Artificial Intelligence is revolutionizing the Banking Sector by improving efficiency, security, and customer experience. However, challenges like high implementation costs, data privacy concerns, and skilled workforce shortages persist. The RBI emphasizes a balanced approach, including a robust regulatory framework and financial inclusion, to ensure successful AI adoption in banking.

Copyright infringement not intended

Picture Courtesy: AINEWS

Malaysian conglomerate YTL Group and Singapore's Sea Ltd have launched Ryt Bank, the world's first AI-powered bank, a major leap for artificial intelligence in the Banking sector.

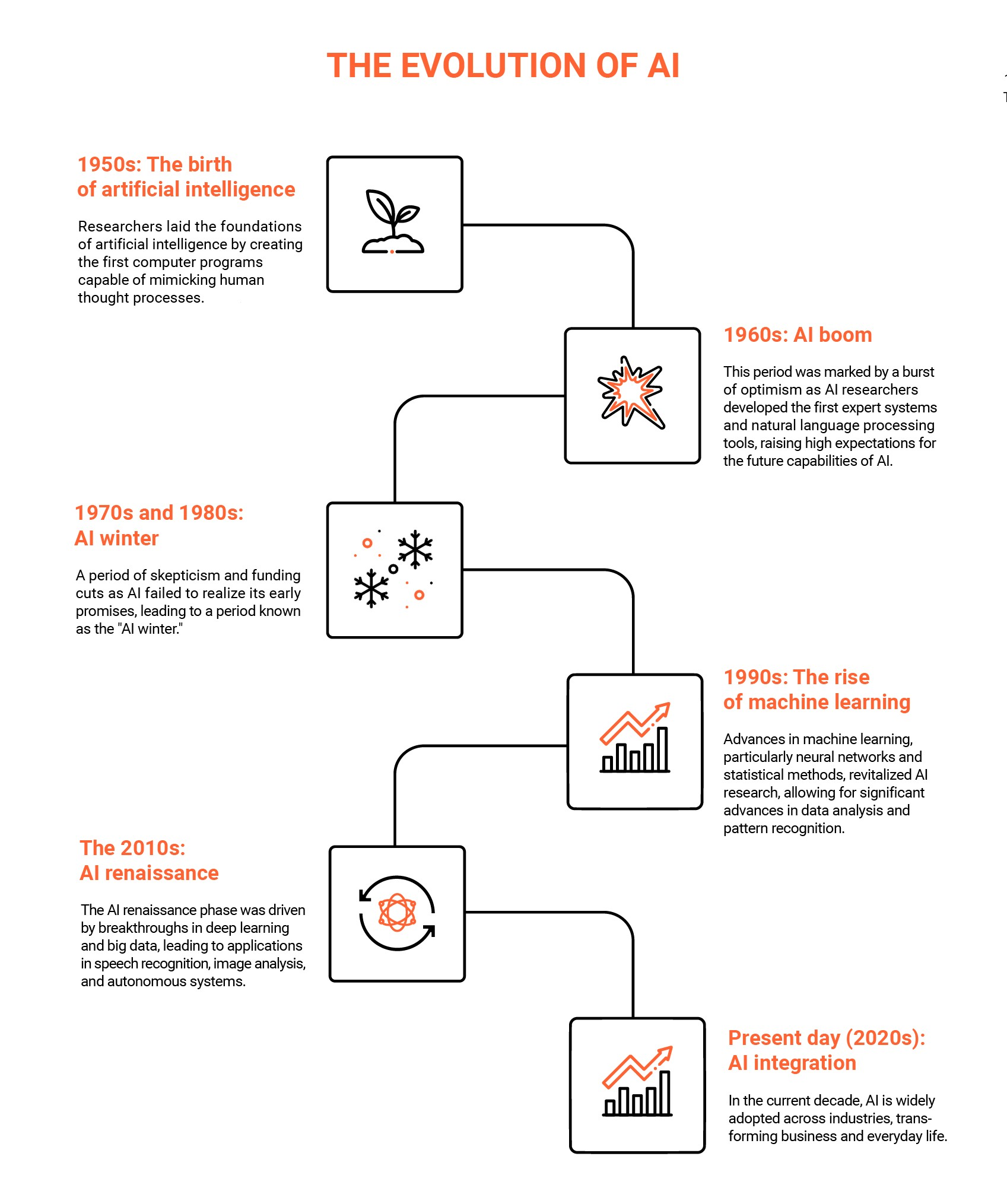

AI refers to machines performing tasks that normally require human intelligence, such as learning, reasoning or language understanding.

