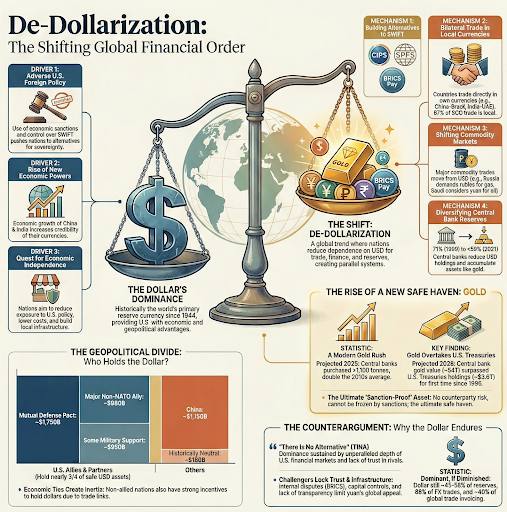

De-dollarisation is accelerating as U.S. sanctions and a shifting global balance push countries to diversify reserves, adopt local-currency trade, and build alternatives to SWIFT. Despite the dollar’s dominance, a multipolar currency system is emerging, offering India a strategic chance to internationalise the rupee.

Copyright infringement not intended

Picture Courtesy: paymentscmi

Recent geopolitical events and economic shifts are accelerating a global trend known as de-dollarisation.

|

Read all about: BRICS Reducing Dollar Dependency |

De-dollarisation is the strategic process of diminishing the U.S. dollar's role as the dominant global currency. Key actions include:

|

The Dollar's Supremacy The U.S. dollar became the world's primary reserve currency first through the Bretton Woods Agreement in 1944, which pegged global currencies to the gold-backed dollar, and later solidified by the "petrodollar" arrangement in the 1970s, requiring oil to be priced and traded exclusively in dollars. |

The Weaponization of the Dollar

The freezing of approximately $335 billion of Russia's central bank assets after 2022 sent a clear signal to other nations about the geopolitical risks of dollar dependency.

Shifting Global Economic Power

BRICS bloc accounted for about 40% of the global economy in Purchasing Power Parity (PPP) terms, surpassing the G7's share of approximately 28% (Source: IMF, 2025). This economic growth provides the impetus and capacity to promote national currencies.

Quest for Monetary Autonomy

Nations are seeking to protect their economies from U.S. monetary policy spillover. Interest rate hikes by the U.S. Federal Reserve causes capital outflows and currency depreciation in emerging markets, a vulnerability countries aim to reduce.

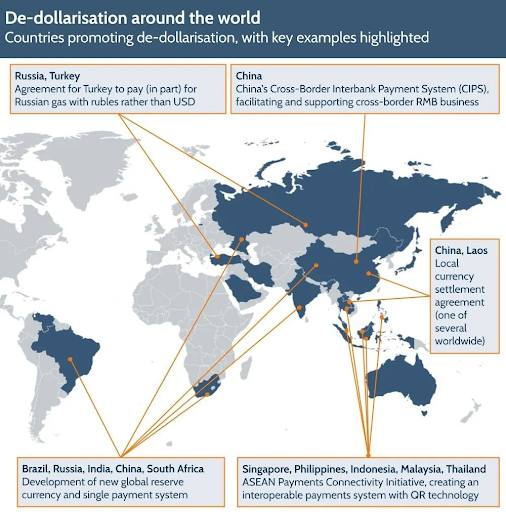

Development of Alternative Financial Infrastructure

To bypass the U.S.-dominated SWIFT system, several countries have created alternatives.

|

Alternative System |

Country/Bloc |

Key Features & Recent Performance |

|

CIPS (Cross-Border Interbank Payment System) |

China |

Launched in 2015 to internationalise the Yuan. In 2024, CIPS processed transactions worth ¥175.49 trillion (approx. $24.47 trillion), a 42.6% increase year-on-year. It now serves over 4,900 banking institutions in 189 countries (Source: CIPS, 2025). |

|

SPFS (System for Transfer of Financial Messages) |

Russia |

Developed after 2014 sanctions. Usage has grown significantly, especially within the Eurasian Economic Union, after Russia's exclusion from SWIFT. |

Declining Share in Global Reserves

The U.S. dollar's share of global foreign exchange reserves continues to decline, hitting a multi-decade low of approximately 56.92% in Q3 2025, down from over 70% in the early 2000s (Source: IMF), signaling a clear diversification trend despite its ongoing dominance.

