To counter the rising threat of “digital arrest” cyber extortion scams, the government has formed a high-level inter-departmental committee involving MHA, MeitY, DoT, and RBI. The task force strengthens coordination, leverages I4C and Sanchar Saathi, tackles mule accounts, and pushes legal and international cooperation.

Copyright infringement not intended

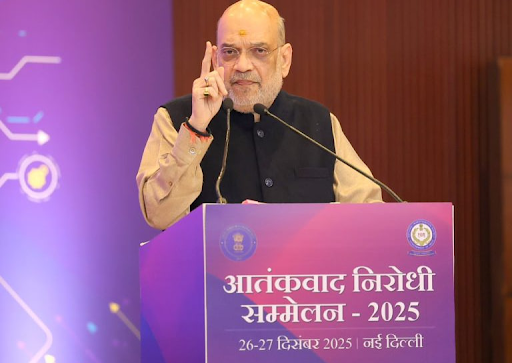

Picture Courtesy: THEHINDU

The Government of India, following Supreme Court directions, has launched a coordinated, multi-agency effort to combat 'digital arrest' scams where cybercriminals impersonate officials to extort money.

|

Read all about: Digital Arrest l SC Intervention on 'Digital Arrests' |

A 'digital arrest' is a cyber extortion scam where fraudsters impersonate officials (e.g., police, CBI) via technology to falsely accuse victims of crimes and coerce them into transferring money to resolve the fictitious case.

Modus Operandi of Digital Arrest Scams

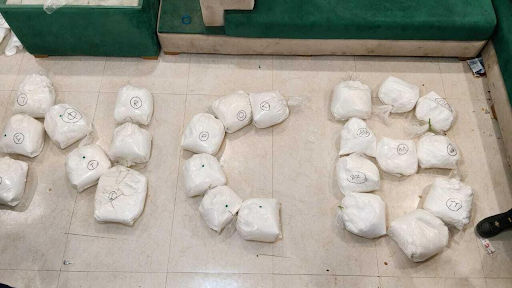

Initial Contact: Victims receive automated calls or messages, impersonating courier services like FedEx or Blue Dart, about an international parcel containing illegal items (drugs, fake passports) addressed to them.

Impersonation & Intimidation: The call is transferred to a fraudster posing as a senior police or CBI official. They create a sense of urgency and fear, often citing provisions of the IPC or PMLA.

Digital Entrapment: The victim is forced onto a video call (e.g., Skype) and instructed not to disconnect, effectively isolating them. Fraudsters use fake ID cards, logos, and official-looking documents to appear legitimate.

Financial Extortion: The victim is accused of being part of a larger criminal network and pressured to transfer money for "verification," "bail," or to "clear their name," with promises of a refund that never materializes.

Technological Sophistication: Criminals use AI voice cloning to mimic officials and deepfake videos to create highly convincing fake scenarios, making it harder for victims to detect the fraud.

The Government of India, through the Ministry of Home Affairs (MHA), created a robust, multi-agency framework coordinated by the Indian Cyber Crime Coordination Centre (I4C) to combat the escalating cyber threat.

Key Government Initiatives and Platforms

National Cybercrime Helpline (1930): A 24/7 helpline for victims to report cyber fraud immediately, enabling real-time action to block the flow of funds.

National Cybercrime Reporting Portal (cybercrime.gov.in): A centralized platform for citizens to report all types of cybercrimes, including digital arrests.

Chakshu Portal: A facility on the Sanchar Saathi portal allowing citizens to report suspected fraudulent communications (calls, SMS, WhatsApp) received for the purpose of cyber-crime or financial fraud (Source: PIB).

Sanchar Saathi Portal: An initiative by the Department of Telecommunications (DoT) that empowers mobile subscribers to check connections registered in their name, report stolen/lost phones, and block fraudulent connections.