In banking, AI uses advanced algorithms and data analysis to automate decisions, predict trends, and personalize services.

Unlike ordinary software, AI “learns” over time from data, improving its accuracy and expanding its abilities.

|

Banking Sector in India Reserve Bank of India (RBI) is the central bank, under which operate Scheduled Commercial Banks (Public Sector Banks, private banks, foreign banks), Regional Rural Banks, Cooperative Banks, small finance/payment banks and various NBFCs. Public Sector Banks hold a majority market share. In FY2023–24, PSBs earned a record ₹1.41 lakh crore net profit and reduced gross non-performing assets (GNPA) to about 3.12% by Sept 2024. |

Enhanced Fraud Detection and Cybersecurity: AI algorithms analyze transaction patterns in real-time to flag anomalies that humans would miss.

Personalized Customer Experiences: By analyzing transaction history and spending patterns, AI delivers customised product recommendations and financial advice.

Efficient Credit Risk Assessment: AI processes vast datasets, including alternative data like mobile usage, to enable faster and more accurate loan approvals.

Streamlined Regulatory Compliance and AML: AI automates and enhances regulatory processes like Know Your Customer (KYC) and Anti-Money Laundering (AML), reduce manual effort, helps banks combat financial crime and manage the global AML compliance costs.

Automation of Back-Office Operations: AI-powered Robotic Process Automation (RPA) automates repetitive tasks like data entry and document verification, cutting operational costs and human error.

24/7 Customer Support via Chatbots: AI-powered virtual assistants provide instant, 24/7 responses to customer queries, boost satisfaction while reducing the load on human agents.

Strategic Decision-Making: AI processes datasets to uncover deep insights into market trends and customer behavior, enabling superior strategic decisions. SBI's analytics team, for example, developed AI/ML models that boosted business and cut risk.

Driving Financial Inclusion: AI expands banking to underserved populations by using alternative data for credit scoring and offering voice-based services in regional languages.

RBI Committees and Guidelines: In Dec 2024 the RBI formed a panel to develop a “Framework for Responsible and Ethical AI (FREE-AI)” in finance.

Risk Detection Tools: RBI’s Innovation Hub launched MuleHunter AI, a system that quickly spots mule (fraud) accounts across banks.

Policy Frameworks: The RBI’s FREE-AI framework calls for building shared financial data infrastructure (an “AI-Kosh”) and an “AI Innovation Sandbox” where banks can safely test AI models on anonymized data.

Securities and Finance Boards: SEBI issued a 2025 consultation on responsible AI use in securities markets. The Government’s IndiaAI Mission and other programs promote AI R&D and startups in finance.

Digital Infrastructure: India’s strong digital public infrastructure (Aadhaar ID, UPI payments, account aggregators) provides a base for AI.

Global Alignment: India is following global trends: like many countries, regulators stress explainability and fairness.

Generative AI: Large language models (LLMs) and generative AI will enable new services (automated report summaries, contract drafting, intelligent chat). RBI projects that generative AI could directly improve banking efficiency by up to 46%.

Data Analytics and Predictive Services: AI for real-time risk forecasting, dynamic pricing and personalized wealth management.

Integrated IoT Finance: AI will integrate with emerging tech – for example, wearable devices or IoT networks could feed data to banks for contextual financial offers.

Quantum and Advanced Computing: AI combined with quantum computing could solve complex risk models much faster, improving security and optimization in banking.

