India's FDI landscape is facing challenges due to a recent plunge in net FDI, driven by rising outward investment and profit repatriation. To attract and retain high-quality foreign capital, India needs a stable policy environment, enhanced infrastructure, and strategic reforms.

Copyright infringement not intended

Picture Courtesy: THEHINDU

India's FDI inflows reached 81 billion in FY 2024-25, but net FDI dropped to 0.4 billion due to disinvestments and outward investments, raising concerns about sustainable growth.

FDI refers to investments by foreign entities in Indian companies, involving at least 10% ownership in listed firms or significant stakes in unlisted ones.

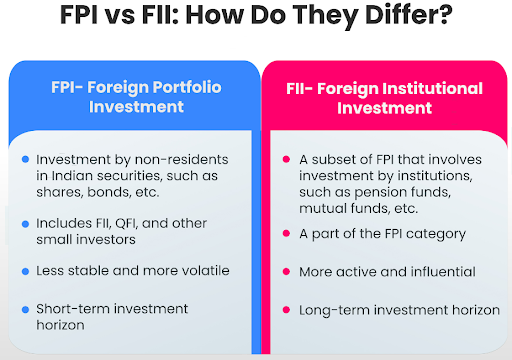

Unlike Foreign Portfolio Investment (FPI), which focuses on short-term financial gains, FDI emphasizes long-term commitment, bringing capital, technology, and jobs.

Routes:

Regulations: Governed by FDI Policy 2020 (Mandatory Government approval for nation sharing border with India) and Foreign Exchange Management Act (FEMA), with Department for Promotion of Industry and Internal Trade (DPIIT) and RBI as key regulators.

Prohibited Sectors: Atomic energy, gambling, lotteries, chit funds, real estate, tobacco.

Gross FDI Inflows: Increased to over $81 billion in FY 2024-25. Top sectors: Services sector (19%), followed by computer software and hardware (16%) and trading (8%). (PIB)

Net FDI Decline: Net FDI (gross inflows minus disinvestments and outward FDI) fell to $0.4 billion in FY 2024-25, due to disinvestments and outward FDI.

Global Pullback: Traditional investors like the US and Germany reduced FDI, favoring financial services over manufacturing.

Boosting Growth: Funds infrastructure and industrial projects (e.g., Japan’s investment in Mumbai-Ahmedabad Bullet Train).

Creating Jobs: Supports jobs via startups and factories.

Enhancing Technology: Brings innovation (e.g., Tesla’s proposed EV plant introducing battery technology).

Increasing Exports: Boosts foreign exchange (e.g., iPhone exports reached $12.1 billion in FY 2023-24).

Strengthening Competition: Pushes domestic firms to adopt global standards (e.g., Amazon’s influence on digital retail).

Market Diversification: Firms like Tata and Reliance expand to Africa and ASEAN to reduce domestic market reliance.

Resource Access: Companies like ONGC Videsh and Adani Group acquire oil, gas, and mineral assets abroad.

Cost Efficiency: IT firms (e.g., Infosys) and auto firms invest in low-cost regions like Eastern Europe and ASEAN.

Trade Agreements: FTAs with UAE and Australia enable easier market access for Indian firms.

Service Sector Globalization: IT and fintech firms expand to developed markets for better client engagement.

Complex Regulations: Tax laws and compliance issues, like Vodafone’s retrospective taxation dispute, deter investors.

Infrastructure Gaps: Poor logistics and power supply increase costs (logistics costs: 14-18% of GDP).

Uneven FDI Distribution: Over 50% of FDI goes to Maharashtra and Karnataka, neglecting rural areas.

Market Competition: Predatory pricing by e-commerce giants (e.g., Amazon) harms local retailers.

Environmental Concerns: Weak enforcement of pollution and waste management rules raises investor doubts.

Labour Issues: Foreign firms like Amazon face criticism for poor working conditions, impacting investor confidence.

Economic Stability: Low net FDI strains balance of payments, reduces foreign reserves.

Currency Pressure: Capital outflows weakened the rupee to 88.37 against the USD in September 2025.

Job and Innovation Loss: Outward FDI reduces domestic job creation and technological advancement.

Streamline Regulations: Implement single-window clearance and fast-track dispute resolution via commercial courts to avoid cases like Vodafone.

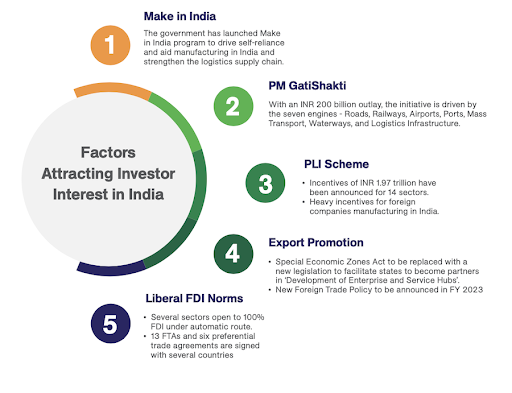

Enhance Infrastructure: Invest in multimodal connectivity (e.g., high-speed rail, expressways) in Tier-II/III cities to reduce logistics costs.

Incentivize Key Sectors: Offer tax breaks and grants for manufacturing, renewable energy, and healthcare to balance FDI distribution.

Encourage Reinvestment: Provide tax incentives for firms reinvesting profits in India (e.g., Tata Motors’ reinvestment post-Jaguar acquisition).

Skill Development: Upskill workforce for high-value sectors like semiconductors and EVs to attract FDI.

Strengthen BITs: Update Bilateral Investment Treaties (BITs) to enhance investor confidence.

India’s FDI story reflects a paradox: robust gross inflows of over $81 billion in FY 2024-25 mask a near-zero net FDI due to disinvestments and outward FDI. Regulatory hurdles, infrastructure deficits, and uneven FDI distribution limit long-term economic benefits. By streamlining policies, improving infrastructure, and incentivizing reinvestment, India can retain capital, boost job creation, and enhance global competitiveness.

Source: THEHINDU

|

PRACTICE QUESTION Q. Critically analyze the role of Foreign Direct Investment (FDI) in India's economic growth. 150 words |

FDI is a long-term investment that gives the investor management control, while FPI is a short-term, passive portfolio investment.

The PLI scheme aims to boost domestic manufacturing and attract FDI by offering financial incentives to companies based on their incremental sales from products made in India.

FDI is prohibited in a few sectors, including lottery business, gambling and betting, Nidhi company, and real estate business (excluding construction of townships).

© 2026 iasgyan. All right reserved