The 56th GST Council meeting approved a simplified two-tier tax structure, scrapping old slabs, to make goods and services more affordable. The "Next-Generation GST Reforms" aim to boost consumption, support key sectors, and streamline the tax system for a more transparent Indian economy.

Copyright infringement not intended

Picture Courtesy: NEWSARENAINDIA

The 56th meeting of the GST Council was held in New Delhi under the chairpersonship of the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman.

GST REFORM: SIGNIFICANCE, CHALLENGES AND WAY FORWARD

Rate Rationalisation: Two-Tier Tax Structure

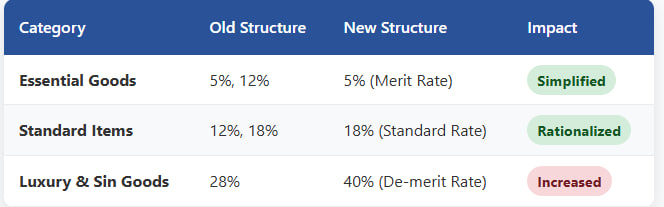

The Council restructured the GST’s four-tier slab (5%, 12%, 18%, 28%) into a two-tier system, effective from September 22, 2025:

This simplification aims to reduce classification disputes and compliance costs, drawing inspiration from simplified tax systems in Australia and Canada, where fewer slabs enhance predictability.

This simplification aims to reduce classification disputes and compliance costs, drawing inspiration from simplified tax systems in Australia and Canada, where fewer slabs enhance predictability.

Cheaper Items (Reduced to 5% or Nil)

Nil Tax (from 5%): UHT (Ultra High Temperature) milk, pre-packaged paneer, Indian breads (chapati, roti, paratha, pizza bread).

Reduced to 5% (from 12%/18%)

Food Sector: Condensed milk, cheese, dried fruits, namkeen, pasta, instant noodles, chocolate, coffee, butter, ghee.

Consumer Goods & Household: Hair oil, soaps, shampoos, toothpastes, tableware, kitchenware.

Health: Essential drugs, medical-grade oxygen, cancer drugs, micronutrients for fertilizers.

Automotive: Three-wheelers, ambulances, motorcycles (up to 350cc), small cars (petrol/CNG up to 1200cc, diesel up to 1500cc, length ≤4000mm), electric vehicles.

Agriculture & Renewables: Hand pumps, sprinklers, solar cookers, bio-gas plants, windmills.

Services: Hotel stays (≤₹7,500/day), beauty/wellness services, cinema tickets (≤₹100).

Costlier Items (Increased to 18% or 40%)

To 18% (from 5%/12%): Coal, lignite, peat, certain paper products, apparel/footwear above ₹2,500.

To 40% (De-merit Rate): Pan masala, aerated drinks, caffeinated beverages, luxury vehicles (SUVs, motorcycles >350cc, yachts), betting, gambling, lotteries.

Insurance: All individual health and life insurance policies (term, ULIP, endowment) and their reinsurance are now GST-exempt, promoting affordability and coverage expansion.

Trade Facilitation and Ease of Doing Business

Simplified Registration: An optional automated scheme grants GST registration within three days for small/low-risk businesses, effective November 1, 2025, benefiting 96% of applicants.

Provisional Refunds: 90% refunds for zero-rated supplies (exports) and inverted duty structure cases, operational from November 1, 2025, with refunds possible within seven days.

Low-Value Exports: Removal of the limit for GST refunds on low-value exports via courier/postal services.

RSP-Based Valuation: GST on pan masala, tobacco, and similar goods now based on Retail Sale Price, enhancing transparency.

Inverted Duty Structure (IDS) Correction

Fertiliser Sector: GST on Sulphuric acid, Nitric acid, and Ammonia reduced from 18% to 5%, addressing IDS and reducing input tax credit accumulation.

Textile Sector: Man-made fibre (MMF) value chain (polyester staple fibre, yarn, fabrics, garments <₹1,000) unified at 5%.

Economic Boost: A recent State Bank of India (SBI) report projected that the GST reform, along with income tax cuts, could increase household disposable income by ₹5.31 lakh crore, or 1.6% of GDP, by lowering rates on essential goods, consumer products, and vehicles.

Global Resilience: A stronger domestic market reduces reliance on external trade, countering global shocks like US tariffs.

Simplified Compliance: The two-tier structure minimises disputes and enhances predictability, aligning with global models like Australia’s GST.

Ease of Doing Business: Automated refunds and pre-filled returns reduce compliance costs.

Cooperative Federalism: The GST Council’s consensus-driven approach ensures state participation, though challenges persist due to revenue concerns.

Sectoral Impact: Manufacturing and retail sectors benefit from freed-up working capital (₹1.5–2 lakh crore), while MSMEs gain from lower compliance burdens.

Revenue Shortfall: States face an estimated ₹48,000–93,000 crore annual revenue loss, with Jharkhand (₹2,000 crore) and Jammu & Kashmir (10-12% reduction) hit hardest.

State Resistance: Opposition-ruled states (e.g., Kerala, Tamil Nadu) demand compensation, fearing fiscal strain on social programs.

Lagged Impact: Consumption benefits may take time, while tariff shocks hit immediately, risking short-term economic strain.

Implementation Gaps: Past GST reforms (e.g., 55th meeting’s Invoice Management System) faced delays due to consensus issues, a risk for the two-tier system.

Compensation Framework: Develop a phased revenue-sharing or transitional loan mechanism to stabilize state finances.

Targeted Relief: Provide fiscal support to exporters and MSMEs to bridge the lag in consumption benefits.

Export Diversification: Pursue new FTAs to enhance market access, aligning with ‘Make in India’ goals.

Policy Integration: Combine GST reforms with trade and industrial policies for resilience and competitiveness.

Continuous Feedback: Adapt reforms based on stakeholder input to ensure transparency and inclusivity.

Strengthen Digital Infrastructure: Enhance GSTN portals for seamless pre-filled returns and refunds, targeting a 50% reduction in compliance time by 2026 (NITI Aayog).

Consensus Building: Address state concerns through revenue-sharing models to strengthen cooperative federalism.

Sectoral Clarity: Issue clear guidelines for emerging sectors (e.g., drones, e-commerce) to reduce litigation, learning from Singapore’s model of real-time tax clarifications.

Public Awareness: Launch campaigns to educate MSMEs on simplified compliance, leveraging initiatives like the Sahyog Portal.

The GST reforms represent a bold step towards simplifying India's tax landscape, with a clear focus on boosting consumption and easing the burden on ordinary citizens and businesses.

Source: PIB

|

PRACTICE QUESTION Q. Analyse the impact of GST rate rationalisation on India’s economic Growth. 150 words |

The GST Council moved from a four-tier to a two-tier tax slab structure (5% and 18%), with a special 40% rate for demerit goods.

GSTAT is a specialized body to resolve GST-related disputes, crucial for reducing litigation and ensuring a quick, expert resolution of tax issues.

It is when you pay more tax on the raw materials you buy than on the final product you sell, which creates a tax imbalance for businesses.

© 2026 iasgyan. All right reserved