NITI Aayog’s proposed Manufacturing & Infrastructure Index to benchmark states on policies, logistics, and approvals, promoting competitive federalism. By guiding investors and policymakers, it seeks to diversify supply chains, cut geopolitical risks, and secure critical resources essential for India’s industrial growth.

Copyright infringement not intended

Picture Courtesy: DOWNTOEARTH

NITI Aayog is developing a new national index to benchmark states on manufacturing and infrastructure performance to strengthen supply chains for critical resources, and to promotes "cooperative and competitive federalism".

The index will provide a composite scorecard on state-level enablers for industrial growth:

Manufacturing sector contributes around 17% to GDP and employs over 27 million workers.

Sectoral Growth and Performance

The Index of Industrial Production (IIP) for manufacturing grew 5.4% in July 2025, with 14 of 23 industry groups expanding. Overall IIP rose 3.5% in July 2025. Key sectors like automobiles exported 5.3 million units in FY 25, and electronics value addition rose to 70% (target 90% by FY27).

Investment and Employment Trends

Foreign Direct Investment (FDI) in manufacturing surged 18% to $19.04 billion in FY25. Total FDI reached $81.04 billion in FY25. EPFO reports 12.9 million net formal jobs created in FY25.

Weak Infrastructure and Logistics Bottlenecks: Logistics costs 14-18% of GDP (vs 8-10% in developed nations). Power outages and transport gaps continue despite Gati Shakti.

Policy Inconsistencies and Bureaucratic Hurdles: Trade/tax changes and land laws delay projects (e.g., POSCO Odisha suspension).

Labor Market Challenges: Informal dominance; contract workers rose to 40.2% (2021-22); Samsung Tamil Nadu protests (2024) highlight wage/union issues. Four Labour Codes not effectively unimplemented.

Inadequate R&D and Technology Adoption: R&D at 0.7% GDP (vs China's 2.4%, Korea's 4.8%); EV batteries rely on Chinese imports, limiting alternatives like sodium-ion.

