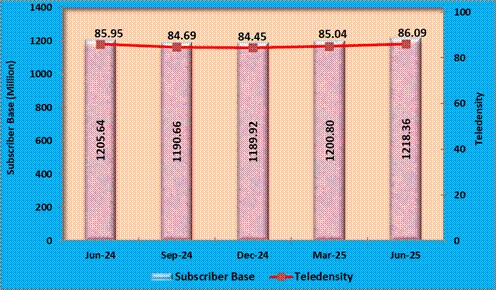

TRAI's 2025 performance report highlights growth, with telephone subscribers reaching 1.218 billion and internet users exceeding 1 billion. Tele-density rose to 86.09%, driven by the private sector's 91.73% market share. This data highlights the rapid expansion of the digital landscape, despite a persistent rural-urban divide.

Copyright infringement not intended

Picture Courtesy: DIG

The Telecom Regulatory Authority of India (TRAI) released the “Indian Telecom Services Performance Indicator Report”.

Subscriber Growth: Total telephone subscribers increased to 1,218.36 million, with tele-density rising to 86.09% (urban: 133.56%, rural: 59.43%).

Internet and Broadband: Internet subscribers increased to 1,002.85 million, with broadband subscribers at 979.71 million.

Internet and Broadband: Internet subscribers increased to 1,002.85 million, with broadband subscribers at 979.71 million.

Wireless Services: Wireless subscribers (mobile + 5G) reached 1,170.88 million. Average data usage: 24.01 GB/subscriber/month.

Broadcasting and Cable: 912 private satellite TV channels permitted. DTH subscribers dropped to 56.07 million.

|

Telecom Regulatory Authority of India (TRAI) It is a statutory body established through the Telecom Regulatory Authority of India Act, 1997. It regulates create fair, transparent environment that promote the orderly growth of the industry. Its chairperson is appointed by the central government. Its functions are advisory and regulatory, including tariff regulation, quality of service monitoring, interconnection regulation, promoting competition, advising the government, and protecting consumer interests. |

1990s Liberalization: The National Telecom Policy (NTP) 1994 and 1999 opened the sector to private players, ending the state monopoly of BSNL/MTNL. Allowed 100% FDI in telecom, prompted competition, reducing call tariffs.

2G Spectrum Scam (2008): Alleged irregularities in spectrum allocation led to stricter TRAI regulations and the 2012 spectrum auction policy, enhancing transparency.

National Digital Communications Policy (2018): Aimed for $100 billion investment and 5 billion IoT devices, fostering digital economy growth.

Jio’s Entry (2016): Reliance Jio’s free data and voice services triggered a price war, consolidating the market into four major players (Jio, Airtel, Vi, BSNL/MTNL).

5G Rollout (2022-23): India’s fastest global 5G rollout covered 717 districts with 3.15 lakh base stations, supported by the GatiShakti Sanchar Portal for streamlined approvals.

Telecommunication Act 2023: Replaced outdated laws, streamlining regulations for emerging technologies like 5G and quantum communications.

Digital India: Launched in 2015, to expand digital infrastructure, BharatNet connects 86% of gram panchayats with optical fiber, enhancing rural connectivity.

Smartphone Penetration: Low-cost smartphones drive telecom growth. India is the world's second-largest manufacturer of mobile phones.

5G Revolution: India’s 5G rollout enabling IoT, smart cities, and industrial automation. Affordable data and robust networks drive this.

Rise of Digital Payments: In July 2025, the Unified Payments Interface (UPI) recorded 1,947 crore transactions, valued at ₹25.1 lakh crore.

OTT Content Boom: OTT market fuels data consumption. Hotstar’s 57.8 crore IPL 2025 views highlight this trend.

Remote Work and Education: COVID-19 pandemic increased data consumption, with sustained demand for hybrid work and e-learning.

Financial Stress: Industry’s debt reached ₹4.09 lakh crore in FY24, driven by high spectrum costs and tariff wars. Vodafone Idea owes ₹2.1 lakh crore, limiting capex.

AGR Dispute: The 2019 Supreme Court ruling imposed ₹1.69 lakh crore in liabilities, with Airtel paying only ₹18,004 crore of ₹43,980 crore dues. This strains balance sheets.

Infrastructure Gaps: Urban tele-density is 133.56%, but rural lags at 59.43%.

Spectrum Pricing: India’s high spectrum costs (₹1.5 lakh crore in 2022 auctions) deter network expansion, unlike Singapore’s affordable models.

Quality of Service: TRAI reports persistent call drops and poor connection rates.

Cybersecurity Threats: Over 13.91 lakh cyber incidents in 2022 (CERT-In) highlight vulnerabilities, especially with 5G’s expanded attack surface.

Regulatory Challenges: Complex licensing and unresolved OTT regulation debates create uncertainty. Telecoms advocate “same service, same rules” for OTT platforms.

Rationalize spectrum pricing: Shift toward a revenue-sharing model for spectrum fees, longer payment periods, and prioritizing efficient usage over revenue maximization.

Resolve the AGR issue: While the government has offered relief, a clear, permanent resolution is crucial to restore financial health and investor confidence.

Implement a "fair-share" mechanism: With the increase of data traffic, telecom service providers (TSPs) are advocating for large technology giants (LTGs) like OTT platforms to contribute to network infrastructure costs.

Infrastructure expansion: A robust fiber backbone is essential for realizing the full potential of 5G and future technologies like 6G. Public-private partnerships and incentives are needed to accelerate last-mile fiber deployment, particularly in rural areas.

Boost rural connectivity through initiatives: India's rural-urban digital divide remains a significant challenge.

Leverage emerging technologies: Implementing AI and blockchain for subscriber verification and regulatory sandboxes for new technologies will drive innovation and security.

Long-term strategic planning: Predictable long-term telecom roadmap, with clear spectrum policies and investment goals, is necessary to attract and retain private capital.

India’s telecom sector, with 1.2 billion subscribers and rapid 5G growth, drives the $1 trillion digital economy vision, contributing 6.5% to GDP. Despite low rural connectivity gaps, and market concentration, strategic reforms like BharatNet and 6G innovation can ensure global leadership by 2030.

Source: PIB

|

PRACTICE QUESTION Q. Discuss the role of the telecom sector in India’s digital transformation. 150 words |

TRAI recommends policy, regulates tariffs, and ensures quality of service to protect consumer interests.

AGR is the revenue on which telecom companies pay license fees and spectrum usage charges to the government.

BharatNet aims to provide broadband connectivity to all 2.5 lakh Gram Panchayats in India.

© 2026 iasgyan. All right reserved