The Four Labour Codes consolidate 29 fragmented laws into a unified, modern framework aimed at improving worker protection while enhancing economic efficiency. They introduce uniform definitions, digital compliance, and risk-based inspections to reduce regulatory burden and improve enforcement. By extending wage, safety, and social security coverage to unorganized, gig, and platform workers, the codes seek to make India’s labour market more inclusive. At the same time, streamlined procedures such as single licensing and online registrations aim to attract investment and support job creation. Overall, the reforms attempt to balance welfare with productivity and build a future-ready labour ecosystem.

Copyright infringement not intended

Picture Courtesy: PIB

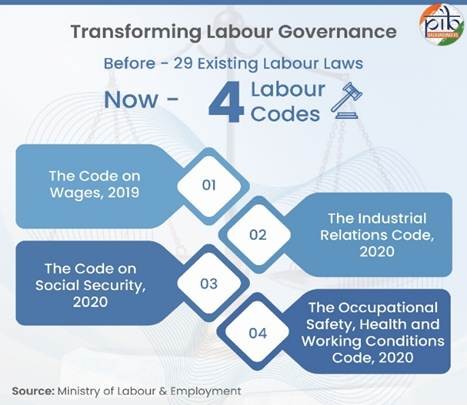

The Government of India has undertaken one of the most extensive labour sector reforms in independent India by consolidating 29 labour legislations into four integrated Labour Codes — the Code on Wages (2019), Industrial Relations Code (2020), Code on Social Security (2020), and the Occupational Safety, Health and Working Conditions Code (2020).

|

Must Read: Labour Codes | New Labour Codes Decoded | New labour codes will force workers into a more precarious existence | What labour needs | |

|

Labour Code |

Description |

Key Features |

|

Code on Wages, 2019 |

Merges four wage-related laws: Minimum Wages Act (1948), Payment of Wages Act (1936), Payment of Bonus Act (1965), and Equal Remuneration Act (1976) into one unified wage framework. |

• Universal application of minimum wages for all employees • Introduction of a national floor wage to prevent States from fixing wages below a basic benchmark • Wage fixation based on skill level, region, and working conditions · Gender-neutral provisions ensuring equal pay and non-discrimination, including for transgender persons · Timely wage payment extended to all employees · Mandatory double wage rate for overtime work · Shift to inspector-cum-facilitator model for supportive compliance · Decriminalization of minor offences with monetary penalties |

|

Industrial Relations Code, 2020 |

Combines the Trade Unions Act (1926), Industrial Employment (Standing Orders) Act (1946), and Industrial Disputes Act (1947) to streamline industrial relations and balance worker rights with business flexibility. |

· Fixed-term employment with parity in wages and benefits; gratuity after one year. · Creation of a re-skilling fund offering 15 days of wages to retrenched workers. · Trade unions with 51% membership recognized as negotiating union. · Expanded definition of workers to include journalists and sales promotion staff. · Higher threshold for retrenchment and closure (from 100 to 300 workers). · Standing orders requirement raised to 300 employees. · Mandatory 14-day notice for strikes and lockouts. · Recognition of work-from-home arrangements. · Faster dispute resolution through two-member tribunals. · Fully digital process for registration, filings, and communication |

|

Code on Social Security, 2020 |

Consolidates nine major social security laws and expands coverage to unorganised sector, gig workers, and platform workers. |

• Universal Employees State Insurance coverage across India. • Time limit of five years for inquiries related to retirement fund dues. • Reduced appeal deposit for retirement fund disputes (25% of dues). • Self-assessment system for construction cess. • Mandatory contributions by digital aggregators for gig and platform workers. • Social security fund for unorganized, gig, and platform workers. • Expanded definition of dependents, including maternal grandparents and dependent parents-in-law. • Uniform wage definition for calculating benefits. • Commuting accidents treated as employment-related. • Gratuity eligibility after one year for fixed-term workers. • Risk-based, digital inspections under inspector-cum-facilitator model. • Mandatory reporting of vacancies to career centres |

|

Occupational Safety, Health and Working Conditions Code, 2020 |

Merges 13 Central Acts related to workplace safety, working conditions, and inter-State migrant workers into a unified framework. |

• Single electronic registration for establishments with 10+ workers. • Coverage for hazardous occupations even with one employee. • Reforms for inter-State migrant workers including travel allowance, portability, helplines, and national database. • Mandatory appointment letters for all employees. • Permission for women to work in all sectors and night shifts with safety provisions. • Broader definition of media workers including digital sectors. • Safety committee’s mandatory for establishments with 500+ workers. • National advisory board for occupational safety and health standards. • Contract labour threshold raised from 20 to 50; five-year all-India licenses. • Working hours capped at 8 hours/day and 48 hours/week; double rate overtime with consent. • Minimum 50% of fines allocated to victim compensation. • Inspector-cum-facilitator model with digital monitoring |

