Description

Copyright infringement not intended

Picture Courtesy: Indian Express

Context:

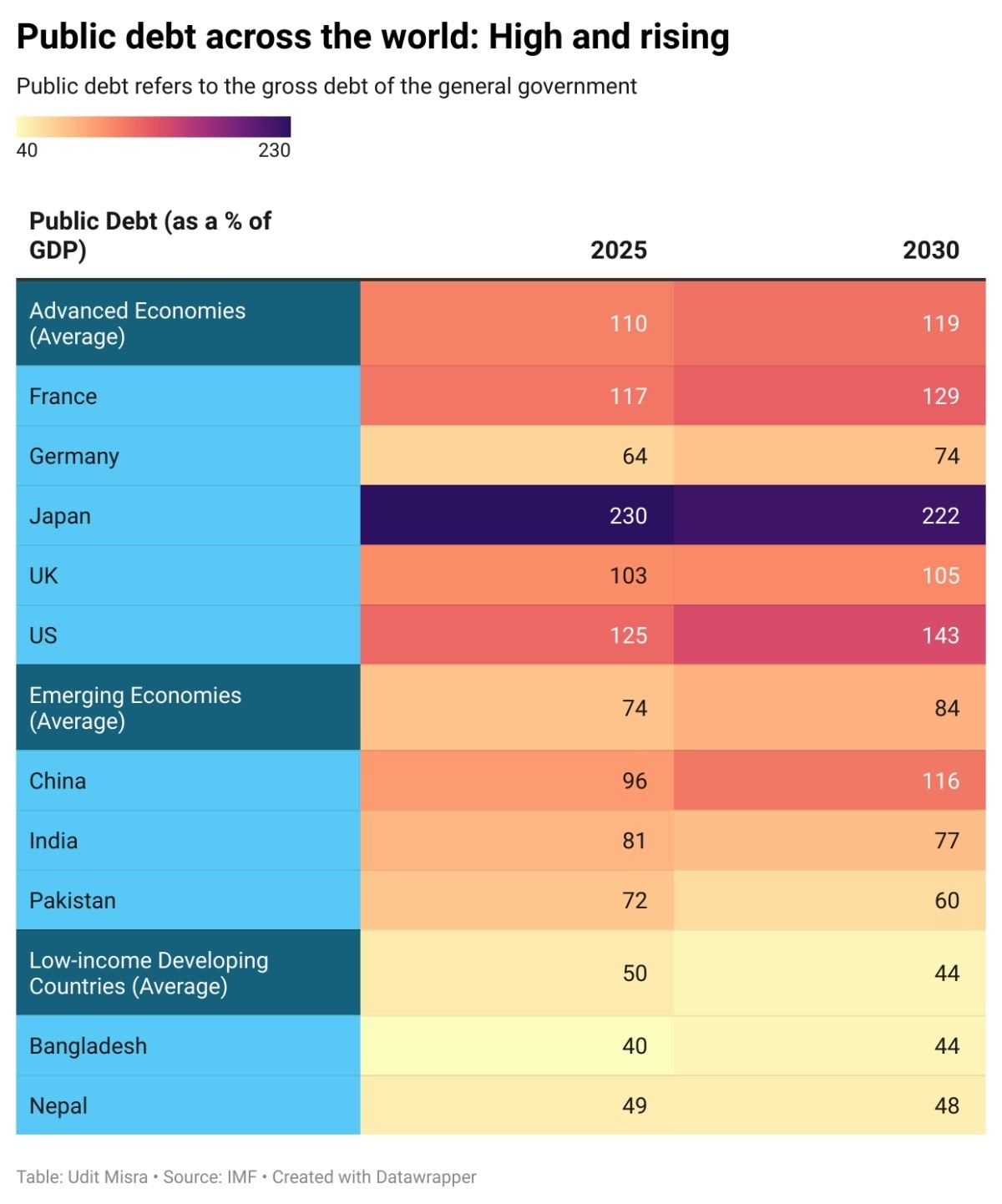

Recent reports from the International Monetary Fund (IMF) indicate that global public debt is expected to surpass 100% of GDP by 2029. Countries borrow to cover the difference between their spending and revenue, known as a fiscal deficit. Each year’s deficit adds to the total public debt, which is expressed as a percentage of a country’s GDP.