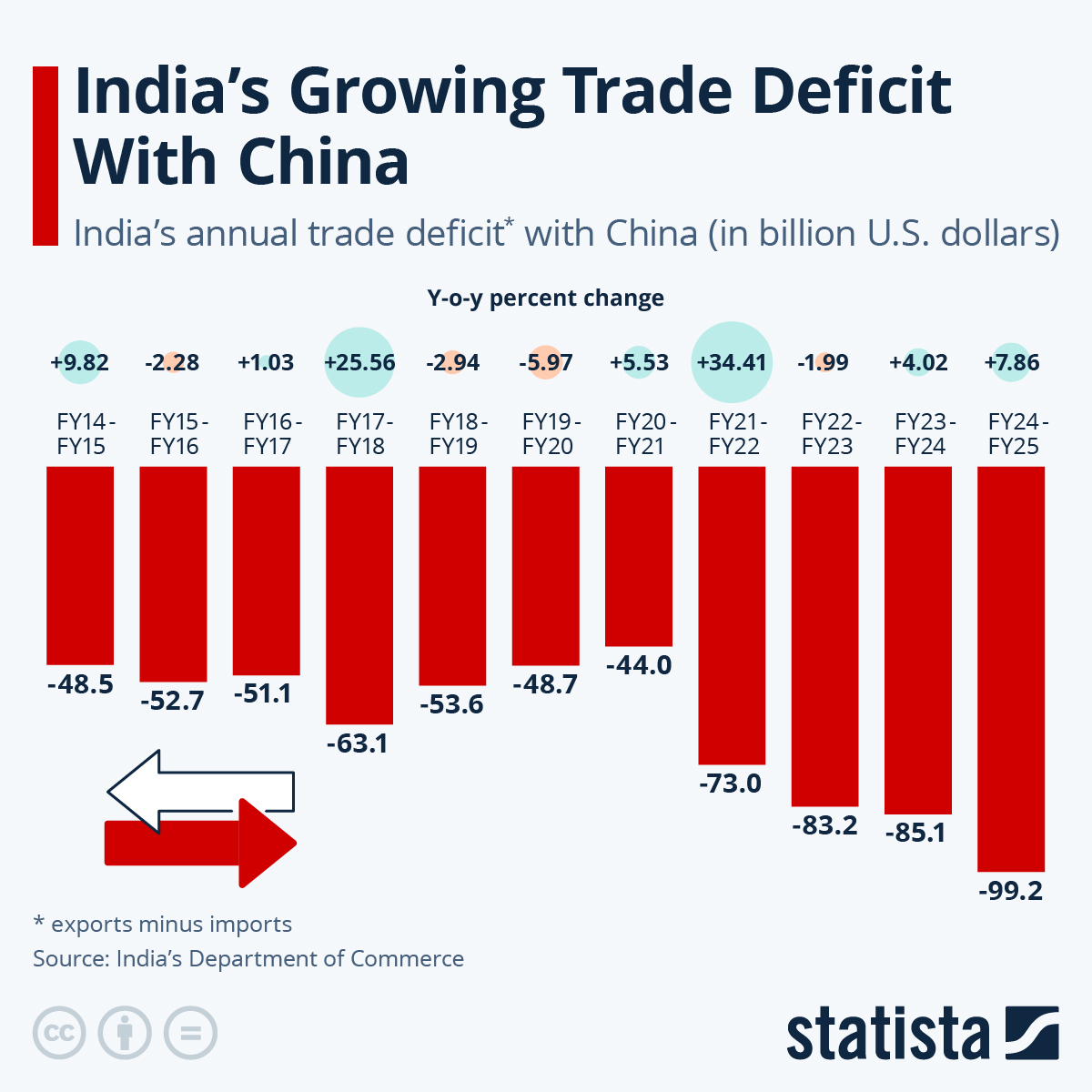

Import Dependence for Key Inputs: Over $99 billion trade deficit with China (FY25); vulnerable to disruptions.