Picture Courtesy: PIB

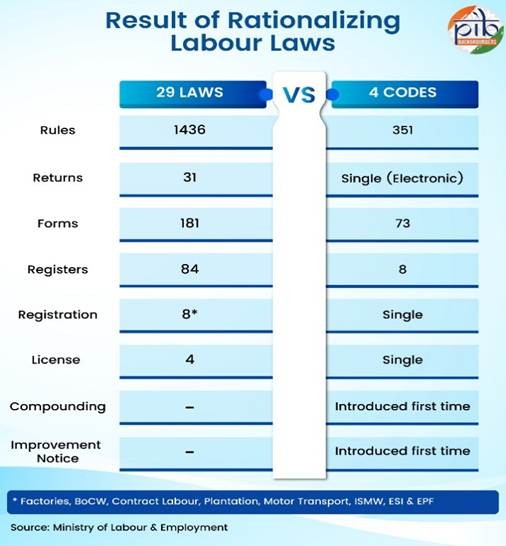

Simplify compliance: For decades, employers had to deal with multiple registrations, licences, and returns across different Acts. This increased compliance costs and discouraged the hiring of formal workers which led to widespread informality (over 90% of Indian workers). A medium-sized manufacturing unit in Gurugram earlier required six different registrations, such as: Registration under Factories Act, Registration under Employees State Insurance, Registration under Contract Labour Act, Registration under Shops and Establishments Act, Registration for bonus, wages, and gratuity obligations. NITI Aayog (Ease of Doing Business Report, 2018) highlighted that Indian firms spend over 30% of their regulatory compliance time on labour-related paperwork.

Under the new codes, this becomes a single registration, reducing time and administrative burden.

Streamline enforcement: Different labour laws meant different inspectors, registers, rules, and penalties causing delays, harassment, rent-seeking, uncertainty for employers and workers. The Comptroller and Auditor General’s Report (2017) revealed that over ₹26,000 crore of construction cess remained unused because States could not coordinate across multiple labour legislations.

The new Social Security Code fixes this through uniform self-assessment and a single implementation authority.

Modernized outdated laws: India’s labour framework did not consider gig and platform work, remote work, fixed-term employment, aggregator-based service models (Ola, Swiggy, Uber, Zomato), digital workplaces, growing service sector, contracting and outsourcing practices. A 2022 study by Oxfam India found that nine out of ten gig workers lacked health insurance or accident coverage. With the new Code, they now get access to ESIC coverage and accident benefits.

Improve ease of doing business and promote Job Creation: Older regulations, especially relating to retrenchment, contract labour, standing orders, and factory registration were seen as restrictive, discouraging firms from growing beyond certain sizes (e.g., 100 workers). World Bank’s Doing Business Report noted that India’s labour regulation complexity discouraged investment and the codes reduce paperwork and improve predictability, a key factor for global investors under programs like Make in India.

Modernized Legal Framework: Earlier labour laws were nearly a century old and did not anticipate current realities like gig work, digital platforms, fixed-term jobs, automation, hybrid workplaces, and large-scale contracting. The Labour Codes update regulatory structures to reflect digitised workplaces, platform-based services (Ola, Swiggy, Zomato), fixed-term employment, growth of service economy, remote and flexible working. According to NITI Aayog’s “India’s Booming Gig and Platform Economy” (2022):

The Social Security Code is India’s first law to recognise gig/platform workers and mandate a social security fund for them.

Universal coverage of wage, safety, and social security rights: Earlier laws applied to narrow categories (e.g., “scheduled employments”), which leads to exclusion of workers.

The Labour Codes extend minimum wages, safety protections and social security (pension, insurance, provident fund) to every worker, including domestic workers, construction labour, gig/platform workers, migrant workers, fixed-term employees and unorganised workers.

Simplified compliance through digital processes and uniform definitions: Earlier, employers had to maintain 20+ registers, file 8–10 different returns, and seek multiple licences. World Bank Enterprise Survey (2020) observed that Indian firms spend 30–35% of compliance time on labour regulations alone.

The new labour codes introduce single registration, single return, standardised wage definition, online licensing, and digital inspections

Greater investment & job creation through predictability and flexibility: Rigid laws discouraged firms from hiring more than 100 workers due to restrictive rules on retrenchment, layoffs, and standing orders. The Industrial Relations Code raises thresholds from 100 to 300 workers, offering firms flexibility without compromising compensation rights.

The consolidation of 29 labour laws into four comprehensive Labour Codes represents a major structural reform aimed at creating a modern, inclusive, and efficient labour governance system in India. By simplifying compliance, expanding worker protection, integrating gig and platform workers, and promoting transparent digital enforcement, the Codes strike a balance between safeguarding workers’ rights and enabling enterprise growth. If implemented effectively, they can help formalize employment, attract investment, and strengthen India’s transition toward a more productive and equitable labour market.

Source: PIB

|

Practice Question Q. Discuss how the consolidation of 29 labour laws into four Labour Codes can contribute to formalization of the workforce in India. (150 words) |

They were introduced to replace a highly fragmented system of 29 labour laws that had overlapping provisions, inconsistencies, and heavy compliance burdens. The goal was to create a simplified, modern, and transparent labour regulatory structure suitable for a rapidly changing economy.

They reduce compliance load through digital filings, single licences, standardized definitions, and risk-based inspections. This is expected to lower administrative costs and increase formalization.

The primary challenge is state-level preparedness. Labour is a concurrent subject, and several states are yet to finalize or notify their rules. Capacity-building for digital inspections and employer awareness are additional hurdles.

© 2026 iasgyan. All right reserved