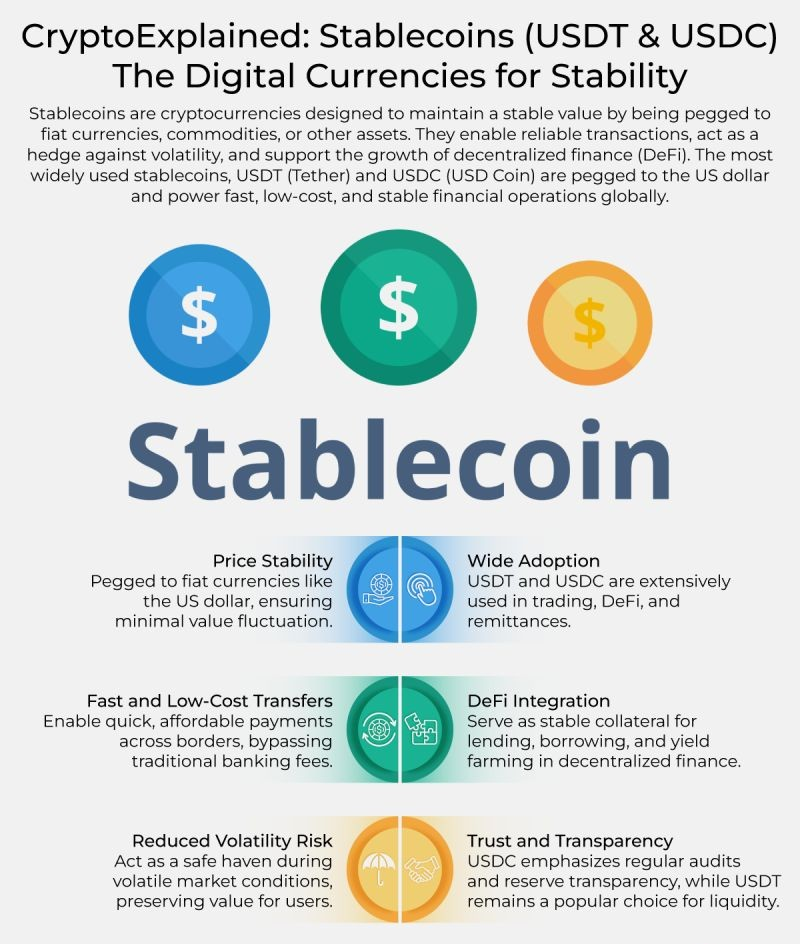

US House passes Genius Act to regulate dollar-pegged stablecoins. They are cryptocurrencies that reduce price volatility by linking them to stable assets like fiat currencies or commodities. They provide price stability, transaction efficiency, and financial inclusion. However, they face challenges like de-pegging risk, centralization, counterparty risk, financial stability risks, and illicit financing concerns.

Copyright infringement not intended

Picture Courtesy: REUTERS

The US House of Representatives has passed the Genesis Act, a bill to regulate US dollar-pegged stablecoins.

It is a special type of cryptocurrency that aims to keep its value steady.

Unlike popular cryptocurrencies like Bitcoin, which can change in price wildly, stablecoins try to stay fixed to something valuable, like one US dollar always equaling one stablecoin.

Holding Back-Up Assets => Most stablecoins hold a matching amount of other assets (like real money or gold) in a reserve account. So, if they issue 1 million stablecoins, they hold 1 million dollars (or equivalent) in a bank.

Using Smart Computer Programs (Algorithms) => Some stablecoins use computer programs that automatically change how many stablecoins are available in the market.

Fiat-Collateralized => A central company holds real money (like US dollars or Euros) in a bank account. For every stablecoin they create, they hold one unit of that real money.

Crypto-Collateralized => Use other cryptocurrencies as their back-up. To make sure they stay stable even if the backing crypto's value changes.

Commodity-Backed => Whose value links to physical things like gold, silver, or even oil. Each token represents a specific amount of that physical item.

Algorithmic (Non-Collateralized) => Depend on computer programs to manage their supply and demand, to keep their price stable.

What makes stablecoins useful?

What makes stablecoins useful?

Stable Value in Market

Faster and Cheaper Payments

Building Blocks for Decentralized Finance (DeFi)

Helping People Without Banks

Connecting Old and New Money Worlds

Many popular stablecoins are run by central companies, which raises concerns about transparency about their holdings.

The Bank for International Settlements (BIS) warned that stablecoins could pose significant risks if they grow unchecked.

Criminals could use them for money laundering, funding terrorism, or other illegal activities.

|

Country/ Region |

Key Regulatory Action/Stance |

|

USA |

The GENIUS Act creates the rules for dollar-pegged stablecoins. It demands that issuers back stablecoins 1:1 with US dollars or very short-term government bonds, make their reserve details public monthly, and follow strict anti-money laundering (AML) rules. |

|

European Union |

The Markets in Crypto-Assets (MiCA) regulation for crypto-assets, including stablecoins. It sets rules for how crypto companies operate, protect consumers and ensure financial stability. |

|

Asia |

Countries like Hong Kong and South Korea have started introducing special licenses and laws to oversee stablecoins. |

RBI's Concerns => Concerned about stablecoins, seeing them as a potential threat to monetary policy and overall financial stability.

Risk of "Dollarization" => If stablecoins linked to the US dollar become very popular, they could weaken the Indian Rupee and the RBI's control over the economy.

Legal Status in India => Currently treat all cryptocurrencies, including stablecoins, as "Virtual Digital Assets" (VDAs) under tax laws (a 30% tax on gains and 1% TDS on transactions), but they are not officially recognized as legal currency.

Supreme Court's View (May 2025) => Urged government to create clear regulations for cryptocurrencies.

Preference for Central Bank Digital Currency (CBDC) => Controlled by the central bank, giving the government full control and addressing financial stability concern.

Stablecoins offer efficiency in digital payments and finance innovation, but also pose risks like financial instability, lack of consumer protection, and potential illegal activities. Strong global rules are needed to manage these risks while promoting responsible innovation. Clear categorization of stablecoins and transparency about reserves are crucial.

Must Read Articles:

Regulating India's virtual digital assets revolution

India's Crypto Regulation Crisis

CENTRAL BANK DIGITAL CURRENCY(CBDC)

Source: NEWSONAIR

|

PRACTICE QUESTION Q. What type of asset commonly collateralizes a stablecoin to maintain its value? A) Rare collectible items. B) Intellectual property rights. C) Fiat money or another cryptocurrency. D) Government bonds from emerging markets. Answer: C Explanation: Stablecoins find their collateral in either fiat money (like the US dollar) or other cryptocurrencies, providing backing for their pegged value. |

The Genesis Act regulates US dollar-pegged stablecoins by mandating liquid asset backing and public disclosure of reserves.

Stablecoins are commonly used by crypto traders to move funds between different tokens.

The Clarity Act aims to create a wider regulatory framework for digital assets beyond stablecoins.

© 2026 iasgyan. All right reserved