Description

Copyright infringement not intended

Picture Courtesy: The Hindu

Context:

Recent data from the Reserve Bank of India (RBI) shows that Indian households are accumulating financial debt at a faster pace than financial assets, highlighting changing trends in savings and investment patterns.

Current Status:

According to Reserve Bank of India data,

- Between 2019-20 and 2024-25, the annual financial assets added by households increased by 48%, from ₹24.1 lakh crore to ₹35.6 lakh crore.

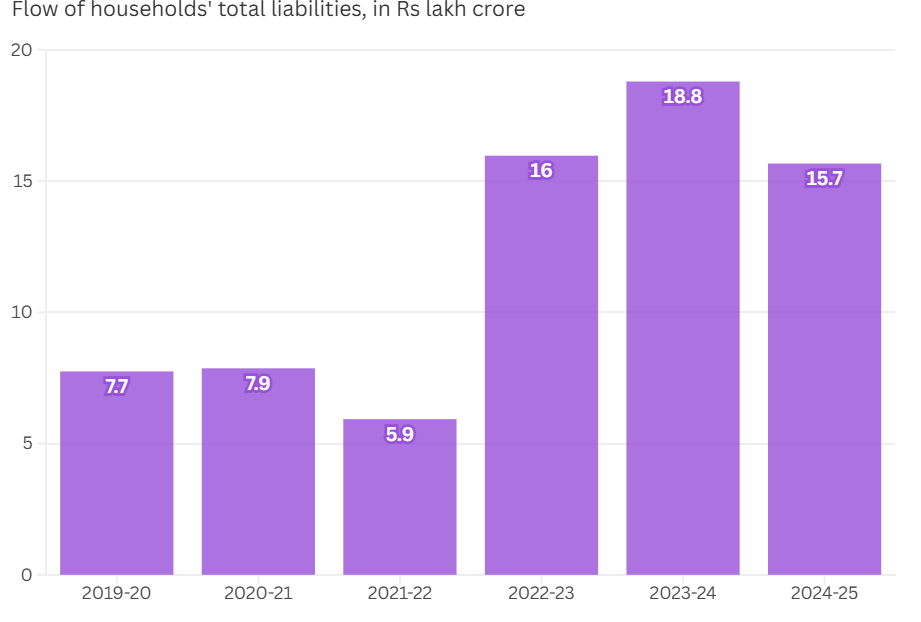

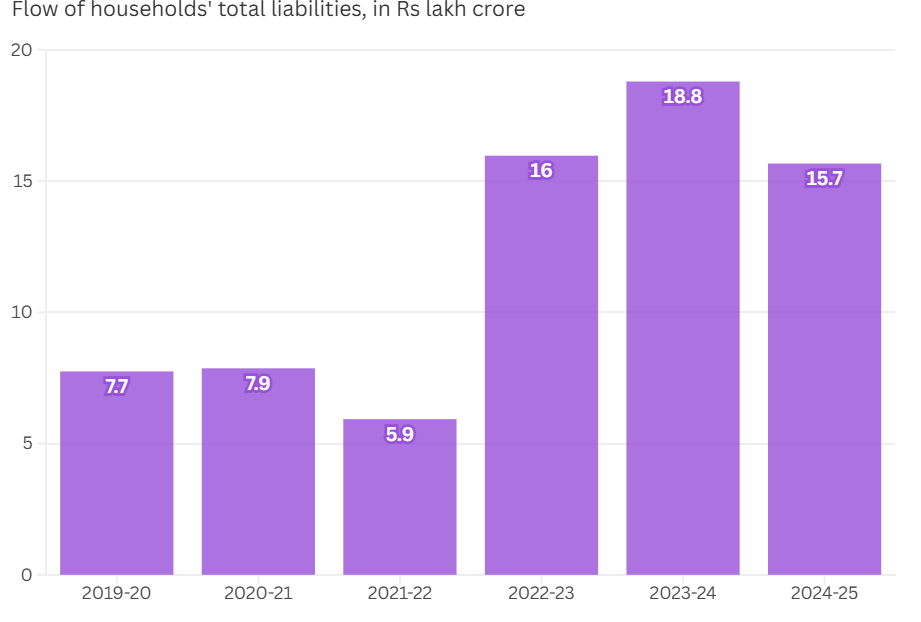

- During the same period, annual financial liabilities grew 102%, rising from ₹7.5 lakh crore to ₹15.7 lakh crore.

- As a share of GDP, financial asset additions have slightly declined from 12% in 2019-20 to 10.8% in 2024-25, while liabilities increased from 9% to 4.7%.

- Bank deposits remain the main choice for savings, making up 33.3% of total household financial assets in 2024-25, up slightly from 32% in 2019-20.

- The total quantum of deposits added grew 54%, from ₹7.7 lakh crore to ₹11.8 lakh crore.

- Mutual funds have emerged as a preferred investment avenue, with their share in newly added assets rising from 6% in 2019-20 to 13.1% in 2024-25.

Picture Courtesy: The Hindu

Why household debt growing faster than household assets in India?

- Rising Consumption and Lifestyle Changes: Increasing disposable income and aspirations have led households to spend more on housing, vehicles, education, and consumer goods.

- Easy Access to Credit: Banks, NBFCs, and fintech lenders have made credit more accessible through home loans, car loans, personal loans, and instant digital credit.

- Slow Asset Growth Relative to Debt: While financial assets like bank deposits, mutual funds, and insurance have grown, the rate of asset accumulation (48% over 2019–25) is slower than debt accumulation (102% in the same period).

- Shift to Debt-Funded Investments: Some households take loans to invest in real estate, stock markets, or business ventures, adding to liabilities without immediately increasing financial assets.

