Description

Disclaimer: Copyright infringement not intended.

Context

- The Startup India Seed Fund Scheme has been approved for the period of 4 years starting from 2021-22.

Background

- Funding from angel investors and venture capital firms becomes available to startups only after the proof of concept has been provided.

- Similarly, banks provide loans only to asset-backed applicants.

- As a result, the Indian startup ecosystem suffers from capital inadequacy in the seed and ‘Proof of Concept’ development stage.

- The capital required at this stage often presents a make-or-break situation for startups with good business ideas.

- Many innovative business ideas fail to take off due to the absence of this critical capital required at an early stage for proof of concept, prototype development, product trials, market entry and commercialization.

- It is essential to provide seed funding to startups with an innovative idea to conduct proof of concept trials.

- Startup India Seed Fund Scheme (SISFS) is one such scheme provides financial assistance to early-stage startups.

Startup India Seed Fund Scheme

- About: To boost the Startup ecosystem in India, the Government launched the Startup India Seed Fund Schemeon 19th April 2021.

- Aim: The scheme aims to provide startups with financial assistance at their early stages such as proof of concept, prototyping, product trials, market entry and commercialization.

- Scheme potential: Once a startup gets access to capital at the early stage, it improves the potential for the enterprise to scale to a level where funding can be sought from angel investors, venture capital firms, Banks and other financial institutions.

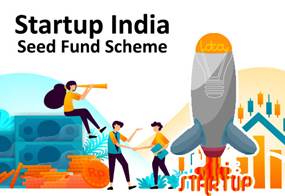

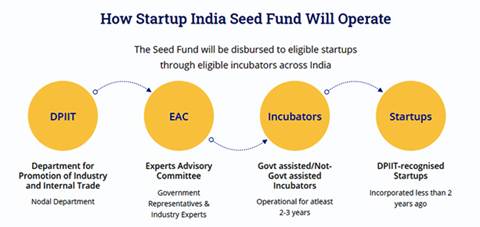

Process of the SISFS

- Department for Promotion of Industry and Internal Trade (DPIIT) has created an Experts Advisory Committee (EAC) to execute and monitor the Startup India Seed Fund Scheme.

- The EAC selects eligible incubators who are provided grants of upto Rs 5 Crores each. In turn, the selected incubators will provide startups with up to Rs 20 lakhs for validation of Proof of Concept, prototype development, product trials to startups.

- Moreover, up to Rs 50 lakhs is provided to the startups for market entry, commercialization, or scaling up through convertible debentures or debt-linked instruments.

Significance

- It is anticipated that the startups that receive support at their early stages shall create significant employment opportunities for everyone.

Start-Up India Initiative

- The Startup India initiative was announced on 15th August, 2015.

- The flagship initiative aims to build a strong eco-system for nurturing innovation and Startups in the country that will drive sustainable economic growth and generate large scale employment opportunities.

.jpg)

Programs Launched under Startup India initiative

The details of various programs undertaken by the Government to promote startups under Startup India initiative across the country are as under:

- Startup India Action Plan: An Action Plan for Startup India was unveiled on 16th January 2016. The Action Plan comprises of 19 action items spanning across areas such as “Simplification and handholding”, “Funding support and incentives” and “Industry-academia partnership and incubation”. The Action Plan laid the foundation of Government support, schemes and incentives envisaged to create a vibrant startup ecosystem in the country.

- Fund of Funds for Startups (FFS) Scheme: The Government has established FFS with corpus of Rs. 10,000 crore, to meet the funding needs of startups. DPIIT is the monitoring agency and Small Industries Development Bank of India (SIDBI) is the operating agency for FFS. The total corpus of Rs. 10,000 crore is envisaged to be provided over the 14th and 15th Finance Commission cycles based on progress of the scheme and availability of funds. It has not only made capital available for startups at early stage, seed stage and growth stage but also played a catalytic role in terms of facilitating raising of domestic capital, reducing dependence on foreign capital and encouraging home grown and new venture capital funds.

- Credit Guarantee Scheme for Startups (CGSS): The Government has established the Credit Guarantee Scheme for Startups for providing credit guarantees to loans extended to DPIIT recognized startups by Scheduled Commercial Banks, Non-Banking Financial Companies (NBFCs) and Venture Debt Funds (VDFs) under SEBI registered Alternative Investment Funds. CGSS is aimed at providing credit guarantee up to a specified limit against loans extended by Member Institutions (MIs) to finance eligible borrowers viz. DPIIT recognised startups.

- Regulatory Reforms: Over 50 regulatory reforms have been undertaken by the Government since 2016 to enhance ease of doing business, ease of raising capital and reduce compliance burden for the startup ecosystem.

- Ease of Procurement: To enable ease of procurement, Central Ministries/ Departments are directed to relax conditions of prior turnover and prior experience in public procurement for all DPIIT recognised startups subject to meeting quality and technical specifications. Further, Government e-Marketplace (GeM) Startup Runway has been developed which is a dedicated corner for startups to sell products and services directly to the Government.