RegTech and Explainable AI: As AI use grows, so will tools for regulation. Banks will adopt explainable-AI methods (XAI) to make models transparent, in line with regulators’ expectations.

Digital Allies: More banks will partner with fintech and BigTech.

Algorithmic Bias and Fairness: Algorithmic bias is not just as a technical flaw but as a modern form of "digital redlining." If left unchecked, it can perpetuate and even deepen historical inequalities, creating new barriers to economic mobility and contradicting the constitutional promise of equality.

Data Privacy and Security in a Third-Party Ecosystem: AI's use of vast amounts of sensitive customer data creates a massive attack risk, which magnified as banks depend on third-party vendors.

The "Black Box" Problem and Lack of Interpretability: Complex deep-learning models operate as a "black box," making it impossible for humans to understand or explain their decisions.

The AI Cybersecurity Arms Race: While banks use AI for defense, threat actors are weaponizing it to launch hyper-realistic and sophisticated attacks. This includes AI-powered phishing, advanced ransomware, and convincing deepfake scams that can bypass traditional security.

Job Displacement and the Urgent Need for Reskilling: While AI can boost productivity, it risks deepening the problem of jobless growth.

Vendor and Concentration Risk: Over-reliance of the entire banking sector on a handful of BigTech firms for cloud computing and AI services (like Google Cloud, and Microsoft Azure) creates a systemic risk.

Talent Shortage and Skill Gap: A 2025 Quess Corp report identified a 42% AI and data talent skill gap within India's Banking, Financial Services, and Insurance (BFSI) sector.

Regulatory Uncertainty and Evolving Compliance: Pace of AI innovation has left regulators worldwide in a race to catch up, creating a complex and uncertain compliance landscape.

Establish a National Framework for Ethical AI in Finance: Include mandatory AI ethics committees within banks and a "human-in-the-loop" requirement for all critical decisions, such as high-value loan rejections.

Develop Sovereign AI Capabilities and Reduce Vendor Risk: Avoid over-reliance on a few global tech giants, encourage development of indigenous AI ecosystem, aligns with the goals of data sovereignty and Atmanirbhar Bharat.

Strengthen Data Infrastructure with a Focus on Privacy: Build shared data platforms that allow banks to train AI models on high-quality, anonymized data.

Mandate Explainable AI (XAI) for Transparency: Address the "black box" problem by mandating that all AI models used for credit scoring and other customer-facing decisions be interpretable.

Innovation Through Regulatory Sandboxes: Encourage experiment in a controlled environment to allow banks and fintechs to test new AI models without posing a risk to the live financial system.

Launch a Sector-Wide Skilling Mission: Address the talent deficit by launching a upskilling and reskilling initiative focused on AI ethics, data science, and AI-driven risk management.

Enhance AI-Specific Cybersecurity Safeguards: Develop a dynamic cybersecurity strategy that uses AI to defend against AI-powered threats, defenses against deepfakes, data poisoning, and other emerging attack vectors.

Promote a "Phygital" Model for Financial Inclusion: Ensure that AI-driven digital transformation bridge digital divide, blend digital efficiency with human-led last-mile connectivity.

Provide Final Regulatory Clarity: Government and RBI must finalize the legal "rules of the road" for AI in finance to provide certainty for long-term investment.

Artificial intelligence is transforming banking sector by automating processes, improving risk management and personalizing services. In India, AI can deepen inclusion and make banks more efficient. However, realizing AI’s full potential requires addressing challenges around bias, security, privacy and cost.

Source: AINEWS

|

PRACTICE QUESTION Q. The adoption of Artificial Intelligence in the Indian banking sector is a double-edged sword. Critically Analyze. 250 words |

It is when an AI system makes unfair or discriminatory decisions because it was trained on biased data, for example, unfairly denying loans based on gender or location.

It is when an AI's decision-making process is so complex that even its creators cannot explain how it arrived at a particular conclusion, making it difficult to audit.

Regtech (Regulatory Technology) uses AI and other technologies to help banks automatically comply with complex financial regulations.

© 2026 iasgyan. All right reserved