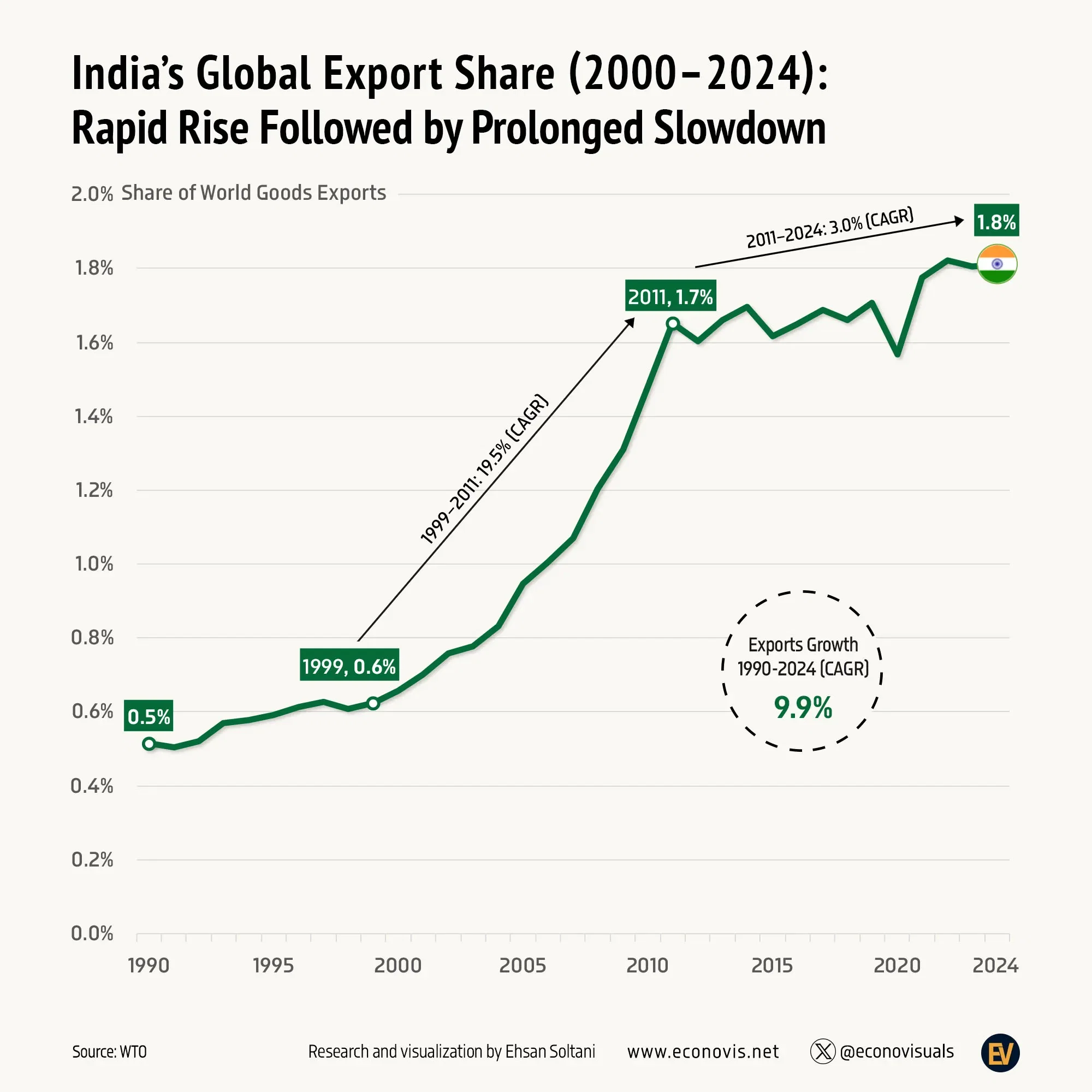

Global Trade Integration Deficiencies: 1.8% global exports share (vs China's 14.7%); Regional Comprehensive Economic Partnership (RCEP) opt-out (2021) missed global value chains (GVCs) opportunities.

Global Trade Integration Deficiencies: 1.8% global exports share (vs China's 14.7%); Regional Comprehensive Economic Partnership (RCEP) opt-out (2021) missed global value chains (GVCs) opportunities.

Competition from Emerging Markets: Vietnam/Bangladesh offer lower costs.

Competition from Emerging Markets: Vietnam/Bangladesh offer lower costs.

Digital and Skill Gaps: 51.25% workforce employable (Economic Survey 2023-24); Global Innovation Index rank 38th (2025).

Fragmented MSME Sector: MSMEs, contributing 30% to GDP and employing 110 million people, face a massive ₹25 lakh crore credit gap, with only 14% accessing formal finance.

Boost Investment: "Make in India" campaigns and liberalized FDI policies have attracted foreign capital, with manufacturing FDI growing 18% to $19.04 billion in FY 2024–25.

Incentivize Production: Production Linked Incentive (PLI) schemes have realised actual investment of Rs 1.76 lakh crore till March 2025, resulted in incremental production/sales of over Rs 16.5 lakh crore and employment generation of over 12 lakhs.

Simplify Business: "Ease of Doing Business" reforms, including the recent reduction in GST slabs and reduced corporate taxes, streamlined procedures and lowered costs.

Spur High-Tech: The Semicon India Programme, with a ₹76,000 crore outlay, promote semiconductor and display manufacturing.

Enhance Connectivity: GatiShakti National Master Plan coordinates infrastructure projects to improve logistics efficiency.

Trade and Policy Reforms: Lower tariffs, negotiate Free Trade Agreements (FTAs) to expand export market, and harmonize regulations for easier business; prioritize quality standards and R&D investment.

Skills and Sustainability: Targeted skilling, financial backing (e.g., expand PLI), and sustainability efforts; build resilient supply chains via Quad/Indian Ocean Region (IOR) cooperation.

Innovation Focus: Adopt modern tech (robotics, semiconductors), reduce compliance burdens, and encourage local sourcing to counter global risks.

Enhance Infrastructure: Accelerate Gati Shakti; complete Eastern/Western Dedicated Freight Corridors; expand port automation. Establish Component Manufacturing Clusters.

Simplify Regulatory Frameworks: Unified single-window clearances; digitize MSME approvals; implement Four Labour Codes.

Promote R&D: Raise R&D to 2% GDP; create Manufacturing Innovation Fund for AI/semiconductors. Encourage industry-academia ties.

Boost Technology Adoption: Subsidies for IoT/robotics in MSMEs; expand PLI for Industry 4.0; tax credits for digital investments.

NITI Aayog’s Manufacturing & Infrastructure Index will rank states to boost competitive federalism, attract investment, diversify supply chains, and secure critical resources for India’s industrial growth.

Source: DOWNTOEARTH

|

PRACTICE QUESTION Q. Discuss the role of NITI Aayog in promoting evidence-based policymaking and encouraging innovation. 150 words |

The manufacturing sector currently accounts for approximately 17% of India's Gross Domestic Product (GDP).

'Make in India' initiative promotes and attracts investment in domestic manufacturing, with the goal of turning India into a global manufacturing hub. 'Made in India' is a label for a product that has been manufactured in India.

MSME sector accounts for 30.1% of India's GDP, 35.4% of manufacturing and 45.73% of exports in the country.

© 2026 iasgyan. All right reserved