- Inflation and Cost of Living: Rising costs of essential goods, healthcare, and education force households to borrow more to maintain living standards, even as savings growth remains modest.

Multidimensional implication of growing household debt exceeding assets in India:

Economic Implications

- Slower GDP Growth: High household debt can reduce disposable income, limiting consumption and slowing economic growth.

- Increased Vulnerability: Debt-ridden households are more sensitive to economic shocks, inflation, or interest rate hikes, which can reduce spending and demand.

Financial Sector Implications

- Rising Non-Performing Assets (NPAs): Higher household leverage increases the risk of loan defaults, putting stress on banks and NBFCs.

- Credit Market Volatility: Over-indebted households may reduce borrowing, affecting lending growth and financial sector stability.

Social Implications

- Increased Financial Stress: Households with high debt face stress, affecting mental health, family stability, and quality of life.

- Inequality Concerns: Lower-income households are disproportionately affected, as they borrow more relative to their assets, widening wealth inequality.

Policy Implications

- Need for Financial Literacy: Promoting awareness about prudent borrowing, budgeting, and long-term investment is critical.

- Regulation of Credit Growth: Policymakers may need stricter lending guidelines to prevent over-leveraging.

Long-Term Implications

- Asset-Liability Mismatch: Persistent debt growth exceeding asset growth can reduce household financial resilience.

- Impact on Retirement Security: Over-indebted households may save less for retirement, risking long-term financial insecurity.

Challenges:

- High Dependence on Credit: Many households rely on loans for housing, education, vehicles, and lifestyle needs. Reducing debt requires either increased income or reduced consumption, both of which can be difficult in the short term.

- Slow Asset Growth: Conservative investments like bank deposits yield low returns, limiting the pace of financial asset accumulation.

- Rising Living Costs and Inflation: Inflation in essentials, healthcare, and education forces households to borrow more, reducing savings capacity.

- Limited Financial Literacy: Lack of awareness about debt management, investment planning, and risk management leads to over-leveraging.

- Lifestyle and Aspirational Spending: Social expectations and desire for a better lifestyle often encourage spending beyond means.

- Income and Employment Uncertainty: Irregular incomes or slow wage growth make simultaneous debt repayment and asset creation challenging.

- Policy and Structural Constraints: While borrowing is encouraged through loans and credit schemes, incentives for long-term asset building are limited, and safety nets remain insufficient.

Government Measures to reduce household debt:

- Financial Literacy and Awareness Programs: Initiatives like National Centre for Financial Education (NCFE) and RBI’s financial literacy campaigns aim to educate households about debt management, budgeting, and investment planning. Focus on promoting prudent borrowing, savings habits, and understanding of financial products.

- Restructuring and Debt Relief Schemes: Loan restructuring options for stressed borrowers in banks and NBFCs help households manage repayment without defaulting. Special relief measures during crises (e.g., pandemic moratoriums) provide temporary respite to reduce financial strain.

- Promotion of Household Savings and Investments: Incentives for long-term investment instruments such as Public Provident Fund (PPF), National Pension System (NPS), and mutual funds. Tax benefits under sections like 80C, 80CCD encourage systematic savings and asset building.

- Regulation of Credit Growth: RBI and SEBI monitor lending practices to prevent over-leveraging by households. Guidelines on responsible lending, interest rate caps, and credit risk assessment reduce exposure to excessive debt.

- Digital Financial Inclusion: Programs like Pradhan Mantri Jan Dhan Yojana (PMJDY) ensure broader access to banking and formal financial products. Mobile banking and digital payment platforms promote easier savings and investments.

- Social Security and Safety Nets: Schemes like Atal Pension Yojana, PM Shram Yogi Maan-dhan, and insurance programs provide fallback support, reducing reliance on high-interest borrowing.

Way Forward:

- Enhance Financial Literacy: Educate households on budgeting, debt management, and long-term investment strategies through workshops, school programs, and digital campaigns.

- Encourage Savings and Asset-Building: Promote investments in mutual funds, pension schemes, and other higher-yield instruments, along with tax incentives to make saving more attractive.

- Responsible Borrowing and Credit Regulation: Implement stricter lending norms, ensure transparency in interest rates, and encourage households to borrow within their repayment capacity.

- Strengthen Social Safety Nets: Expand insurance, pension, and welfare programs to reduce households’ dependence on high-interest borrowing during emergencies.

- Support Income Growth and Employment Security: Create stable job opportunities, enhance wages, and support skill development to help households repay debt and build assets simultaneously.

- Promote Behavioural Change: Encourage disciplined financial planning, reduce consumption-driven borrowing, and foster a culture of long-term wealth creation.

Conclusion:

The rising trend of household debt outpacing asset growth in India poses significant economic, financial, and social challenges. While households are increasingly relying on credit, asset creation through traditional savings has not kept pace, highlighting the need for balanced financial management. Strengthening financial literacy, promoting long-term investments, ensuring responsible lending, expanding social safety nets, and supporting income growth are critical steps forward. A coordinated approach between households, policymakers, and financial institutions can help achieve sustainable financial security and reduce vulnerability to debt stress.

Source: The Hindu

|

Practice Question

Q. Rising household debt in India is outpacing asset creation, posing risks to financial stability and economic growth. Analyse the reasons for this trend, discuss its economic and social implications, and suggest policy measures to address the issue.

|

Frequently Asked Questions (FAQs)

It means that Indian households are borrowing more than the financial wealth or savings they are accumulating, creating a gap that can affect financial stability.

Reasons include rising consumption and lifestyle aspirations, easy access to credit, slow growth of financial assets, inflation, and limited financial literacy.

Adopt disciplined budgeting, invest in higher-yield instruments like mutual funds or pension schemes, borrow responsibly, and prioritize long-term savings over short-term consumption.