Indian textile industry faces challenges like outdated technology, fragmentation, and global competition. Government initiatives like the PM MITRA scheme for infrastructure and the Production-Linked Incentive (PLI) scheme aim to address these issues. A key strategy for the future involves embracing technical textiles and sustainable practices to boost competitiveness and exports, leveraging India's rich heritage in the sector.

Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

Indian textile industry seeks government support—cash incentives, soft loans, interest subventions, or market schemes—to counter rising US tariffs.

India is the second-largest producer of textiles and garments in the world. The industry is diverse, covering everything from cotton farming, spinning, and weaving to the manufacturing of apparel, home textiles, and advanced technical textiles.

Economic Contributor & Employer: The sector contributes to India's GDP (around 2.3%), industrial production (13%), and exports (12%). It provide direct employment to over 45 million people, 2nd largest after agriculture.

Global Player (Exports): India is the world's 6th largest exporter of textiles & apparel, holding a 4.1% share and contributing 8.63% to total merchandise exports in 2024-25.

Market Size & Growth: The Indian textile and apparel market is projected to grow at a 10% compound annual growth rate (CAGR) to reach US$350 billion by 2030. Exports are also expected to reach US$100 billion by 2030.

Raw Material Strength: India holds the top spot in global cotton acreage (around 40% of the world's total area under cultivation) and is the second-largest producer, behind China.

Focus on Technical Textiles: India is the 6th largest producer of Technical Textiles with a 6% Global Share and promotes this high-value segment.

Significance of the Textile Sector

Economic Contribution: Contributes 2.3% to GDP, 13% to industrial production, and 12% to exports.

Employment Generation: 2nd largest employment generators, after agriculture, with over 45 million people employed directly, including many women and the rural population.

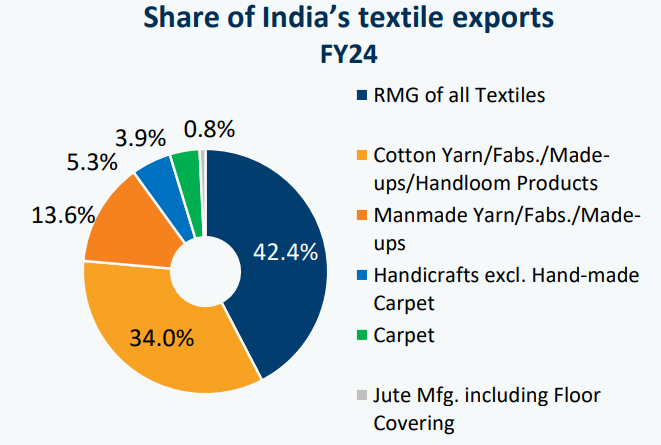

Export Earnings: 6th-largest exporter, with total textile and apparel exports reaching $34.4 billion in FY 2023-24, holding a 3.9% share of the global trade.

Government Policies

Government Policies

Production Linked Incentive (PLI) Scheme: With an outlay of ₹10,683 crore, this scheme provides financial incentives to boost the domestic manufacturing of high-value Man-Made Fibre (MMF) apparel, MMF fabrics, and technical textiles.

PM MITRA Parks (Mega Integrated Textile Region and Apparel): Create seven world-class, integrated textile parks designed to house the entire textile value chain (from spinning to garmenting) in a single location, reducing logistics costs and improving efficiency.

National Technical Textiles Mission (NTTM): Make India a global leader in technical textiles by promoting research, innovation, market development, and skill training.

Amended Technology Upgradation Fund Scheme (ATUFS): Encourage technology upgrades in the MSME-dominated textile industry by providing capital subsidies for benchmarked technology.

Samarth (Scheme for Capacity Building in Textile Sector): Provides skills training for the textile sector's workforce, aiming to improve productivity and quality.

SEZs (Special Economic Zones): Offer tax and duty benefits within dedicated export-oriented zones, encouraging textile export growth.

Textile Sector Skill Council (TSC): Develop National Occupational Standards, under the National Skill Development Corporation (NSDC).

Scheme for Integrated Textile Parks (SITP): Creates modern textile parks with world-class infrastructure, reducing logistics costs and improving efficiency for textile manufacturers.

Foreign Direct Investment (FDI): Government permits 100% FDI in the textile sector through the automatic route.

Kasturi Cotton: Initiative by the Ministry of Textiles to brand, trace, and certify Indian cotton to enhance its value in domestic and international markets.

Export Promotion: Government supports exporters through schemes like the Rebate of State and Central Taxes and Levies (RoSCTL) and by negotiating Free Trade Agreements (FTAs) with key partners like the UAE and Australia.

National Handloom Development Programme (NHDP): Provides end-to-end support for the handloom sector, including cluster development, marketing assistance, and the Raw Material Supply Scheme, benefiting weavers and promoting handloom exports.

Market Access Initiative (MAI): Assists exporters and export promotion councils in conducting market research, organizing trade fairs, participating in exhibitions, and building capacity to explore new markets and expand export reach.

Technical Textiles: This is a high-growth area, with applications in industries like automotive, construction, healthcare, and defense. The NTTM is promoting this segment through research grants and skill development.

Sustainable and Eco-Friendly Practices: Growing global demand for sustainable textiles presents a significant opportunity, India is the world's largest producer of cotton and jute, and the second-largest producer of silk.

