India faces a paradox of unused 44 GW of renewable energy capacity due to lack of Power Purchase Agreements, weak grid infrastructure, and limited demand-side readiness. Resolving this requires multi-pronged reforms, including enhanced storage, accelerated electrification, smart meters, market reform, and state capacity alignment.

Copyright infringement not intended

Picture Courtesy: DOWNTOEARTH

|

Read all about: ENERGY SECURITY FOR INDIA: CHALLENGES & A SUSTAINABLE WAY FORWARD |

India’s energy sector stands at a crossroads, despite a booming renewable energy (RE) sector, 44 GW of ready capacity remains unused due to a lack of Power Purchase Agreements (PPAs).

Renewable Energy Growth: Total installed power capacity reached 476 GW by June 2025.

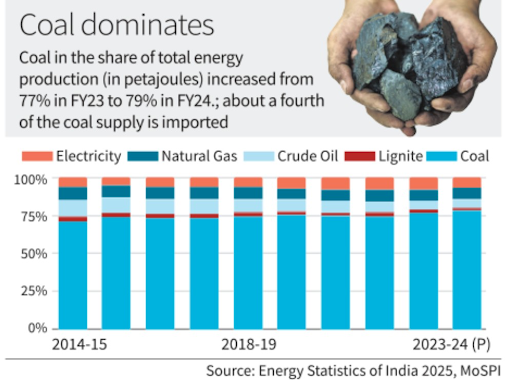

Coal Dominance: Coal and lignite account for 79% of domestic energy production. Over 85% of oil and 50% of gas are imported, highlighting energy import dependency.

Energy Demand Surge: India’s energy consumption is projected to grow at 3.2% annually till 2045, driven by urbanization and industrialization (NITI Aayog).

Lack of Demand for RE: 44 GW of RE capacity remains idle due to unsigned PPAs; a long-term contract between a power producer (seller) and an energy consumer (buyer) for the sale and purchase of electricity.

High Costs of Renewables: While solar and wind prices have fallen, India’s tariffs remain higher than global benchmarks. For example, solar power in Saudi Arabia is nearly half the cost of that in India, due to high capital costs, GST, and import duties.

Storage and Grid Limitations: Battery storage for RE is not yet commercially viable, limiting supply during peak demand.

Low Electrification Levels: Limited electrification in mobility (EV two-wheelers penetration: 6.2%, NITI Aayog), cooking, and industrial heating restricts RE absorption.

Reliability Issues: India’s System Average Interruption Duration Index (SAIDI) is 600 minutes annually, compared to 35 minutes in Thailand and 46 in Malaysia.

Energy Security: Heavy reliance on imported fuels (85% oil, 50% gas) threatens economic stability, especially during global price volatility.

Environmental Risks: Coal’s dominance contradicts India’s Paris Agreement commitments and net-zero target by 2070, increasing exposure to climate risks.

Economic Competitiveness: High RE tariffs and unreliable power deter investments in advanced sectors, impacting India’s global economic ranking.

Policy Misalignment: Uniform Renewable Purchase Obligation (RPO) targets (43.3% by 2030) strain financially weak states, raising costs for discoms and consumers.

Boost Storage Incentives: Increase VGF for battery storage to reduce costs below Rs 6 per unit. Promote 8–12-hour storage systems for peak-hour reliability, as recommended by NITI Aayog.

Accelerate Electrification: Expand EV adoption through subsidies and charging infrastructure. Promote electric cooking and industrial heating to raise electricity’s share in energy consumption.

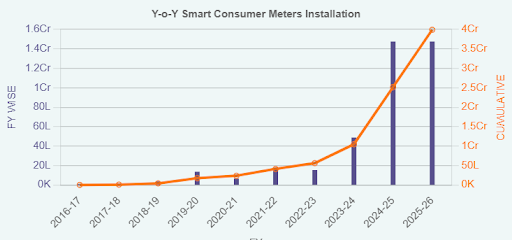

Enhance Grid Flexibility: Expand smart meters to enable real-time demand response. Upgrade urban and industrial distribution networks to reduce SAIDI to 100 minutes.

Reform Must-Run Rules: Shift from mandating RE as market-based mechanisms, allowing discoms to balance costs and reliability. Introduce time-of-day tariffs to incentivize off-peak RE consumption.

Customize RPO Targets: Design RPO agreement based on state-specific grid capacity and financial health to ensure affordability. Support weaker states with central funding to meet RPO goals.

India must align its renewable energy push with demand-side reforms to resolve the green energy paradox. Strengthening storage, electrifying key sectors, and modernizing the grid will enhance RE absorption.

Source: DOWNTOEARTH

|

PRACTICE QUESTION Q. India’s renewable energy capacity is stranded due to demand-side weaknesses rather than supply constraints. Critically analyze. 150 words |

India's green energy paradox is the situation where a significant renewable energy capacity is ready for deployment but lacks takers due to the absence of Power Purchase Agreements (PPAs).

PPAs are long-term contracts that guarantee a buyer for the electricity produced, providing financial certainty for developers to invest in and operationalize projects.

It promotes solar pumps and decentralized solar plants for farmers to reduce reliance on grid power.

© 2026 iasgyan. All right reserved