The Inter-Agency Coordination Mechanism

An Inter-Departmental Committee works under the I4C to ensure a seamless and coordinated response.

|

Agency/Ministry |

Primary Role and Actions |

|

Ministry of Home Affairs (MHA) & I4C |

Overall coordination, policy formulation, running awareness campaigns ('Cyber Dost'), and managing the National Cybercrime Reporting Portal. |

|

Department of Telecommunications (DoT) |

|

|

Ministry of Electronics & IT (MeitY) |

Blocking fraudulent websites, apps, and social media accounts used for criminal activities under Section 69A of the IT Act. Mandating intermediaries to enforce due diligence. |

|

Reserve Bank of India (RBI) & Dept. of Financial Services |

|

|

Law Enforcement Agencies (State Police, Central Agencies) |

Investigation, attribution, and prosecution of criminals. Conducting raids and collaborating with international agencies like Interpol to tackle cross-border elements. |

Absence of Specific Definitions

"Digital arrest" is not explicitly defined in law. While investigators use general provisions for cheating (Section 318 of BNS) and impersonation (Section 66D of IT Act), the lack of a targeted "digital arrest" statute creates a legal gray area for prosecution.

Anonymity Tools

Fraudsters use VPNs, encrypted messaging apps (WhatsApp, Skype), and VoIP calls to mask their identities and locations, making tracing extremely difficult.

Deepfakes and AI

Scammers use AI-powered deepfake videos and voice modulation to impersonate high-ranking officials or judges, creating highly convincing fake "courtroom" environments.

Cross-Border Operations

Most scams originate from call centers in Southeast Asia (Myanmar, Laos, Cambodia) or China. Pursuing offenders across borders is delayed by slow Mutual Legal Assistance Treaty (MLAT) processes and limited diplomatic cooperation.

Mule Account Networks

Stolen funds are funneled through mule accounts (opened with fake KYC) and converted into cryptocurrency, making it nearly impossible to recover the money once siphoned.

Under-Reporting and Stigma

Many victims do not report the crime due to social shame, fear, or confusion about legal procedures, which leads to a loss of critical digital forensic evidence.

Strengthening Legal Frameworks: Amend the Information Technology Act or Bharatiya Nyaya Sanhita (BNS) to explicitly define "digital arrest" as a distinct offense.

Investing in Capacity Building: Equip law enforcement agencies with advanced cyber-forensic tools, AI-driven threat intelligence platforms, and continuous training on emerging cyber threats.

Centralized Database: Create a real-time, shared blacklist of fraudulent UPI IDs, bank accounts, and phone numbers accessible to all law enforcement agencies (LEAs) and financial intermediaries.

Enhancing Public-Private Partnership: Collaboration with telecom companies, banks, and social media platforms to enable faster real-time blocking of fraudulent numbers, accounts, and transactions.

Public Awareness: Targeted, multi-lingual awareness campaigns using simple and relatable content to educate citizens, especially vulnerable groups, on how to identify and react to such scams.

International Cooperation: Strengthening international agreements for faster intelligence sharing and coordinated operational actions against global cybercrime syndicates.

Combating the 'digital arrests' crisis requires a dynamic strategy—combining strong law enforcement, advanced technology, strict regulations, and digital literacy—coordinated by the I4C to build a secure digital ecosystem for all Indians.

Source: THEHINDU

|

PRACTICE QUESTION Q. Analyze the legal challenges in prosecuting cross-border cyber-syndicates involved in impersonating Indian law enforcement agencies. 250 words |

A 'digital arrest' is a cyber extortion method where scammers impersonate officials from law enforcement agencies like the police, CBI, or ED. They accuse the victim of a crime, force them onto a video call, and coerce them into transferring large sums of money under the threat of immediate arrest.

The Sanchar Saathi portal, an initiative of the Department of Telecommunications (DoT), allows users to check and report fraudulent mobile connections issued in their name and block lost/stolen phones. The Chakshu facility, integrated with it, allows citizens to proactively report suspected fraudulent communications (calls, SMS, WhatsApp) to help authorities take timely action.

A primary challenge for law enforcement is the use of a vast network of "mule accounts." Scammers coerce victims to transfer money into these accounts, which are then quickly layered and moved through multiple other accounts to obscure the financial trail, making it difficult to trace and recover the funds.

© 2026 iasgyan. All right reserved