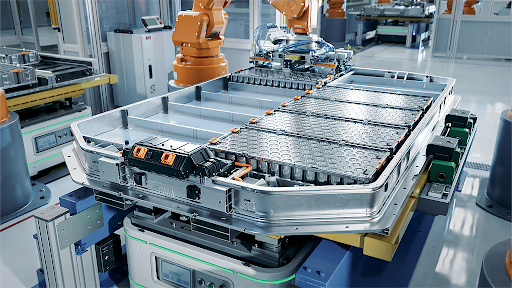

ACC battery PLI scheme is faltering, achieving just 2.8% of its 50 GWh target after four years. Rigid value-addition norms, weak ecosystem support, and design flaws demand a reset toward an integrated value-chain strategy, from minerals to recycling, aligned with global best practices.

Copyright infringement not intended

Picture Courtesy: DOWNTOEARTH

According to the Institute for Energy Economics and Financial Analysis (IEEFA) South Asia and JMK Research, the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage has achieved only 2.8% of its targeted manufacturing capacity in four years.

|

Read all about: Production-Linked Incentive (PLI) Scheme |

It is also known as the National Programme on ACC Battery Storage, is part of 'Make in India' and the clean energy strategy.

Objectives: Launched in 2021 by the Ministry of Heavy Industries, to reduce import reliance, especially on China, by strengthening the domestic ecosystem for electric mobility and grid energy storage.

Budgetary Outlay: ₹18,100 crore

Primary Target: To establish 50 Gigawatt-hours (GWh) of domestic ACC manufacturing capacity.

Key Mandates for Beneficiaries:

Current Status and Progress

|

Metric |

Target |

Achievement (as of late 2025 reporting) |

Percentage Achieved |

|

Manufacturing Capacity |

50 GWh |

1.4 GWh (Commissioned entirely by Ola Electric) |

2.8% (Source: IEEFA & JMK Research). |

|

Investment Mobilized |

₹11,250 crore |

₹2,870 crore |

25.6% (Source: IEEFA & JMK Research). |

|

Job Creation |

1.03 million |

1,118 jobs |

0.12% (Source: IEEFA & JMK Research). |

|

Incentive Disbursal |

₹2,900 crore (planned) |

Zero |

0% (Source: IEEFA & JMK Research). |

Stringent Domestic Value Addition (DVA) Norms: Requirement to achieve 25% DVA quickly and scale it to 60% is a major challenge for new entrants in a nascent Indian component ecosystem.

Aggressive Timelines: A two-year period to establish complex manufacturing facilities has proven too ambitious, compounded by procedural delays like obtaining visas for technical experts.

Flawed Evaluation Criteria: Bidding process favored new entrants over experienced battery makers like Exide, who failed to qualify due to higher weightage given to DVA commitments and subsidy quotes.

Adopt a Holistic Value-Chain Approach

Move beyond just cell manufacturing. Introduce dedicated incentive schemes for critical mineral sourcing, refining, component manufacturing, and recycling infrastructure.

Re-evaluate Timelines and Penalties

Extending timelines and providing temporary relief from penalties to give beneficiaries the necessary time to overcome initial hurdles.

Attract Global Expertise

Create a more favorable environment for established global battery manufacturers to invest and facilitate technology transfer.

Strengthen Ancillary Infrastructure

Invest in robust cell testing and certification facilities and launch focused programs for skill development and R&D.

Implement Calibrated Tariff Protection

Use measures like Basic Customs Duty (BCD) to protect the nascent domestic industry from unfair competition and predatory pricing.

Lessons from Global Best Practices

|

Country/Region |

Core Strategy |

Key Features |

|

China |

Holistic Ecosystem Development |

Dominates the entire value chain, from mineral refining to component manufacturing. Domestically produced 79% of the world's natural graphite in 2024 (Source: U.S. EIA). |

|

United States |

Strong Financial Incentives |

The Inflation Reduction Act (IRA) offers tax credits and subsidies to boost domestic production and attract global manufacturers. |

|

European Union |

Regulatory Framework for Circular Economy |

Mandates stringent battery collection, recycling efficiency, and recycled content. By 2031, new batteries must contain at least 16% recycled cobalt and 6% recycled lithium. (Source: European Commission). |

The ACC PLI scheme, vital for India's energy security and 'Aatmanirbhar Bharat,' is failing due to design flaws that underestimated the complexity of establishing a battery manufacturing ecosystem. To achieve self-reliance in the global battery market, India needs a strategic reset focusing on the entire value chain, realistic timelines, and a supportive environment.

Source: DOWNTOEARTH

|

PRACTICE QUESTION Q. The success of 'Make in India' in high-technology sectors depends not just on production-linked incentives but on holistic ecosystem development. Discuss. 150 words |

The objective is to establish a domestic manufacturing capacity of 50 gigawatt-hours (GWh) for Advanced Chemistry Cells (ACC) to reduce India's reliance on imports (primarily from China) and support the growth of electric mobility and grid-scale energy storage.

The scheme is significantly behind its targets. As of October 2025, it has achieved only 1.4 GWh (2.8%) of its 50 GWh manufacturing goal. Correspondingly, investment and job creation are also extremely low, and no incentive payouts have been made.

The main hindrances are:

© 2026 iasgyan. All right reserved