Money laundering legitimizes illegal funds, posing threats to security and economies. Methods include hawala and crypto. India combats it via PMLA, supported by international efforts like FATF. Challenges involve sophisticated tactics, technology, and cross-border complexities. Way Forward requires stronger regulations, advanced tech, and international cooperation to mitigate its challeneges.

Copyright infringement not intended

Picture Courtesy: EQS

According to a report submitted by the Finance Minister to the Rajya Sabha, special courts have ordered convictions in only 15 of 5,892 Prevention of Money Laundering Act (PMLA) cases since 2015, highlighting the complexities of money laundering cases.

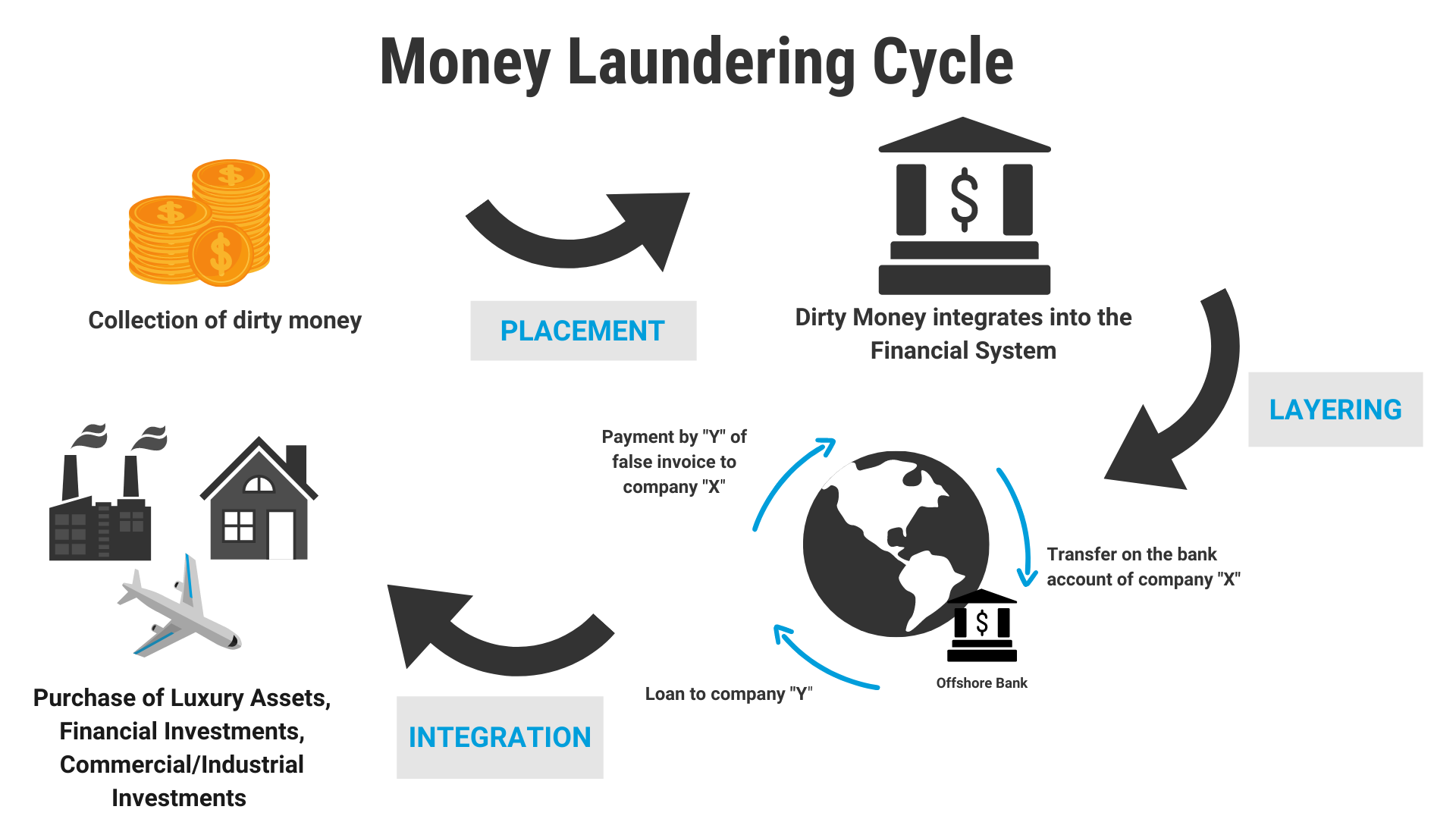

3 stages of Money laundering

Key Methods used in money laundering

Key Methods used in money laundering

Impact of Money Laundering

Weakens Social Fabric: It empowers illegal businesses, aggravates issues like drug addiction and corruption, and shifts economic power from legitimate entities to illicit ones, eroding morality and ethics.

Undermines Economic Integrity: Money laundering damages financial institutions' reputations, distorts market mechanisms, and raises business costs, especially for small enterprises.

Creates Macroeconomic Instability: Unanticipated fund transfers cause volatility in exchange and interest rates, lead to misallocation of resources, erode market confidence, discourage foreign investment, and contribute to artificial inflation, jobless growth, income inequality, and poverty.

Fuels Political Instability: Economic power gained by criminals through money laundering enables corrupting influence, leading to the takeover of legitimate governments and undermining democratic processes.

Threatens National Security: It finances criminal activities like drug trafficking, arms dealing, terrorism (through informal channels like hawala), and human trafficking, increasing government security costs.

