GST transformed the indirect tax system, boosting revenue and formalizing the economy, but challenges like the exclusion of petroleum products, a complex rate structure, and delays in dispute resolution require reforms like phased inclusion of excluded sectors and deeper digital integration to achieve the "One Nation, One Tax" ideal and fuel economic growth.

Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

The Prime Minister announced next-generation GST reforms to simplify the tax structure and reducing taxes on daily items, will be implemented by Diwali 2025.

It is an indirect tax reform, implemented on July 1, 2017, unifies the complex indirect tax structure into a single, destination-based tax on the supply of goods and services.

Key features of GST

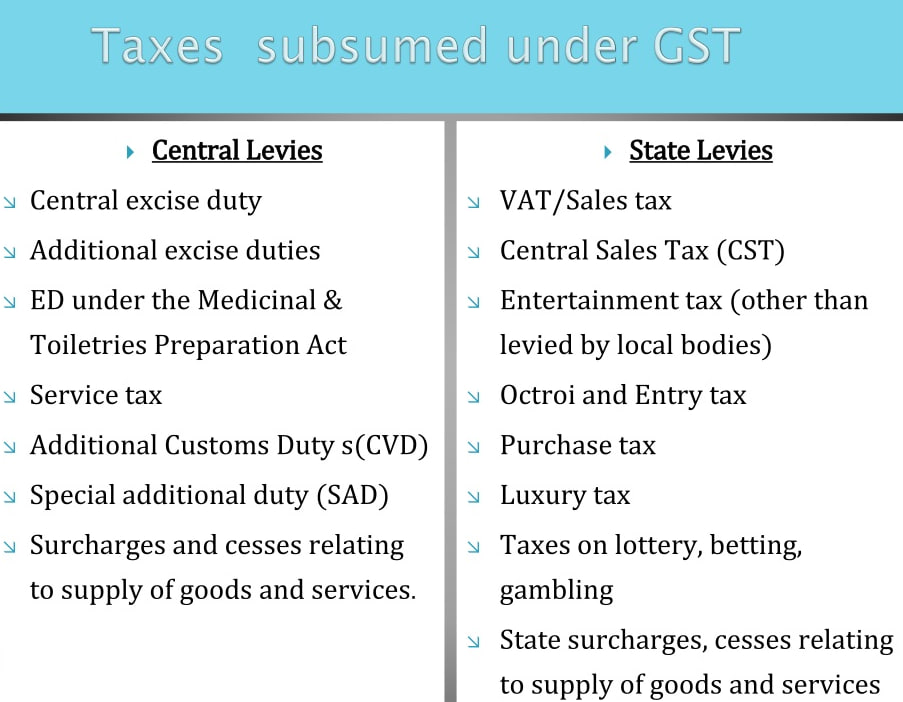

Key features of GSTUnified Tax System: GST replaced multiple Central and State indirect taxes, creating a single tax regime across India.

Constitutional Basis: The 101st Constitutional Amendment Act introduced GST by inserting Article 246A (granting concurrent power to Centre and States to legislate on GST) and Article 279A (establishing the GST Council).

Dual Structure: Both the Central and State governments concurrently levying taxes on intra-state supplies.

Value-Added Tax (VAT) Principle: GST is a value-added tax levied at each stage of the supply chain, but only on the value added at that stage, eliminating the cascading effect.

Input Tax Credit (ITC): Businesses can claim credit for the GST paid on inputs against their GST liability on outputs, preventing double taxation.

Destination-Based Consumption Tax: GST revenue accrues to the state where the goods or services are finally consumed.

Tax Slabs: GST rates are structured into 0%, 5%, 12%, 18%, and 28%. The GST Council determines the rates based on product classification.

GST Council Governance: The GST Council, a constitutional body established under Article 279A, governs GST.

Goods and Services Tax Network (GSTN): GSTN, a non-profit, non-government company, provides the shared IT infrastructure and services for the GST portal.

GST Compensation Cess: To compensate states for revenue losses during the initial five years of GST implementation (until July 1, 2022), the government levied a Compensation Cess on the supply of specific goods and services.