Digital Transformation: Innovations include automated looms, digital printing for customized designs, and AI-driven demand forecasting. E-commerce platforms are opening direct-to-consumer sales channels, which allow exporters to reach global markets more easily.

Handloom and Craft-Based Products: Resurgence in global preference for handmade and artisanal products. India's handwoven fabrics, account for 95% of the world's production, are in high demand in niche and luxury markets.

Market Diversification: The US and EU remain major markets, exporters are exploring new destinations in Africa, South America, and Southeast Asia to reduce dependency and tap into new growth areas.

Falling Export: Overall textile and apparel exports (including handicrafts) stood at $35.874 billion in FY 2023-24, decrease from $36.686 billion in FY 2022-23 and $44.435 billion in FY 2021-22.

Fragmented Value Chain: Industry suffers from fragmentation, particularly in the weaving, processing, and garmenting sectors, with small, unorganized units dominating, hinders economies of scale and global competitiveness.

Outdated Technology: Many textile units, still depend on obsolete machinery and technology, which limits their ability to meet global quality standards and reduces their competitiveness.

Raw Material Price Volatility: Cotton price fluctuations and government-imposed Quality Control Orders (QCOs) on imports force domestic yarn makers to use expensive local alternatives, increasing production costs and affecting industry profitability.

Lack of Free Trade Agreements (FTAs): Countries like Bangladesh and Vietnam benefit from duty-free access or preferential trade agreements with major markets like the EU, giving them a cost advantage over India.

Recent US Tariff Hikes: Imposition of 25% tariff on Indian textile imports by the United States, due to oil trade with Russia, makes Indian goods more expensive, with effective tariff rates on some apparel categories exceeding 60%.

Sustainability Pressures: Global brands are enforcing strict environmental and social compliance standards, meeting these demands requires investment in renewable energy, waste recycling, and supply chain traceability, a challenge for Small and Medium Enterprises (SMEs).

Intense Global Competition: Competition from countries like China, Vietnam, and Bangladesh. These nations benefit from low labor costs, vertically integrated supply chains, and favorable trade agreements (like Bangladesh's duty-free access to many markets), which make their exports more attractive.

Skill Gap and Labour Shortage: Shortage of skilled labor, particularly in the organized sector, hinders technological advancements and productivity gains. About 70% of workers in the unorganized sector have very basic education.

Infrastructure Deficiencies: Inadequate infrastructure, including transportation bottlenecks, power shortages, and outdated technology, hampers the textile industry's efficiency and increases production costs.

Lack of Investment: Foreign investors show hesitation in investing in the Indian textile sector, contributes to a lack of necessary capital infusion for modernization and expansion.

Complex Regulations and Export Procedures: Indian textile exporters face complex regulations and customs procedures. This increases compliance costs and hinders competitiveness compared to nations with simpler export processes and free trade agreements.

Strengthen Supply Chains: Government and industry must work together to create vertically integrated "fibre-to-fashion" hubs, within the PM MITRA parks, to reduce fragmentation and logistics costs. Reassessing restrictive QCOs on raw materials could also lower production costs.

Strengthen Integrated Manufacturing: Develop large-scale, vertically integrated textile parks (like the PM MITRA parks), streamline production, reduce fragmentation, lower costs, and shorten lead times.

Negotiate Favorable Trade Agreements: Securing FTAs with major markets like the EU and resolving tariff issues with the US through diplomatic engagement are critical to leveling the playing field for Indian exporters.

Promote Innovation: Investment in digital design, and smart textiles for moving up the value chain from basic yarns to high-value-added products.

Skill Development and Labor Reforms: Expand skill development programs like Samarth and creating better living conditions for workers, such as housing near factories, can improve productivity and reduce attrition.

Market Diversification: Explore and develop new export markets to reduce dependence on traditional partners and mitigate risks from geopolitical trade disputes.

Boost MMF & Technical Textiles: Shift focus to the Man-Made Fibre (MMF) and Technical Textiles segments, which have high global demand.

Modernize & Automate: Adopt advanced technologies like automation, AI, and IoT for increased efficiency, and quality. Automation reduces reliance on manual labor, improves consistency, and lowers operational costs.

Promote Sustainability: Invest in green technologies, providing financial incentives to MSMEs to adopt sustainable practices, use sustainable raw materials (e.g., organic cotton, recycled fibers), and adopt green certifications, aligns with global demand and reduces environmental impact.

Attract Investment: Leverage 100% FDI (automatic route) and create a supportive investment environment.

Reduce Costs: Address challenges like high raw material costs and fragmented supply chains to lower production expenses.

Boost Innovation & R&D: Promote research and development, especially in technical textiles.

Support Traditional Sectors: Digitize supply chains for artisans, integrate them into e-commerce platforms, and use Geographical Indications (GI) for branding traditional products like Banarasi silk or Kanchipuram silk.

Source: INDIAN EXPRESS

|

PRACTICE QUESTION Q. Analyze the role of the textile sector in India's economic growth and employment generation. 150 words |

Technical textiles are products designed for specific functions, not just aesthetics, used in sectors like healthcare and agriculture.

It contributes about 2.3% to India's GDP and 13% to industrial production.

It employs over 45 million people directly and provides indirect livelihoods to around 100 million.

© 2026 iasgyan. All right reserved