The Union Cabinet approved the PM e-DRIVE Scheme (₹10,900 crore, 2024–26) to replace FAME-II and boost EV adoption. It offers demand incentives, charging infra support, and e-bus funding, aligns with Production Linked Incentive Scheme, cuts battery import dependence, and advances Aatmanirbhar Bharat toward the 2070 Net Zero goal.

Copyright infringement not intended

Picture Courtesy: thehindu

As of December 30, 2025, the PM E-DRIVE Scheme met its target for e-3W (L5) units ahead of schedule with 2.88 lakh units sold.

The PM E-DRIVE (Electric Drive Revolution in Innovative Vehicle Enhancement) is a Central Sector Scheme launched by the Ministry of Heavy Industries in 2024, with financial outlay of ₹10,900 crore.]

It replaces the earlier FAME-II scheme, to accelerate the adoption of electric vehicles (EVs).

It aims to establish a robust charging infrastructure, and build a competitive domestic EV manufacturing ecosystem, aligning with India's goal of achieving net-zero emissions by 2070.

Core Objectives of the Scheme

Accelerate EV Adoption: Boost the uptake of electric vehicles, particularly in the commercial and public transport segments, to reduce vehicular emissions and improve air quality.

Develop Charging Infrastructure: Address "range anxiety" by promoting the widespread development of a reliable and accessible network of public EV charging stations.

Boost Domestic Manufacturing: Promote Aatmanirbhar Bharat and resilient EV manufacturing industry by encouraging domestic production of EVs and their components through a Phased Manufacturing Programme (PMP).

Promote Sustainable Mobility: Reduce India's dependency on fossil fuel imports and transition towards cleaner, more sustainable transportation solutions.

Promote Innovation: Encourage the adoption of advanced automotive technologies and upgrade the national vehicle testing infrastructure.

Key Features and Components

Demand Incentives

A total of ₹3,679 crore is allocated for subsidies on various EV categories, including e-2Wheelers, e-3Wheelers, e-ambulances, and e-trucks.

Support for E-Buses

An allocation of ₹4,391 crore aims to support the deployment of 14,028 electric buses, in nine cities with populations exceeding 4 million (Source: PIB). This focuses on electrifying public transportation.

Charging Infrastructure

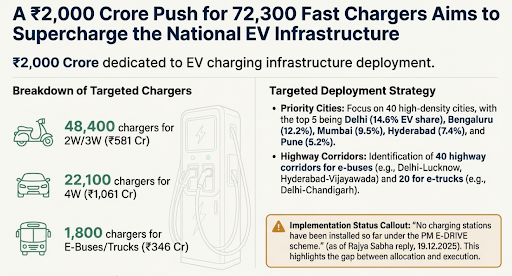

₹2,000 crore is dedicated to establishing a dense network of 72,300 public fast-charging stations across cities and highways to ensure user confidence and convenience (Source: PIB).

E-Ambulances & E-Trucks

₹500 crore each is allocated for e-ambulances and e-trucks. E-truck incentives require a valid vehicle scrapping certificate.

Aadhaar-linked e-Vouchers

The scheme uses an Aadhaar-authenticated e-voucher system for transparency and streamlined subsidy. Generated on the portal and sent to the buyer's mobile, the voucher is used at the dealership for the incentive.

Upgrading Testing Agencies

₹780 crore is allocated by the Ministry of Heavy Industries to modernize vehicle testing facilities for emerging EV technologies and safety standards.

Implementation Timeline

The scheme was initially implemented from October 1, 2024, to March 31, 2026. However, recognizing the longer gestation periods for certain categories, the government has extended the timeline for e-trucks, e-buses, and testing agencies until March 31, 2028, within the same financial outlay.

Three-Wheeler Segment Success

The target of supporting 2,88,809 units was fully met by December 2025, leading to the closure of incentives for this category.

Growth in EV Penetration

The penetration of electric vehicles in the three-wheeler category has reached approximately 32%, indicating a successful market transition towards self-sustainability in this segment. (Source: PIB)

Progress in Two-Wheeler Segment

As of December 2025, over 1.84 million electric two-wheelers have been sold under the scheme, accounting for about 74% of the target. (Source: PIB).

Exclusion of Key Vehicle Categories

The scheme has been criticized for not including subsidies for private electric cars (e-4W) and light commercial vehicles (N1 category), which could slow down adoption in the personal mobility and last-mile delivery sectors.

Infrastructure Bottlenecks

Despite funding, challenges in land acquisition, grid stability, and high upfront costs for setting up charging and battery-swapping stations persist, particularly for private operators.

Digital Divide and e-Vouchers

The mandatory Aadhaar-linked e-voucher system may pose a barrier for potential buyers in rural or less digitally literate areas who lack consistent internet access or smartphones.

Financing for Private Operators

Private bus operators, who constitute the vast majority of India's bus fleet, are largely excluded from subsidies, and face hurdles in securing financing due to high initial costs and uncertainties about battery life.

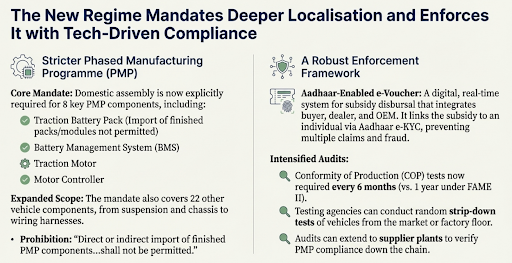

Compliance and Enforcement

Weak enforcement of localization norms (Phased Manufacturing Programme) risks repeating FAME-II problems, where some companies improperly received subsidies.

Adopt a More Inclusive Approach: Policymakers should consider a balanced strategy with incentives for private electric cars and light commercial vehicles to speed up the transition.

Innovative Financing Models: The government can support private operators by promoting Battery-as-a-Service (BaaS), offering interest subventions, and providing credit guarantees to de-risk e-bus investments.

Strengthen Public-Private Partnerships (PPPs): Collaboration between public and private sectors is crucial for rapid and efficient charging infrastructure rollout.

Focus on Technology Standardization: Standardizing charging and battery-swapping technology will improve interoperability and user convenience, creating a more seamless ecosystem.

Robust Monitoring: Strict oversight and penalties are key to ensuring compliance with domestic value addition norms and preventing subsidy misuse.

The PM E-DRIVE scheme has shown success in segments like three-wheelers by focusing on public transport, commercial vehicles, and charging infrastructure, but needs to address exclusions and improve financing for a comprehensive national electric mobility transition.

Source: PIB

|

PRACTICE QUESTION Q. "The PM E-DRIVE scheme marks a strategic shift from merely subsidizing electric vehicles to building a robust EV ecosystem." Critically analyze. (250 words) |

The PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM e-DRIVE) is a new government scheme with a ₹10,900 crore outlay, running from October 1, 2024, to March 31, 2026. It aims to accelerate the adoption of electric vehicles, develop charging infrastructure, and promote domestic EV manufacturing in India.

The PM e-DRIVE Scheme is the successor to the FAME-II scheme. It builds upon its foundation with a renewed focus on aggressively tackling key challenges. While FAME-II initiated the subsidy model, PM e-DRIVE integrates it more deeply with domestic manufacturing goals through a Phased Manufacturing Programme (PMP) and synergies with PLI schemes.

Consumers purchasing electric two-wheelers (private/commercial), electric three-wheelers (commercial only), e-ambulances, and e-trucks are eligible for demand incentives. A key condition is that the vehicle must be fitted with an advanced battery.

© 2026 iasgyan. All right reserved