Record Revenue Growth: In FY 2024-25, gross collections hit a record ₹22.08 lakh crore, marking a 9.4% year-on-year growth, with an average monthly collection of ₹1.84 lakh crore.

Expanded Taxpayer Base: Number of registered taxpayers has increased from 65 lakh in 2017 to over 1.51 crore as of April 2025. This indicates increased formalization of the economy and enhanced tax compliance.

Digital Transformation and Compliance Efficiency: Over 95% of filings are now digital, this digitization reduces errors and fraud.

Enhanced Ease of Doing Business: GST's "One Nation, One Tax" framework replaced the multi-layered system, created a unified market and removed inter-state tax barriers like checkpoints and entry taxes.

Boost to 'Make in India': GST, with its destination-based taxation and IGST levy on imports, ensures equality between domestically produced goods and imported ones, making products more competitive.

Support for Micro, Small, and Medium Enterprises (MSMEs): GST introduced simplified compliance options for MSMEs, such as the composition scheme (paying a fixed rate with minimal paperwork for goods up to ₹1.5 crore and services up to ₹50 lakh turnover).

Efficient Refund Processing: Automated IGST refunds via the Customs ICEGATE portal have accelerated refund processing times to within a week.

Cooperative Federalism: The GST Council, a joint forum of the Centre and all states, has held 56 meetings and has made thousands of decisions, mostly through consensus, on complex issues like tax rates, rules, and exemptions, strengthening the federal fabric of the nation.

Anti-Evasion Measures: GST utilizes advanced technology and data analytics, including AI, to detect and curb evasion. Authorities detected over ₹2.23 lakh crore in GST evasion in FY 2024-25.

Consumer Benefits: Consumers benefit from the elimination of cascading taxes, leading to lower prices on many goods and services, and reduction in black market activities ensures consumers purchase genuine products.

Complex Rate Structure: Multiple tax slabs (0%, 5%, 12%, 18%, 28%), along with special rates (e.g., 0.25% for diamonds, 3% for jewellery) and exemptions, complicates classification, leading to disputes and litigation between taxpayers and authorities, as businesses attempt to classify goods under lower tax brackets.

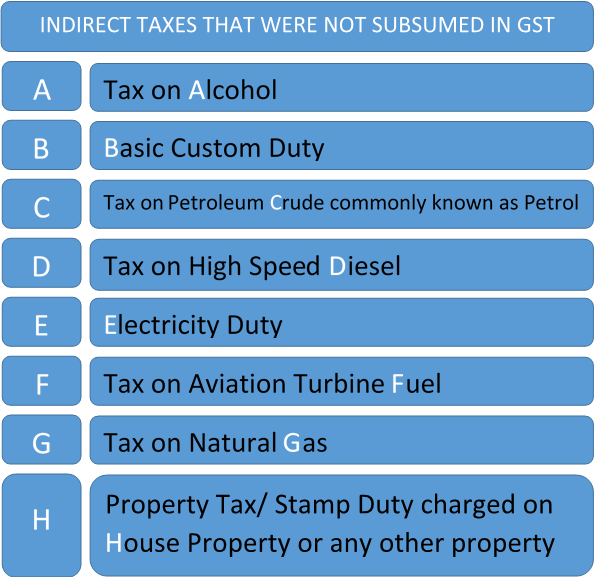

Exclusion of Key Sectors: Petroleum products (petrol, diesel, natural gas, ATF), alcohol for human consumption, and real estate currently remain outside the GST purview, leads to cascading tax effect, as businesses cannot claim Input Tax Credit (ITC) for excluded items, affecting their cash flow and increasing costs for consumers.

Delay in GST Appellate Tribunal (GSTAT): Dispute resolution process, creates uncertainty for taxpayers, and strains the judicial system. As of May 2025, there are over 8,100 pending GST cases.

Procedural and Compliance Hassles: Issues include frequent rule changes, the need to adapt to evolving return formats, and difficulties in navigating complex notifications.

Technological Hurdles: GST relies heavily on IT infrastructure (GSTN), technical glitches, system slowdowns during peak filing periods, and disparities in technology adoption among businesses remain challenges.

