The Reserve Bank of India (RBI) manages rupee depreciation through tools like selling US Dollars and adjusting interest rates, addressing factors like trade deficits and capital outflows. A weaker rupee boosts exports but exacerbates inflation and increases debt costs, crucial for India's economic stability.

Copyright infringement not intended

Picture Courtesy: REUTERS

The Indian Rupee hit a record low of 88.36 against the US dollar, driven by the US-India diplomatic and trade crisis, combined with global and domestic factors, impacting Indian economy and foreign policy.

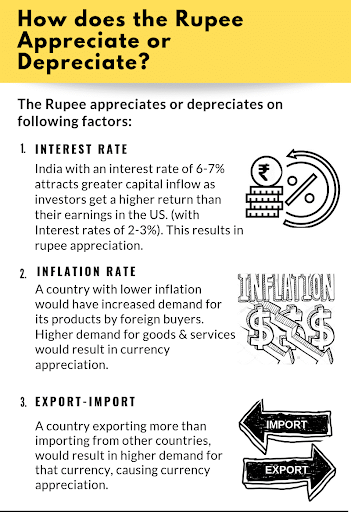

Rupee depreciation occurs when the Rupee’s value falls against foreign currencies, like the US dollar, in the open market.

Unlike devaluation (a deliberate government action to lower currency value), depreciation results from market forces like supply and demand, capital flows, and global economic conditions.

India follows a managed floating exchange rate, where the Reserve Bank of India (RBI) intervenes to control volatility but does not fix the rate.

Internal Factors

Rising Inflation: Higher domestic prices reduce the rupee’s purchasing power, making Indian goods costlier abroad.

Widening Trade Deficit: India’s trade deficit hit $27.35 billion in July 2025, driven by high imports of crude oil and electronics. This increases dollar demand, weakening the rupee.

Foreign Capital Outflows: Foreign Portfolio Investors withdraw ₹1.13 lakh crore from Indian equities in 2025 (as of July) due to trade tensions and weak earnings. Many shifted investments to China due to its financial incentives.

Domestic Structural Weaknesses: Heavy reliance on imported energy (e.g., 80% of crude oil imports) and critical materials like electronics keeps pressure on the rupee.

External Factors

US-India Trade Crisis: The US imposed a 25% reciprocal tariff and an additional 25% penalty on Indian exports, due to diplomatic tensions over Russian oil imports and the mediation controversy. This threatens 70% of India’s exports to the US.

Rising Crude Oil Prices: The West Asia crisis pushed global oil prices, increasing India’s import bill and dollar demand.

US Dollar Strength: The US Federal Reserve’s rate hikes strengthened the dollar index, making the rupee weaker.

Geopolitical Tensions: The Russia-Ukraine conflict and US-India friction have raised global uncertainty, prompting capital flight from emerging markets like India.

Positive Impacts

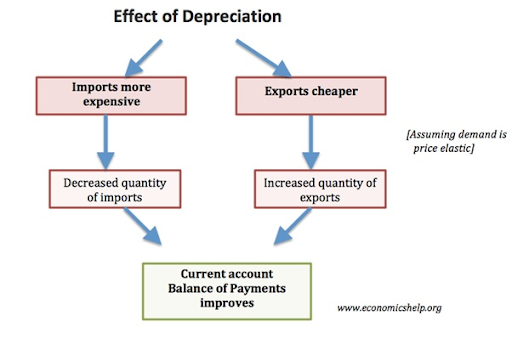

Boost to Exports: A weaker rupee makes Indian goods cheaper abroad. Sectors like IT, textiles, and pharmaceuticals benefit.

Higher Remittance Value: Non-Resident Indians (NRIs) get more rupees per dollar. Remittances rose to $ 135.46 in 2024-25 and are expected to increase further.

Potential Domestic Investment: Increased export earnings may encourage investment in export-oriented industries.

Negative Impacts

Higher Import Costs: Expensive imports, especially crude oil, widen the trade deficit.

Inflationary Pressures: Imported inflation could push inflation in the domestic market. Higher input costs raise prices for consumers and businesses.

Capital Flight: Foreign Institutional Investors (FII) outflows, reduced forex reserves, eroding investor confidence.

Increased Foreign Debt Costs: India’s external debt of 736.3 billion (March 2025) becomes costlier to service, straining government finances.

The RBI has shifted to a less interventionist approach since November 2024, allowing the rupee to depreciate.

Limited Interventions: The RBI sold dollars to stabilize the rupee but avoided heavy spending of forex reserves.

Strategic Tolerance: Experts note the RBI’s new governor, Sanjay Malhotra, continues the policy of controlled depreciation to conserve reserves and boost exports.

Short-Term Measures

Forex Interventions: The RBI can sell dollars from reserves to reduce rupee volatility.

Currency Swap Agreements: Bilateral swaps with countries like Japan or UAE can stabilize dollar demand.

Monetary Policy Adjustments: Raising repo rates (currently 6.5% August 2025) can attract foreign investment.

Import Rationalization: Restrict non-essential imports like luxury goods to lower dollar demand.

Long-Term Measures

Diversify Trade Payments: Promote rupee-based trade to reduce dollar reliance.

Boost Exports: Strengthen schemes like Production Linked Incentive (PLI) to enhance exports in electronics and pharmaceuticals.

Reduce Import Dependency: Expand domestic production via Make in India to cut reliance on imported oil and electronics.

Attract FDI: Improve ease of doing business to draw long-term foreign investment.

Inflation Control: Use fiscal tools to keep inflation below 4%, stabilizing the rupee’s value.

Strengthen Strategic Autonomy: Balance ties with the US, Russia, and BRICS to protect national interests.

Diversify Trade Partners: Pursue FTAs with the EU, UK, and ASEAN to reduce reliance on the US market.

Build Forex Reserves: Increase reserves as a buffer against shocks.

Promote Domestic Growth: Invest in infrastructure and manufacturing to boost GDP growth.

Engage in Diplomacy: Resolve tensions with the US through dialogue while reinforcing Quad and G20 commitments.

The 2025 US-India crisis and rupee depreciation highlight the challenges of balancing economic stability and strategic autonomy. While short-term measures like RBI interventions can ease volatility, long-term strategies—such as diversifying trade, boosting exports, and reducing import dependency—will ensure India’s economic resilience.

Source: REUTERS

|

PRACTICE QUESTION Q. A depreciating rupee is not a sign of economic weakness but a reflection of market forces. Critically analyze. 150 words |

It is a decrease in the value of the Indian Rupee relative to other currencies, especially the US Dollar, due to market forces of demand and supply.

Depreciation is a decline in currency value in a flexible exchange rate system, while devaluation is a deliberate government action to lower its currency's value in a fixed exchange rate system.

Key causes include a high current account deficit (when imports exceed exports), capital outflows by foreign investors, and a strengthening US Dollar globally due to factors like rising interest rates.

© 2026 iasgyan. All right reserved