The emerging priorities of India’s banking sector for 2025–2035 centre on strengthening deposit mobilisation to support rapid credit expansion, especially by deepening outreach in rural and semi-urban areas. Banks are shifting focus toward high-growth segments such as manufacturing, infrastructure, and renewable energy, while expanding green finance through sustainability-linked lending and support for technologies like Small Modular Reactors. Financial inclusion remains a core objective, with schemes such as PM MUDRA, PM Vishwakarma, PM Surya Ghar, PM Vidyalaxmi, and KCC enhancing grassroots access to credit. Agriculture lending is being redesigned under the PM Dhan Dhanya Yojana to boost productivity in low-performing districts. At the global level, banks are strengthening their presence through platforms like GIFT City and the India International Bullion Exchange. A parallel priority is improving customer experience through multilingual digital platforms and faster grievance redressal, reflecting a shift toward more technology-driven and citizen-centric banking.

Copyright infringement not intended

Picture Courtesy: PIB

Context:

India’s banking system has undergone a profound structural transformation over the past decade. What was once a sector weighed down by stressed assets, weak balance sheets, and sluggish credit growth has evolved into a capital-strong, profitable, digitally empowered, and resilient financial architecture.

|

Must Read: India’s Vision for World-Class Banks | GLOBAL CAPITAL FLOWS INTO INDIAN BANKS | |

Current Status of banking sector in India:

Picture Courtesy: PIB

Evolution of Banking sector in India:

|

Phase |

Description |

|

1. Pre-Independence Foundations (1786–1947) |

The evolution of Indian banking began with early institutions like the General Bank of India and later the Presidency Banks, establishing a basic financial structure that largely served colonial trade and laid the groundwork for future regulatory and institutional reforms. |

|

2. Post-Independence Regulation & Stabilisation (1947–1968) |

Building on this limited colonial foundation, independent India strengthened central banking by nationalising the RBI and introducing the Banking Regulation Act, which formalised supervision but still left banking concentrated in urban regions with restricted access for rural populations. |

|

3. Nationalisation & Social Banking Expansion (1969–1990) |

Recognising these limitations, the government nationalised major banks in 1969 and 1980, which significantly expanded rural outreach, encouraged inclusive credit through priority sector lending, and transformed banking into an instrument of socioeconomic development. |

|

4. Liberalisation & Market Reforms (1991–2000) |

As the social banking model matured, the 1991 economic reforms opened the sector to private and foreign banks, introduced prudential norms, and deregulated interest rates, thereby shifting Indian banking toward a more competitive, efficient, and market-driven framework. |

|

5. Technological Modernisation (2000–2010) |

Riding on the momentum of liberalisation, banks adopted Core Banking Solutions, ATMs, RTGS, NEFT, and internet banking, which modernised operations, improved customer service, and prepared the system for deeper digital integration. |

|

6. Twin Balance Sheet Stress & Regulatory Tightening (2010–2018) |

However, rapid expansion and infrastructure-heavy lending in the previous decade led to significant stressed assets, prompting the RBI to initiate the Asset Quality Review in 2015, which exposed hidden NPAs and strengthened the regulatory framework for credit discipline. |

|

7. Structural Reforms & Consolidation (2018–2025) |

The recognition of stress guided major reforms such as PSB consolidation, large-scale recapitalisation, the strengthening of the Insolvency and Bankruptcy Code, and the implementation of the PCA framework, collectively resulting in cleaner balance sheets and more resilient banks. |

|

8. Digital Transformation & Mass Financial Inclusion (2016–Present) |

With the sector stabilised, India moved toward large-scale digital innovation through UPI, Aadhaar-enabled services, Jan Dhan accounts, and mobile banking, which revolutionised real-time payments and brought millions into the formal financial system. |

|

9. Current Innovation-Driven Phase (2020s) |

Building on strong balance sheets and digital infrastructure, banks are now embracing AI-based underwriting, CBDC pilots, fintech partnerships, and global-standard provisioning norms like ECL, creating a future-ready banking ecosystem aligned with India’s high-growth aspirations. |

What are the contributions of the Indian banking system?