Inverted Duty Structure: Some sectors, like textiles and electric vehicles, face situations where the GST rate on inputs is higher than the rate on outputs.

Disparities in State Revenue Growth: Some states show strong growth (e.g., Maharashtra, Karnataka with 17-18.8% growth), while others lag, suggests uneven consumption patterns and concerns about revenue distribution.

Compliance Burden for Small Businesses: Micro, Small, and Medium Enterprises (MSMEs) lack the resources, digital literacy, and expertise to manage the complexities of GST compliance, increases their operational costs and hinder their profitability.

Lack of Transparency and Audit in Compensation: The Comptroller and Auditor General (CAG) had not audited the GST Compensation Fund for over six years.

Rate rationalization and simplification: Simplify the current multi-slab structure (5%, 12%, 18%, 28%) to a simple two-slab system (5% and 18%), with a special 40% rate for select demerit/sin goods.

Inclusion of excluded sectors: Include petroleum products (petrol, diesel, natural gas, ATF) and alcohol for human consumption under GST, to eliminate the cascading effect, and harmonize prices across states.

Strengthening dispute resolution: Full operationalization of the GST Appellate Tribunal to reduce the backlog of appeals and ensure faster, specialized dispute resolution.

Procedural simplification and technology enhancement: Implement technology-driven, time-bound registration processes, especially for small businesses and startups.

Strengthening the GSTN and Digital Infrastructure: Improve system robustness, and enhance user-friendliness for taxpayers.

GST revolutionized the tax system, boosting revenue and formalizing the economy by expanding the taxpayer base, but challenges persist with petroleum exclusion, a complex multi-rate structure, and delays in dispute resolution, necessitating reforms for a true "One Nation, One Tax" system and sustained economic growth.

Source: INDIAN EXPRESS

|

PRACTICE QUESTION Q. With reference to the Goods and Services Tax (GST) Council, which of the following functions falls under its purview? 1. Recommending the taxes, cesses, and surcharges to be subsumed in GST. 2. Deciding the date from which GST is to be levied on petroleum crude and high-speed diesel. 3. Establishing a mechanism to adjudicate disputes between the Centre and states. 4. Auditing the accounts of the Union and the states related to GST collections. Select the correct answer using the code given below: A) 1 and 2 only B) 1, 2 and 3 only C) 3 and 4 only D) 1, 2, 3 and 4 Answer: B Explanation: Statement 1 is Correct: The GST Council, under Article 279A(4) of the Constitution, is tasked with making recommendations to the Union and the States on matters including the taxes, cesses, and surcharges levied by the Centre, States, and local bodies that merged into GST. This was a core function of the Council in the initial stages of GST implementation, as it was responsible for transitioning from the previous multi-tax regime to a unified GST system. Statement 2 is Correct: Article 279A(5) of the Constitution empowers the GST Council to recommend the date from which GST shall be levied on petroleum crude, high-speed diesel, motor spirit (petrol), natural gas, and aviation turbine fuel. While these petroleum products are constitutionally included within the GST framework, the actual implementation depends on the Council's decision and government notification. Statement 3 is Correct: The GST Council plays a crucial role in dispute resolution between the Centre and states regarding GST matters. It acts as a forum where such disputes can be discussed and addressed, aiming to achieve consensus and resolve conflicts. Statement 4 is incorrect: While the GST regime includes various audit mechanisms, including audit by tax authorities and special audit provisions, the function of directly auditing the accounts of the Union and states related to GST collections does not specifically fall under the purview of the GST Council. These audits are carried out by tax authorities. |

GST, or Goods and Services Tax, is a comprehensive, multi-stage, destination-based indirect tax that has subsumed numerous central and state taxes, including Central Excise Duty, Service Tax, Countervailing Duty, Value Added Tax (VAT), Octroi, and Entry Tax.

It means the tax is levied at the point of consumption, so the tax revenue goes to the state where the goods or services are finally consumed, not the state where they are produced.

GSTAT is a specialized quasi-judicial body being set up to hear appeals against orders passed by GST authorities, providing a dedicated forum for dispute resolution.

© 2026 iasgyan. All right reserved