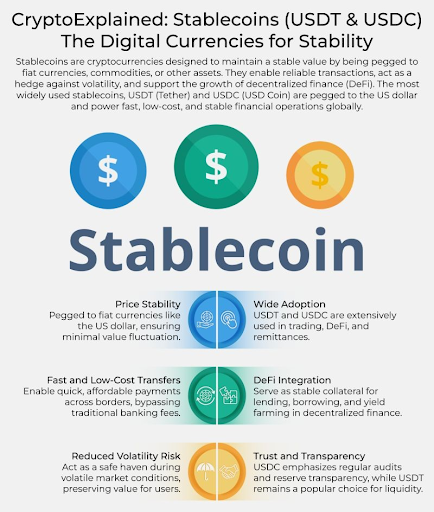

Stablecoins are cryptocurrencies pegged to assets like the dollar or gold to ensure price stability. They enable fast, low-cost global payments and support DeFi, but raise risks of financial instability and regulatory concerns. India remains cautious, prioritizing UPI and Digital Rupee while debating stablecoin regulation amid growing global adoption.

Copyright infringement not intended

Picture Courtesy: INDIANEXPRESS

Globally stablecoins are seen as beneficial for remittances and decentralized finance (DeFi), however, their risks and limited advantages make them less suitable for India, which already has robust and stable payment systems like UPI.

|

Read all about: STABLECOINS: MEANING, TYPES AND MECHANISMS |

Definition: Stablecoins are a type of cryptocurrency designed to maintain a stable value; by pegging their value to an external asset like the U.S. dollar.

Types of Stablecoins

|

Type |

Mechanism |

|

Fiat-Collateralized |

Backed 1:1 by a fiat currency (e.g., U.S. dollar) held in reserves with a custodian. |

|

Commodity-Backed |

Backed by physical commodities like gold, held in reserve by a custodian. |

|

Crypto-Collateralized |

Backed by a reserve of other cryptocurrencies, such as Ethereum. |

|

Algorithmic |

Uses algorithms and smart contracts to manage the token supply to maintain its price peg, without reserves. |

Indian Payment Systems Are Already World-Class

Unified Payments Interface (UPI) handles around 50% of global digital payment volume, letting millions send money instantly for nearly zero cost.

RTGS (Real Time Gross Settlement) and NEFT (National Electronic Funds Transfer) move large sums quickly, and Aadhaar simplifies ID checks.

The Digital Rupee, a blockchain-based currency from RBI, offers stablecoin-like tech with government backing. Stablecoins add no value addition.

Remittance Savings Are Overhyped

While stablecoins could cut remittance fees, India’s formal channels are already efficient.

Banks and services like Western Union integrate with UPI, keeping costs low.

The Digital Rupee could further streamline cross-border payments without private stablecoins’ risks.

DeFi Is Niche and Risky

Stablecoins in DeFi rely on private reserves or algorithms, which can fail. For example, TerraUSD crashed by 60% in 2022.

India’s regulated banking system, with strong capital and credit quality, offers safer lending and borrowing.

U.S. Model Doesn’t Apply

The U.S. GENIUS Act requires stablecoins to hold safe assets, but risks remain without a central bank safety net.

Indian economy, built on tight rules and stability, can’t afford to mimic a country with a history of exporting financial crises.

Strengthen UPI and Digital Rupee: Upgrade UPI for cost effective global remittances and expand the Digital Rupee for blockchain-based payments with RBI’s trust.

Regulate Strictly or Ban: If stablecoins are allowed, make companies hold 100% rupee reserves under RBI’s watch, or ban dollar-backed stablecoins to protect the rupee.

Focus on Safe Blockchain Tech: Use blockchain for deposit tokens (digital bank deposits) for business payments, which follow strict rules unlike stablecoins.

Shape Global Rules: Work with the G20 to set stablecoin standards that suit India’s needs, avoiding risks to emerging economies.

India should prioritize strengthening UPI and the Digital Rupee over rupee-backed stablecoins, balancing innovation with RBI’s control and financial stability under clear crypto laws.

Source: INDIANEXPRESS

|

PRACTICE QUESTION Q. Consider the following statements about stablecoins:

Which of the above statements is/are correct? A) 1 only B) 2 only C) Both 1 and 2 D) Neither 1 nor 2 Answer: C Explanation: Statement 1 is correct: Stablecoins are designed to maintain a stable value by being pegged to an asset. Statement 2 is correct: Their reliance on private reserves makes them vulnerable to a sudden loss of confidence, similar to traditional bank runs. |

A stablecoin is a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset like the US dollar, gold, or a basket of currencies.

Unlike volatile cryptocurrencies, stablecoins aim for price stability, making them suitable for payments, remittances, and digital contracts.

India has not legalized them; the RBI has flagged risks, while the Supreme Court (2020) allowed crypto trading. In 2025, discussions on regulatory clarity are ongoing.

© 2026 iasgyan. All right reserved