The Government of India proposes a special cess on goods like pan masala to create a non-lapsable fund for health and national security, linking public health with national stability. Critics warn it weakens fiscal federalism and risks poor fund use amid past evidence of unspent cess.

Copyright infringement not intended

Picture Courtesy: INDIANEXPRESS

Context

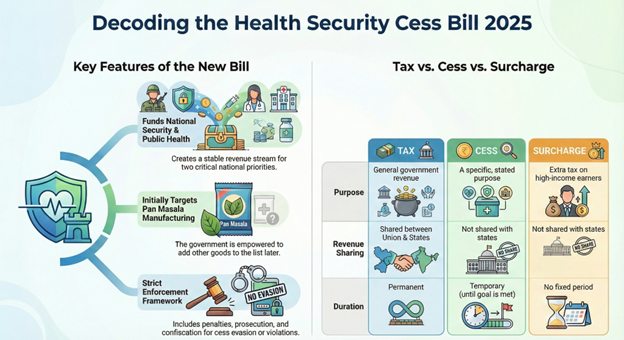

The Lok Sabha passed the Health Security se National Security Cess Bill, 2025, aimed at levying a cess on manufacturing units of paan masala and utilising the funds thus collected in strengthening national security and improving public health.

What is Health Security se National Security Cess Bill, 2025?

It aims to raise funds for public health and national security by levying a cess on the production of specific goods, initially including pan masala and any other items the central government may designate.

Purpose of the Cess: The Bill introduces a special excise cess to fund national security and public health needs via a stable revenue stream.

Goods Covered: Initially, the cess applies only to pan masala, but the Government can add other goods later.

Taxable Persons: Any individual or entity that owns, operates, or controls machinery or processes for manufacturing specified goods must pay the cess.

Enforcement Framework: The Bill imposes strict enforcement, with penalties, prosecution, arrest, and confiscation for violations like undeclared machinery, cess evasion, record falsification, or hindering officials.

Appeals Authority: The multi-tier appellate mechanism allows taxpayers to challenge decisions sequentially through the Appellate Authority, Tribunal, High Court, and Supreme Court, guaranteeing legal remedy and procedural fairness.

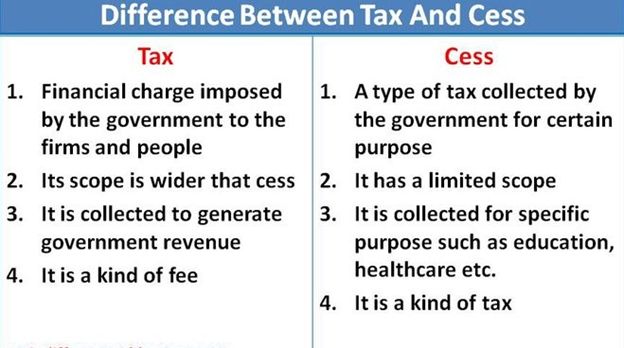

What is Cess?

A cess is a form of tax levied by a government for a specific, defined purpose.

Key Characteristics

Purpose-Specific: Funds collected must be used exclusively for the intended cause, such as education, healthcare, or infrastructure development.

Temporary: A cess is imposed for a limited duration and is expected to be discontinued once the specific objective is met or sufficient funds are raised.

Additional Levy: It is charged as an additional tax on top of existing tax liabilities (a "tax on tax"), such as income tax, GST, or excise duties.

No State Sharing: In India, the central government is not required to share cess revenue with state governments, unlike other central taxes.

Mandatory: Every individual or entity liable for the base tax must also pay the applicable cess.

Common Types of Cess in India

Health and Education Cess: Currently, a 4% cess is charged on the total income tax liability of all taxpayers to fund public health and education programs.

Road and Infrastructure Cess: This is levied on petrol and diesel to generate funds for building and maintaining roads and highways.

GST Compensation Cess: This was introduced to compensate states for potential revenue losses arising from the implementation of the Goods and Services Tax (GST). It is applied to certain luxury and "sin" goods like tobacco products and luxury cars.

Construction Workers Welfare Cess: Employers in the construction industry pay a 1% cess on the cost of construction to fund welfare schemes for workers.

Cess on Crude Oil: An ad valorem cess is imposed on domestically produced crude oil to support the development of the domestic oil industry.

Source: INDIANEXPRESS

|

PRACTICE QUESTION Q. While cesses provide a dedicated revenue stream for specific objectives, they are criticized for their impact on state finances and issues with fund utilization. Critically analyze. 250 words |

It is a bill introduced by the Indian government to levy a special cess, initially on goods like pan masala. The revenue collected will be used to create a dedicated, non-lapsable fund to strengthen public health infrastructure and enhance national security.

Cesses and surcharges are collected by the Central Government and are not part of the divisible pool of taxes shared with the states. Critics argue that increasing reliance on cesses reduces the financial resources available to states, even though states are primarily responsible for implementing health services.

The bill proposes a capacity-linked cess on manufacturing machinery for specified goods, creates a dedicated fund for health and national security from the proceeds, establishes a stringent enforcement framework for non-compliance, and sets up a multi-tier appellate mechanism for disputes.

© 2026 iasgyan. All right reserved