Description

Copyright infringement not intended

Picture Courtesy: The Hindu

Context:

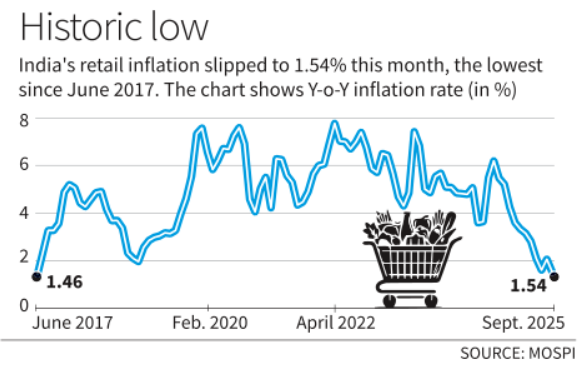

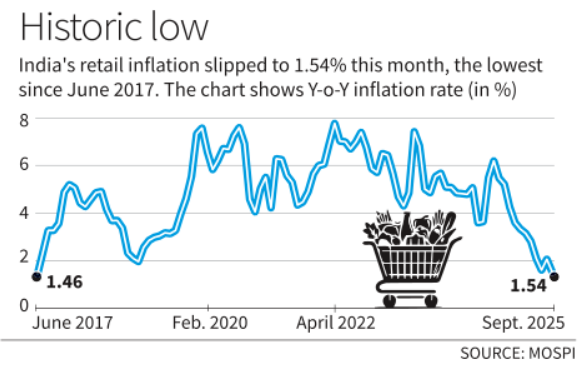

Retail inflation in India dropped to a 99-month low of 1.54% in September 2025, mainly due to a fall in food and fuel prices, according to data from the Ministry of Statistics and Programme Implementation.

What is Retail Inflation?

Retail inflation refers to the rise in the overall price level of goods and services that consumers buy for personal use, measured at the retail level — i.e., the prices you and I pay in shops and markets.

Measured by: The Consumer Price Index (CPI), which tracks price changes of a basket of commonly used goods and services.

Base Year: Currently 2012 is used as the base year for CPI calculations in India.

Published by: The Ministry of Statistics and Programme Implementation (MoSPI) every month.

RBI’s Comfort Zone: The Reserve Bank of India (RBI) aims to keep retail inflation between 2% and 6% to ensure price stability and economic growth.

Current Status of Retail inflation: (Source: The Hindu)

- The food and beverages segment saw prices shrink by 1.4% in September, compared to a slight rise of 05% in August and a steep 8.4% inflation during the same month last year.

- Inflation in edible oils remained high at 3%, marking the 11th straight month of double-digit growth.

- Fuel and light inflation dropped to 98% in September, from 2.3% in August.

- Inflation in clothing and footwear stood at 28%, slightly lower than 2.33% in August.

- Prices in pan, tobacco, and intoxicants rose slightly to 7%, while housing inflation increased to 4%, up from 3.1% the previous month.

Year-on-Year Trend:

|

Month / Period

|

Year-on-Year Retail Inflation (%)

|

Notes / Source

|

|

April 2025

|

3.16%

|

Compared with April 2024. (Source: DD News)

|

|

March 2025

|

3.34%

|

Lowest in nearly six years. (Source: The Times of India)

|

|

June 2025

|

2.10%

|

Compared with June 2024. (Source: mint)

|

|

August 2025 (Provisional)

|

2.07%

|

Compared with August 2024. (Source: Press Information Bureau)

|

|

September 2025

|

1.54%

|

Lowest in 99 months, compared with September 2024. (Source: Reuters)

|

Implications of Low Retail Inflation:

- Increased Purchasing Power: When inflation is low, the prices of essential goods and services rise very slowly — or even fall. This means consumers can buy more with the same amount of money, improving their real income and living standards.

- Relief for Households: Low inflation reduces pressure on household budgets, especially for essentials like food and fuel. This is particularly beneficial for middle- and lower-income groups.

- Encourages Savings: When prices are stable, people are more likely to save, as the value of their savings doesn’t erode quickly. This supports long-term financial planning and boosts investment in banks.

- Room for RBI to Cut Interest Rates: If inflation remains below the RBI’s target range (2–6%), the central bank may reduce policy interest rates. Lower rates make borrowing cheaper, which can stimulate investment and consumption in the economy.

