The State of Finance for Forests 2025 report shows forest investments are underfunded. To achieve 2030 climate and biodiversity goals, governments must triple annual funding from $84 billion to $300 billion, redirect harmful subsidies, and mobilize private capital toward nature-based solutions to fully protect and restore forests.

Copyright infringement not intended

Picture Courtesy: DOWNTOEARTH

The 2025 State of Finance for Forests (SFF) report, "Unlock. Unleash.," reveals financial shortfall in protecting and restoring global forests.

Massive Funding Gap

Imbalance: Public vs. Private Finance

Imbalance: Domestic vs International Finance

India's Leadership in Domestic Commitment

The report emphasizes that a significant expansion of nature-based solutions (NbS) is crucial to achieve climate, biodiversity, and land degradation targets.

Expansion Targets: The area under protection and other types of NbS needs to expand by an additional 1 billion hectares by 2030 and 1.8 billion hectares by 2050.

Six Complementary NbS for Tropical Forest Countries: The report projects that by 2030, tropical forest countries will require an estimated $67 billion annually, allocated across six key NbS:

The report highlights a critical issue: significant financial flows continue to harm forests, undermining conservation efforts.

Triple Investments by 2030: Governments and private investors must commit to increasing forest investments dramatically to meet the $300 billion annual target.

Shift Public Finance to International Support: Developed countries must increase their international public finance for forests, particularly for tropical forest countries.

Mobilize Private Capital: Innovative mechanisms are needed to attract private investors, moving beyond traditional finance models to include blended finance, green bonds, and impact investing.

Align Policies and Regulations: Governments must align their economic, trade, and land-use policies with forest goals, actively discouraging environmentally harmful subsidies and financial flows.

Empower Indigenous Peoples and Local Communities: Direct funding and legal recognition of customary land rights for Indigenous Peoples and Local Communities (IPs and LCs) are crucial, as they are proven, effective guardians of forests.

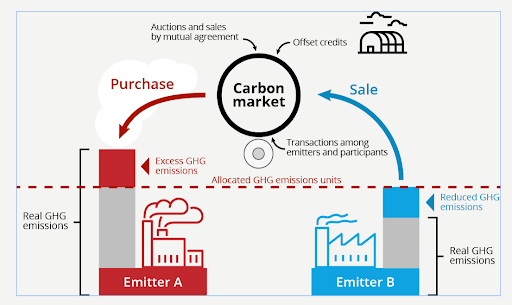

Strengthen Voluntary Carbon Markets: Improve the integrity and transparency to build investor confidence and ensure that carbon credits represent genuine, verifiable emissions reductions.

The "State of Finance for Forests 2025" report highlights the severe undervaluation and underfunding of forests, critical for climate and biodiversity. Despite India's domestic spending, global public and private investment is crucial to close the finance gap, align economic policies, and achieve 2030 deforestation targets.

Source: DOWNTOEARTH

PRACTICE QUESTIONQ. Which international agreements' targets are linked to the increase in forest finance? 1. The Rio Conventions 2. The Paris Agreement 3. The Kunming-Montreal Global Biodiversity Framework 4. The Stockholm Convention Select the correct answer using the code given below: A) 1 and 2 only B) 1, 2 and 3 only C) 3 and 4 only D) 1, 2, 3 and 4 Answer: B Explanation: The need for increased forest finance to achieve the targets set under the Rio Conventions, the Paris Agreement, and the Kunming-Montreal Global Biodiversity Framework. The Stockholm Convention deals with persistent organic pollutants and is not directly linked. |

The Green India Mission is one of the eight missions under the National Action Plan on Climate Change (NAPCC). It aims to protect, restore, and enhance India's forest cover, combat climate change, and improve ecosystem services.

CAMPA was formed under the Compensatory Afforestation Fund Act, 2016, to manage funds from forest land diversion for compensatory afforestation, wildlife management, and forest protection.

Launched in 2023, the Green Credit Program encourages individuals, companies, and organizations to earn tradable "green credits" for environmentally friendly actions like afforestation and land restoration. This initiative aims to increase private sector involvement in climate action and forest conservation.

© 2026 iasgyan. All right reserved