Surge in Central Bank Gold Purchases

Emerging market central banks bought over 1,000 tonnes of gold for the third straight year in 2024 for diversification, hedging against geopolitical risks and reducing dollar reliance (Source: World Gold Council, 2025).

Increasing Bilateral Trade in Local Currencies

India & UAE: Agreement allows trade settlement in Rupees and Dirhams. Total bilateral trade reached $100.06 billion in fiscal year 2024-25, showing strong growth under the Comprehensive Economic Partnership Agreement (CEPA) (Source: IBEF).

Russia & China: Trade between the two nations has almost completely de-dollarised. By late 2025, over 99% of their bilateral trade was settled in Russian rubles or Chinese yuan.

Structural & Economic Challenges

Dominance and Liquidity of the USD: The U.S. dollar remains the most widely used currency globally in trade, finance, and central bank reserves, supported by the size and liquidity of U.S. financial markets.

Lack of Credible Alternatives: Rival currencies like the euro and Chinese yuan have limits: the euro lacks a unified sovereign debt market, and the yuan is hindered by capital controls and political risk.

Institutional Inertia: Shifting from the established dollar-based system (e.g., SWIFT) requires global effort and willingness to adapt from institutions and businesses.

Commodity Pricing: Key commodities like oil and gold are mainly priced and traded in U.S. dollars, necessitating the use of the greenback for international trade of these goods.

Transition & Geopolitical Limitations

Transition Costs: Switching financial systems and renegotiating trade agreements to use alternative currencies involves substantial expenses and logistical hurdles.

Market Volatility and Instability: Introducing new currencies or abruptly moving away from the dollar can lead to increased exchange rate volatility and market uncertainty; disrupting global trade and investment flows.

Debt Servicing Issues: Countries with dollar-denominated debt face higher repayment costs and financial instability if their local currency depreciates during a transition period.

Geopolitical Pushback: Efforts by some nations to reduce dollar reliance can be met with resistance from established players, escalating trade wars or leading to new forms of economic retaliation from the U.S..

Cooperation Issues: Efforts by blocs like BRICS to establish an alternative currency are hindered by the diverse economic, political, and cultural interests of member nations, complicating consensus.

The de-dollarisation trend presents both opportunities and challenges for India, which is actively pursuing the internationalisation of the Indian Rupee (INR).

Opportunities for India

Reduced Currency Risk: Settling trade in rupees shields Indian businesses from dollar-rupee exchange rate volatility.

Lower Transaction Costs: Eliminating dollar conversions reduces costs for both importers and exporters.

Enhanced Strategic Autonomy: A greater global role for the rupee would increase India's economic influence and reduce its vulnerability to external pressures.

India's Strategic Actions

The Reserve Bank of India (RBI) has implemented a framework to facilitate global trade settlement in INR. This involves Indian banks opening Special Rupee Vostro Accounts (SRVAs) for banks from partner countries.

In 2025, the RBI allowed surplus SRVA balances to be invested in Indian corporate bonds and commercial papers, enhancing the appeal of holding rupees.

Challenges for the Rupee

Limited Convertibility: The Rupee is not yet fully convertible on the capital account, which restricts its free movement and attractiveness as a reserve currency.

Trade Deficit Issues: Countries with a trade surplus with India may be hesitant to accept payments in INR if they have limited avenues to invest or spend the accumulated rupees. This was a key issue in India-Russia trade.

Market Depth: India's debt and financial markets need to become deeper and more liquid to absorb large international flows.

The shift from the U.S. dollar's absolute dominance towards a more multipolar international monetary system necessitates that India strengthen its economic fundamentals, build robust financial infrastructure, and work towards enhancing the global stature of the Indian Rupee.

Source: THE HINDU

|

PRACTICE QUESTION Q. "De-dollarization is less about an abrupt rejection and more about a strategic diversification." Critically analyze. 150 words |

De-dollarisation is the process by which countries reduce their dependence on the U.S. dollar in the global economy. This includes shifting foreign exchange reserves, using other currencies for international trade, and developing alternative financial systems.

The primary driver is the "weaponization of the dollar," where the U.S. uses financial sanctions as a foreign policy tool, creating geopolitical risks for other nations. Other factors include the shifting global economic power towards countries like the BRICS nations and the desire for greater monetary autonomy to avoid the impact of U.S. monetary policy.

Solidified in the 1970s, the petrodollar system was an arrangement where major oil-exporting nations, particularly Saudi Arabia, agreed to price and trade petroleum exclusively in U.S. dollars. This created a persistent global demand for dollars, cementing its status as the primary reserve currency.

© 2026 iasgyan. All right reserved