- Reduced Cost of Living: Essential goods like food, fuel, and clothing become more affordable. This can also improve consumer confidence and increase demand over time.

- Possible Concern for Growth: If inflation stays too low for too long, it may signal weak demand or sluggish economic activity. Businesses may cut production or delay investment if prices — and profits — are not rising.

Government measures to maintain retail inflation:

Monetary Policy Measures (by RBI)

- The Monetary Policy Committee (MPC) uses key tools such as:

- Repo Rate – currently around 50% (2025) to influence lending rates and money supply.

- Cash Reserve Ratio (CRR) and Open Market Operations (OMOs) to manage liquidity in the banking system.

- When inflation rises, the RBI raises interest rates to reduce demand; when inflation falls below target, it cuts rates to support growth.

- The RBI also regularly revises inflation forecasts (FY26 projection lowered to 1%) and maintains transparent communication to anchor inflation expectations.

Food Supply Management

- Since food prices form nearly 46% of CPI, the government focuses on stable food supplies through:

- Buffer stock management of rice, wheat, and pulses by the Food Corporation of India (FCI).

- Release of buffer stocks to control prices during shortages.

- Ban or restriction on exports (e.g., rice, onions) and duty cuts on imports to stabilize domestic supply.

- Market intervention schemes like PM-AASHA and Price Stabilization Fund for pulses and vegetables.

- Control of Fuel Prices: The government adjusts excise duties and taxes on petrol, diesel, and LPG to cushion global price shocks.

- Agricultural and Rural Initiatives: Schemes like PM-KISAN, PMFBY (crop insurance), and PM Krishi Sinchai Yojana enhance farmers’ income and productivity, ensuring steady food supply and price stability.

- Fiscal and Import Measures: Reduction in customs duty on edible oils and pulses to manage imported inflation and ban on hoarding and black marketing under the Essential Commodities Act, 1955.

- Promoting Long-Term Price Stability: Continued focus on supply-side reforms, logistics improvement, and agricultural diversification.

Way Forward:

- Maintain Price Stability: The RBI should continue to monitor inflation trends closely to keep it within the 2–6% target range. (Source: RBI)

- Support Rural and Agricultural Sectors: Low food inflation benefits consumers but may reduce farmers’ income. In June 2025, India's food inflation fell to a negative 1.1%, signaling a serious challenge for the farming community. (Source: Rural Voice)

- Encourage Investment and Consumption: With inflation under control, the RBI can consider a gradual reduction in interest rates to boost borrowing, investment, and demand in the economy. The RBI's decision in April 2025 to cut the repo rate by 25 basis points is an example of this approach, signaling a shift toward supporting growth while inflation remained within its target band. (Source: PIB)

- Monitor Global Price Trends: Global factors such as oil prices and commodity markets still influence domestic inflation. A 2025 study found that during 2014–2023, supply-side factors like food and oil price shocks, along with supply chain disruptions, were the primary contributors to both CPI and GDP deflator inflation across 20 economies. (Source: Science Direct)

- Promote Self-Reliance in Key Commodities: Encouraging domestic production of edible oils, pulses, and fertilizers can reduce import dependence and keep prices stable. Domestic edible oil production was only 11.57 million tonnes in 2021–22, far short of the total consumption of over 25.0 million tonnes. (Source: Business Standard)

- Enhance Data and Policy Coordination: Strengthening coordination between the Ministry of Statistics, RBI, and state governments will ensure timely responses to emerging inflation trends.

Source: The Hindu

|

Practice Question

Q. “Low retail inflation provides relief to consumers but poses challenges for producers.” Critically analyze this statement with reference to recent data on India’s inflation trends. (250 words)

|

Frequently Asked Questions (FAQs)

Retail inflation refers to the rise in the overall prices of goods and services purchased by consumers at the retail level. In India, it is measured through the Consumer Price Index (CPI), which tracks changes in prices of a fixed basket of items like food, clothing, housing, and fuel.

The Ministry of Statistics and Programme Implementation (MoSPI) releases CPI-based retail inflation data every month.

Under the Monetary Policy Framework (2016), the Reserve Bank of India (RBI) aims to maintain retail inflation between 2% and 6%, with 4% as the medium-term target.