India faces a rise in “digital arrest” fraud where scammers impersonate officials to extort money through fear and isolation. Data leaks, low digital literacy, and cross-border crime fuel it. Despite I4C and helpline 1930, stronger laws, policing, global cooperation, and public awareness remain essential.

Copyright infringement not intended

Picture Courtesy: THEHINDUBUSINESSLINE

Context

The Supreme Court has ordered central agencies to address the rise in "digital arrest" cyber extortion in India.

|

Read all about: Digital Arrests Explained l SC Intervention on 'Digital Arrests' |

What is 'Digital Arrest'?

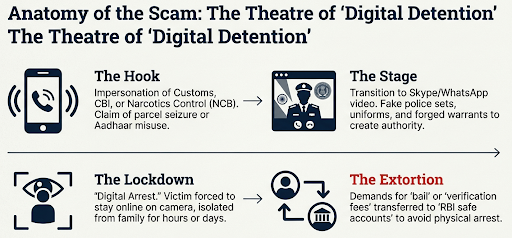

"Digital arrest" is a cyber-extortion scam where fraudsters impersonate law enforcement or government officials (such as the CBI, ED, or Police) to falsely accuse victims of crimes like money laundering or drug trafficking.

Victims are forced into staying on continuous video calls, creating a state of "virtual custody" to isolate and extort them.

How Scammers Operate

Impersonation: Fraudsters use deepfake technology, fake IDs, and elaborate setups mimicking police stations or courtrooms.

Modus Operandi: The victim receives a call claiming an illegal parcel (e.g., containing drugs) has been addressed to them.

Isolation: Victims are forced to remain on video calls (via Skype or WhatsApp) and instructed not to contact family or legal counsel.

Financial Extortion: Scammers demand immediate "security deposits" or "fines" to "clear" the victim's name, often via UPI or cryptocurrency.

Scale of the Cybercrime Threat in India

|

Year |

Reported Incidents |

Total Financial Loss |

Source |

|

2022 |

69,44,46 |

₹2,290.23 crore |

National Cyber Crime Reporting Portal |

|

2023 |

13,103,61 |

Rs 7,463.2 crore |

National Cyber Crime Reporting Portal |

|

2024 |

19,188,52 |

Rs 22,849.49 crore |

National Cyber Crime Reporting Portal |

|

2025 |

21,77,524 |

Rs 19,812.96 crore |

National Cyber Crime Reporting Portal |

Key Trends & Observations

Rapid Growth: Incident reports rose by over 120% between 2022 and 2024, driven by increased internet penetration (now reaching 86% of households) and improved reporting through the National Cyber Crime Reporting Portal

Dominant Fraud Types: Investment scams accounted for approximately 77% of all financial losses, followed by "digital arrest" scams (8%) and credit card fraud (7%). (Source: Indian Cyber Crime Coordination Centre)

Geographic Centers: The highest financial losses in 2025 were recorded in Maharashtra (₹3,203 crore), followed by Karnataka (₹2,413 crore) and Tamil Nadu (₹1,897 crore). (Source: Indian Cyber Crime Coordination Centre)

Cross-Border Threats: Approximately 45% of cyber fraud complaints in 2025 were traced to organized scam networks based in Southeast Asian countries like Cambodia, Myanmar, and Laos.

Government and Regulatory Response

Indian Cyber Crime Coordination Centre (I4C): Established under the Ministry of Home Affairs, I4C is the nodal agency for coordinating the national response to cybercrime.

National Cyber Crime Reporting Portal (NCRP): An online platform (cybercrime.gov.in) where citizens can report all types of cybercrimes, especially those related to financial fraud.

National Helpline Number 1930: A 24/7 helpline for victims of online financial fraud to report incidents and get immediate assistance to block financial transactions.

Legislative Framework:

Proposed Systemic Solutions: A high-level committee is examining proposals for a 'transaction kill switch' to allow users to instantly freeze all their financial accounts if they suspect fraud, and a robust fraud insurance mechanism to cover losses.

Factors Driving the Rise of Digital Arrest Scams in India

Technological Enablers

Rapid Digitalization: With over 86% of Indian households having internet access, the pool of potential targets has expanded massively. (Source: PIB)

Easy Access to Personal Data: Widespread data breaches have made personal details easily available to criminals on the dark web.

Sophisticated Tools: Use of AI-powered deepfakes, voice cloning, and number spoofing technology makes impersonation highly convincing.

Cross-Border Operations: Scams are often orchestrated by international syndicates, using complex networks of mule accounts and cryptocurrency for laundering, making them difficult to trace.

Socio-Economic Vulnerabilities

Digital Literacy Gap: Despite high digital penetration, many lack scam awareness. The Central Board for Workers Education reports only 38% of Indian households are digitally literate (61% urban, 25% rural).

Inherent Fear of Authority: Scammers exploit the common person's fear and deference towards law enforcement agencies to create immediate panic and compliance.

Targeting the Vulnerable: Fraudsters often target the elderly, NRIs, and those living alone who are more susceptible to isolation and intimidation.

Administrative & Legal Gaps

Jurisdictional Hurdles: The cross-border nature of these crimes creates challenges in evidence gathering and prosecution due to slow processes under Mutual Legal Assistance Treaties (MLATs).

Enforcement Challenges: Local law enforcement often lacks the specialized skills, training, and forensic infrastructure required to investigate complex, multi-layered cybercrimes effectively.

Way Forward

Strengthening the Legal Framework

Need to amend the Information Technology Act, 2000, to include specific provisions against social engineering scams like digital arrest, ensuring stricter penalties and faster trials.

Enhancing Law Enforcement Capacity

State police forces must be equipped with dedicated, well-trained, and modernised cyber cells. Regular training for police, prosecutors, and the judiciary is crucial.

Public-Private Partnership (PPP)

A stronger, real-time collaboration between law enforcement, banks, fintech companies, and telecom service providers is essential to detect and block fraudulent activities proactively.

Learning from Global Best Practices

Adopt models like Singapore's Anti-Scam Centre (ASC), where police and bank staff are co-located for immediate freezing of accounts and tracing of funds, increasing recovery rates.

Investing in Digital Literacy

A sustained, nationwide mission to educate the public on identifying and responding to such scams is necessary to build collective resilience.

Conclusion

Digital arrest is a psychological assault requiring a 'whole-of-society' approach with stronger laws, a secure digital ecosystem, and empowered citizens through digital literacy.

Source: THEHINDUBUSINESSLINE

|

PRACTICE QUESTION Q. The term 'Mule Account' in cyber-forensics refers to: A) An account used by government agencies to trap hackers. B) A bank account used by third parties to launder stolen money. C) An encrypted account used for cross-border trade. D) A high-security vault for storing digital assets. Answer: B Explanation: A mule account is a bank account used by criminals to launder illegally obtained money. The person who holds the account, known as a "money mule," can be an unwitting victim or a paid accomplice, and their account is used to move funds, often internationally, to conceal the money's origin. |

'Digital arrest' is a type of online fraud where criminals impersonate officials from law enforcement agencies like the CBI or police. They create a false scenario, such as a criminal case linked to the victim, and use intimidation and psychological manipulation over a prolonged video call to extort large sums of money.

These scams are rising due to a combination of factors: easy access to personal data from breaches, a gap in digital literacy among the public, the general fear of authority, and the use of sophisticated technology by scammers who often operate from outside India, making them hard to trace.

The I4C, established by the Ministry of Home Affairs, serves as the central agency to coordinate the fight against cybercrime in India. It facilitates collaboration between various central and state law enforcement agencies to tackle cyber threats effectively.

© 2026 iasgyan. All right reserved