Financial inclusion and social empowerment: The banking system has been central to expanding financial inclusion, particularly through large-scale initiatives such as the Pradhan Mantri Jan Dhan Yojana (PMJDY). Launched in 2014, PMJDY enabled over 51 crore bank accounts by 2025, creating what the World Bank called “the world’s largest financial inclusion programme”.

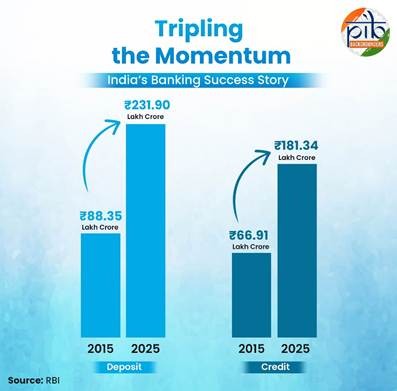

Credit delivery for economic growth and industrialisation: Banks have been the primary source of credit for India’s industrial, agricultural, and service sectors. Domestic credit increased from ₹66.91 lakh crore in 2015 to ₹181.34 lakh crore in 2025, showcasing the expanding role of banks in financing economic activity.

|

Case Study MSMEs: The banking sector supported over 1.3 crore MSME units through the Emergency Credit Line Guarantee Scheme (ECLGS) during COVID-19, preventing large-scale closures and protecting almost 1.5 crore jobs, according to the Ministry of Finance. |

Supporting infrastructure development: Indian banks have historically been critical in financing large-scale infrastructure projects—roads, ports, airports, and power plants. Although infrastructure NPAs rose in the early 2010s, improvements in asset quality post-IBC have revived institutional lending. As of FY 2025, infrastructure loans account for nearly 13% of total bank credit, demonstrating the continued role of banks in nation-building.

Promoting digital transformation: Banks have been central to India becoming a global leader in digital payments. The integration of banking with UPI, IMPS, AEPS, and mobile wallets created a seamless digital ecosystem. In 2024, UPI alone processed over 120 billion transactions, exceeding the combined volumes of the US, UK, and Europe.

Employment generation and skill creation: The banking system is a major employer, with more than 13 lakh employees across public and private sector banks. Beyond direct employment, it supports millions more through business correspondents, fintech partnerships, recovery agencies, and outsourced service providers.

What are the challenges that Indian banking sector is facing?

Re-emergence of retail credit risk: India’s banking system has increasingly shifted from corporate lending to retail loans—particularly personal loans, credit cards, and unsecured consumer credit. While this diversification initially lowered NPA stress, it has created a new risk cycle. According to RBI’s Financial Stability Report (2023–24), unsecured personal loans grew by over 20% annually, prompting the RBI to increase risk weights by 25 percentage points.

Informal Sector Lending: MSMEs, which constitute 30% of India’s GDP, continue to face cyclical stress. Even after post-COVID relief, several MSMEs struggle with repayment due to fluctuating demand and cash-flow issues. RBI data shows that MSME NPAs remain above 8–9%, significantly higher than retail or agricultural credit.

Limited deposit growth vs. Rising credit demand: While bank credit has grown at 14–16% annually in recent years, deposit growth has slowed to around 11%, creating a structural funding gap. This mismatch could impact liquidity conditions and force banks to rely heavily on high-cost borrowings or certificate of deposits.

Digital Fraud Risks: With India leading global digital transactions, UPI alone processing over 120 billion transactions in 2024 which leads to increasing cyberattacks, phishing scams, and data breaches. Although digital penetration has enhanced efficiency, it has simultaneously expanded the attack surface.

High vulnerability to economic cycles: The banking sector’s performance is closely tied to macroeconomic conditions. Slowing global demand, commodity price fluctuations, or geopolitical tensions can reduce corporate earnings, thereby affecting loan servicing capacity.

Recommendations of different committees on Indian Banking:

Narasimham Committee I (1991) – Financial Sector Reforms & Deregulation: The Narasimham Committee I recommended a shift from a heavily regulated banking structure to a more market-oriented system. It suggested reducing statutory pre-emptions like SLR and CRR, introducing prudential norms on income recognition and provisioning, granting greater autonomy to banks, and allowing private sector banks to enhance competition. These recommendations formed the foundation of India’s post-1991 financial liberalisation.