Legal Pillars

|

PMLA & The Supreme Court Vijay Madanlal Choudhary vs Union of India (2022)

Tarsem Lal vs Directorate of Enforcement (2024): The Court ruled that the ED needs court permission to arrest an accused after the Special PMLA Court has taken cognizance of the offense. Accused's Rights (2025): The Court held that accused individuals in PMLA cases are entitled to copies of all investigation documents. |

Institutional Framework

Conventions

Vienna Convention (1988): Criminalized laundering of drug trafficking proceeds and promoted international cooperation.

Council of Europe Convention (1990): Established a common policy, international cooperation for all types of criminality.

UN Conventions: Conventions against Terrorism Financing (1999), Transnational Organized Crime (2000), and Corruption (2003), support global anti-money laundering (AML) efforts.

International Bodies

Financial Action Task Force (FATF): Founded in 1989, sets international standards and promotes effective implementation of AML measures; India became a member in 2010.

Basel Committee on Banking Regulations: Issued principles to encourage banks to prevent their use for criminal funds.

United Nations Global Programme against Money Laundering (GPML): Established in 1997, it provides technical cooperation and manages the Anti-Money Laundering International Database (AMLID).

Egmont Group of FIUs (1995): A coordinating body for international FIUs, promoting cooperation among its 165 global member units.

Asia-Pacific Group on Money Laundering (APG): A regional organization of 42 members aiming for regional commitment to implement AML policies.

Wolfsberg AML Principles: Non-binding best practice guidelines to combat financial crime.

Sophisticated criminal tactics: Criminals constantly innovate, utilizing techniques like shell companies, offshore accounts, digital currencies, and complex layering transactions to obscure illicit funds.

Technological advancements: While providing opportunities for detection, technology also empowers criminals with tools like cryptocurrencies, blockchain, and online payment platforms, which challenge traditional anti-money laundering (AML) systems to keep pace.

Cross-border regulatory complexities: Differing AML laws and enforcement standards across jurisdictions create gaps that criminals exploit.

Resource constraints: Financial institutions and regulatory bodies face limitations in funding, personnel, and technological infrastructure, limit the implementation of effective AML programs.

Data management issues: Organizations struggle with unreliable and incomplete customer and transaction data, impact the accuracy and effectiveness of risk assessment and monitoring efforts.

Insufficient adoption of advanced analytics: Many organizations lag in leveraging data mining, predictive analytics, and big data analysis for deeper insights and improved detection capabilities.

Enforcement Limitations: Widespread smuggling and insufficient bank KYC compliance hinder efforts.

Multiple agencies dealing with economic crimes lack convergence, restricting a holistic approach.

Low Conviction Rates: According to a report submitted by the Finance Minister in the Rajya Sabha, the Enforcement Directorate (ED) has investigated 5,892 cases under the Prevention of Money Laundering Act (PMLA) 2002 since 2015. However, only 15 cases have resulted in convictions by special courts.

Strengthen Regulations: Regularly update and enforce robust anti-money laundering (AML) and counter-terrorist financing (CTF) regulations to address emerging risks.

Prevention of Money Laundering Act (PMLA) needs ongoing adjustments to counter evolving threats.

Use Advanced Technology: Implement Artificial Intelligence (AI) and Machine Learning (ML) to improve detection.

Prioritize Risk-Based Approaches: Focus AML efforts on the highest-risk areas, such as transactions involving high-risk jurisdictions or individuals.

Promote Public-Private Partnerships: Encourage collaboration between financial institutions, law enforcement, and regulators to share information on suspicious activities.

Invest in Training and Education: Provide continuous training for AML professionals and staff to keep them updated on new money laundering methods, technologies, and regulations.

Address Cryptocurrency Risks: Enforce strict Know Your Customer (KYC) measures and transaction monitoring for cryptocurrencies. The FATF Travel Rule requires data sharing between crypto exchanges to improve accountability.

Inter-Agency Convergence: Creating specialized cells for money laundering activities, linked with international organizations like INTERPOL, and encouraging information sharing among enforcement agencies.

FATF Compliance: Implement FATF recommendations, including risk identification, policy development, criminalizing money laundering across all serious offenses, applying targeted financial sanctions, and reviewing non-profit organization vulnerabilities.

The fight against money laundering demands continuous adaptation, enhanced international cooperation, technological investment, and ongoing refinement of regulatory frameworks to stay ahead of sophisticated criminal networks.

|

For Prelims: ENFORCEMENT DIRECTORATE l FATF (FINANCIAL ACTION TASK FORCE) For Mains: Prevention of Money Laundering Act l Anti-Money Laundering Law |

Source: THE HINDU

|

PRACTICE QUESTION Q. Money laundering poses a serious threat to India's economic sovereignty. What are its challenges and what steps are required to be taken to control this menace? (250 words) |

Money laundering is the process criminals use to make illegally obtained funds appear legitimate. They aim to obscure the true source of the "dirty" money, allowing them to use it freely without suspicion.

The three stages are placement (introducing illegal funds into the financial system), layering (creating complex transactions to hide the source), and integration (re-introducing the money into the economy as legitimate funds).

A scheduled offense is a list of specific serious crimes (like drug trafficking, terrorism, corruption, etc.) mentioned in the PMLA, from which the "proceeds of crime" must originate for a money laundering case to be registered.

© 2026 iasgyan. All right reserved