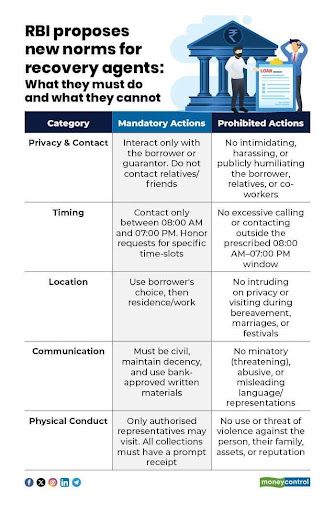

The Reserve Bank of India has issued draft Responsible Business Conduct (Second Amendment) Directions, 2026 to regulate the conduct of loan recovery agents, effective from July 1, 2026. The guidelines prohibit harassment, abusive language, excessive or anonymous calls, inappropriate digital messages, and any form of intimidation or public humiliation of borrowers or guarantors. Banks are required to establish a dedicated grievance redressal mechanism and adopt board-approved policies covering due diligence, code of conduct, and performance standards for recovery agents. The move aims to strengthen financial consumer protection, promote ethical recovery practices, and balance borrower dignity with credit discipline in India’s expanding retail lending ecosystem.

Copyright infringement not intended

Picture Courtesy: Money Control

Context:

The Reserve Bank of India has issued draft guidelines titled Commercial Banks – Responsible Business Conduct (Second Amendment) Directions, 2026 to regulate the conduct of loan recovery agents. The norms will come into force from July 1, 2026 after public consultation.

|

Must Read: COMPROMISE SETTLEMENT OF WILFUL DEFAULTERS | LOAN LOSS PROVISION | NON-PERFORMING ASSETS | |

Key Highlights of RBI draft norms on loan recovery agents:

Conduct Restrictions

Institutional Safeguards

Picture Courtesy: Money Control

Challenges in implementing RBI’s recovery agent norms:

Key measures for effective implementation of RBI’s recovery agent norms:

Strengthening supervisory technology and audit systems: Banks should deploy call recording, AI-based monitoring, and geo-tagged field visit reports to track recovery interactions, while periodic third-party compliance audits can ensure adherence to the guidelines issued by the Reserve Bank of India.

Professionalisation and certification of recovery agents: A mandatory training and certification framework through the Indian Institute of Banking & Finance (IIBF) or similar bodies can improve professionalism, given that a large proportion of agents currently operate on commission without formal training.

Improving borrower awareness and financial literacy: Banks should provide SMS/email-based rights charters at the time of loan sanction and integrate awareness campaigns with the RBI’s Financial Literacy Centres, especially since national financial literacy levels remain below 30%.

Strengthening grievance redressal and accountability: Dedicated recovery grievance portals with time-bound resolution (e.g., 30 days), escalation to the Integrated Ombudsman Scheme, 2021, and penalties for repeat violations can enhance borrower confidence.

Regulating digital and fintech-linked recovery practices: Clear protocols for digital communication, data privacy, and consent-based contact are essential as retail and digital lending expands rapidly, particularly in unsecured personal loans.

Conclusion:

The draft recovery conduct norms of the Reserve Bank of India mark a significant step toward balancing credit discipline with borrower dignity in India’s expanding retail credit ecosystem. As retail loans now account for over 30% of bank credit and financial inclusion deepens, ensuring ethical, transparent, and non-coercive recovery practices is critical for sustaining public trust in the formal financial system. Effective implementation—through strong supervision, borrower awareness, and accountability—will not only curb harassment but also promote responsible lending, financial stability, and a healthy credit culture in the long run.

Source: The Hindu and Money Control

|

Practice Question Q. The increasing use of recovery agents by banks and NBFCs has raised concerns about borrower rights and ethical lending practices. In this context, examine the significance of the recent guidelines issued by the Reserve Bank of India to regulate loan recovery practices. (250 words) |

© 2026 iasgyan. All right reserved