Narasimham Committee II (1998) – Strengthening Banking Structure: Building on the earlier reforms, Narasimham Committee II focused on banking consolidation, recommending a three-tier structure with large international banks, strong national banks, and regional/local banks. It emphasised cleaning up balance sheets through faster NPA recovery, setting up of Asset Reconstruction Companies, strengthening of the RBI’s supervisory role, and recapitalisation of weak banks. Many of these ideas paved the way for later PSB mergers and NPA reforms.

Basel Committee Implementation Guidance for India: Following global best practices, committees under the RBI recommended adoption of Basel I, II, and later Basel III norms. This included higher capital adequacy ratios, Tier-1 capital strengthening, better risk-weighted asset management, and liquidity coverage ratios. These recommendations improved the resilience of the Indian banking system, particularly during the global financial crisis.

Malegam Committee on Microfinance (2011): The Malegam Committee examined the microfinance crisis in Andhra Pradesh and recommended capping interest rates, limiting multiple lending, and establishing credit bureaus for small borrowers. It played a key role in designing the regulatory framework for NBFC-MFIs and shaping RBI’s fair-practice code for microfinance institutions.

Financial Stability and Development Council (FSDC) Recommendations: The FSDC recommended improved macro-prudential norms, stress-testing frameworks, and inter-regulatory coordination. These measures enhanced the system’s ability to withstand shocks, especially during the IL&FS crisis and COVID-19 disruptions.

Standing Committee on Finance Reports (2017–2024): Various Parliamentary committees recommended strengthening PSB autonomy, reforming the recapitalisation process, enhancing accountability in loan sanctioning, and improving recovery mechanisms under IBC and DRT. These inputs guided the government’s 4R Strategy—Recognition, Resolution, Recapitalisation, Reform.

What are the emerging priorities of Indian banking sector?

Strengthening deposits: Banks aim to strengthen deposit mobilisation by deepening their presence in rural and semi-urban regions, as these areas hold significant untapped household savings; and without faster deposit growth, the rising credit demand of India’s expanding economy cannot be sustainably financed.

Expanding targeted growth areas: To support India’s structural transformation, banks are prioritising lending to high-growth sectors such as corporate manufacturing, infrastructure development, and renewable energy, recognising that these sectors not only boost long-term economic productivity but also create stable, high-quality loan portfolios.

Scaling Green finance: The sector is placing renewed emphasis on green finance by supporting renewable energy projects, emerging technologies like Small Modular Nuclear Reactors (SMRs), and sustainability-linked credit models, acknowledging that climate-aligned lending is essential for India’s net-zero transition and global competitiveness.

Deepening financial inclusion: Banks are strengthening inclusion by expanding credit under schemes such as PM MUDRA, PM Vishwakarma, PM Surya Ghar Muft Bijli Yojana, PM Vidyalaxmi, and Kisan Credit Card, ensuring that marginalised groups, micro-enterprises, artisans, women, and rural households can participate more fully in economic activity.

Building customer-centric and technology-driven banking: The sector is prioritising customer-centric reforms by offering multilingual digital platforms, improving user experience, and instituting faster grievance-redressal mechanisms, making banking more accessible, inclusive, and efficient for a diverse population.

Conclusion:

India’s banking sector has moved from high stress to high strength, driven by structural reforms, digital innovation, improved asset quality, and record profitability. With robust capital, low NPAs, and a future-ready regulatory ecosystem, banks are positioned to power India’s journey toward becoming a top-three global economy.

Source: PIB

|

Practice Question Q. Deposit mobilisation will be the central challenge for Indian banks in the next decade. Analyse. (150 words) |

Strengthening deposits is essential because credit demand in India is growing faster than deposit growth. Without adequate deposits, banks may face liquidity pressures and be forced to rely on costly borrowings. Expanding deposit mobilisation in rural and semi-urban areas helps sustain long-term credit expansion.

These sectors drive long-term economic productivity and create stable lending opportunities. By supporting manufacturing and infrastructure, banks contribute to India’s ambition of becoming a global supply-chain hub, while green energy lending aligns with India’s net-zero commitments.

Green finance helps banks support renewable energy, energy-efficient technologies, and emerging solutions like Small Modular Reactors (SMRs). It reduces climate-related risks, opens access to global green capital, and strengthens India’s transition to sustainable development.

© 2026 iasgyan. All right reserved