- Support for Intellectual Property Protection: Startups are eligible for fast-tracked patent application examination and disposal. The Government launched Start-ups Intellectual Property Protection (SIPP) which facilitates the startups to file applications for patents, designs and trademarks through registered facilitators in appropriate IP offices by paying only the statutory fees. Facilitators under this Scheme are responsible for providing general advisory on different IPRs, and information on protecting and promoting IPRs in other countries. The Government bears the entire fees of the facilitators for any number of patents, trademark or designs, and startups only bear the cost of the statutory fees payable. Startups are provided with an 80% rebate in filing of patents and 50% rebate in filling of trademark vis-a-vis other companies.

- Self-Certification under Labour and Environmental laws: Startups are allowed to self-certify their compliance under 9 Labour and 3 Environment laws for a period of 3 to 5 years from the date of incorporation.

- Income Tax Exemption for 3 years: Startups incorporated on or after 1st April 2016 can apply for income tax exemption. The recognized startups that are granted an Inter-Ministerial Board Certificate are exempted from income-tax for a period of 3 consecutive years out of 10 years since incorporation.

- International Market Access to Indian Startups: One of the key objectives under the Startup India initiative is to help connect Indian startup ecosystem to global startup ecosystems through various engagement models. This has been done though international Government to Government partnerships, participation in international forums and hosting of global events. Startup India has launched bridges with over 15 countries (Brazil, Sweden, Russia, Portugal, UK, Finland, Netherlands, Singapore, Israel, Japan, South Korea, Canada, Croatia, Qatar and UAE) that provides a soft-landing platform for startups from the partner nations and aid in promoting cross collaboration.

- Faster Exit for Startups: The Government has notified Startups as ‘fast track firms’ enabling them to wind up operations within 90 days vis-a-vis 180 days for other companies.

- Startup India Hub: The Government launched a Startup India Online Hub on 19th June 2017 which is one of its kind online platform for all stakeholders of the entrepreneurial ecosystem in India to discover, connect and engage with each other. The Online Hub hosts Startups, Investors, Funds, Mentors, Academic Institutions, Incubators, Accelerators, Corporates, Government Bodies and more.

- Exemption for the Purpose Of Clause (VII)(b) of Sub-section (2) of Section 56 of the Act (2019): A DPIIT recognized startup is eligible for exemption from the provisions of section 56(2)(viib) of the Income Tax Act.

- Startup India Showcase: Startup India Showcase is an online discovery platform for the most promising startups of the country chosen through various programs for startups exhibited in a form of virtual profiles. The startups showcased on the platform have distinctly emerged as the best in their fields. These innovations span across various cutting-edge sectors such as Fintech, EntrepriseTech, Social Impact, HealthTech, EdTech, among others. These startups are solving critical problems and have shown exceptional innovation in their respective sectors. Ecosystem stakeholders have nurtured and supported these startups, thereby validating their presence on this platform.

- National Startup Advisory Council: Government in January 2020 notified constitution of the National Startup Advisory Council to advise the Government on measures needed to build a strong ecosystem for nurturing innovation and startups in the country to drive sustainable economic growth and generate large scale employment opportunities. Besides the ex-officio members, the council has a number of non-official members, representing various stakeholders from the startup ecosystem.

- Startup India: The Way Ahead: Startup India: The Way Ahead at 5 years celebration of Startup India was unveiled on 16th January 2021 which includes actionable plans for promotion of ease of doing business for startups, greater role of technology in executing various reforms, building capacities of stakeholders and enabling a digital Aatmanirbhar Bharat.

- Startup India Seed Fund Scheme (SISFS): Easy availability of capital is essential for entrepreneurs at the early stages of growth of an enterprise. The capital required at this stage often presents a make-or-break situation for startups with good business ideas. The Scheme aims to provide financial assistance to startups for proof of concept, prototype development, product trials, market entry and commercialization. Rs. 945 crore has been sanctioned under the SISFS Scheme for period of 4 years starting from 2021-22.

- National Startup Awards (NSA): National Startup Awards is an initiative to recognize and reward outstanding startups and ecosystem enablers that are building innovative products or solutions and scalable enterprises, with high potential of employment generation or wealth creation, demonstrating measurable social impact. Handholding support is provided to all the finalists across various tracks viz. Investor Connect, Mentorship, Corporate Connect, Govt. Connect, International Market Access, Regulatory Support, Startup Champions on Doordarshan and Startup India Showcase, etc.

- States’ Startup Ranking Framework (SRF): States’ Startup Ranking Framework is a unique initiative to harness strength of competitive federalism and create a flourishing startup ecosystem in the country. The major objectives of the ranking exercise are facilitating states to identify, learn and replace good practices, highlighting the policy intervention by states for promoting startup ecosystem and fostering competitiveness among states.

- Startup Champions on Doordarshan: Startup Champions program on Doordarshan is a one-hour weekly program covering stories of award winning/ nationally recognised startups. It is telecasted in both Hindi and English across Doordarshan network channels.

- Startup India Innovation Week: The Government organises Startup India Innovation week around the National Startup Day i.e. 16th January, with the primary goal was to bring together the country's key startups, entrepreneurs, investors, incubators, funding entities, banks, policymakers, and other national/international stakeholders to celebrate entrepreneurship and promote innovation.

.jpg)

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=1881495#:~:text=The%20Startup%20India%20Seed%20Fund,effect%20from%201st%20April%202021.