Current Status:

- Projected Growth: The International Monetary Fund (IMF) forecasts that global public debt will exceed 100% of global GDP by 2029, marking the highest level since 1948 (Source: The News Market)

- Debt Composition: As of mid-2025, global debt reached a record $337.7 trillion, with emerging markets accounting for over $109 trillion. The global debt-to-GDP ratio stands at approximately 324%, while emerging markets' ratio is around 242.4% (Source: Reuters)

- Contributing Factors: Increased government spending on defence, climate change, social welfare, and technology, coupled with rising interest rates, has led to higher borrowing costs

- Central Government Debt: India's central government debt was approximately ₹63 lakh crore (USD 736.3 billion) at the end of FY25, accounting for about 57.1% of GDP. The government has set a target to reduce this ratio to 47.5–52% by FY31 (Source: Business Standard)

- State Government Debt: The combined debt of all 28 states rose from ₹17.57 lakh crore in 2013–14 to ₹59.6 lakh crore in 2022–23, increasing from 16.66% to nearly 23% of Gross State Domestic Product (GSDP) (Source: Reddit)

- External Debt: India's external debt stood at ₹63.03 lakh crore (USD 736 billion) at the end of FY25, representing 19.1% of GDP (Source: The Times of India)

- FY25: The fiscal deficit for FY25 was ₹15.77 lakh crore (4.8% of GDP), slightly exceeding the target of ₹15.70 lakh crore (Source: mint)

- Q1 FY26: In the first quarter of FY26 (April–June 2025), the fiscal deficit reached ₹2.81 lakh crore, accounting for 17.9% of the full-year target (Source: Business Standard)

- Debt Reduction Plan: The government aims to reduce the debt-to-GDP ratio to 47.5–52% by FY31, with a target of 56.1% for FY26 (Source: Business Standard)

What is public debt?

Public debt (also called government or national debt) is the total amount of money a government owes to domestic and foreign lenders. It arises when government spending exceeds revenue, creating a fiscal deficit that is financed through borrowing. Public debt includes:

- Internal Debt – Borrowed from domestic sources such as banks, financial institutions, and citizens (via government bonds).

- External Debt – Borrowed from foreign governments, international organizations, or foreign investors.

Positive Implications

- Finances Development Projects: Enables government to invest in infrastructure, healthcare, education, and social welfare.

- Economic Stimulus: Borrowed funds can boost economic growth during downturns.

- Smooths Revenue Gaps: Helps governments meet expenditure commitments when revenue is insufficient.

Negative Implications

- High Interest Burden: More debt → more interest payments → less money for developmental expenditure.

- Tax Burden on Citizens: Government may raise taxes to repay debt, reducing disposable income.

- Crowding Out Private Investment: Excessive borrowing may increase interest rates, discouraging private sector investment.

- Economic Vulnerability: High debt-to-GDP ratios limit fiscal flexibility during economic shocks.

- Inflation Risk: Financing debt by printing money can lead to inflation.

Implication of High Public Debt:

Economic Implications

- Interest Burden: High debt increases government spending on interest payments, reducing funds for development.

- Crowding Out Private Investment: Heavy borrowing can raise interest rates, discouraging private sector investment.

- Inflationary Pressures: If debt is monetized (financed by printing money), it may trigger inflation.

- Reduced Growth Potential: Excessive debt can slow down long-term economic growth by diverting resources from productive investment.

Fiscal Implications

- Limited Fiscal Space: Governments have less flexibility to increase spending during economic crises.

- Higher Taxes: To service debt, governments may raise taxes, affecting disposable income and consumption.

- Austerity Measures: High debt may force spending cuts in welfare, healthcare, and infrastructure.

Social Implications

- Impact on Welfare: Reduced fiscal space may affect subsidies, pensions, and social safety nets.

- Income Inequality: Tax increases and spending cuts can disproportionately affect lower-income groups.

Political and Governance Implications

- Policy Constraints: High debt limits governments’ ability to introduce new reforms or stimulus packages.

- Risk of Public Unrest: Austerity or higher taxes can lead to social dissatisfaction and protests.

Global/Geopolitical Implications

- Dependence on Foreign Lenders: High external debt increases vulnerability to global financial conditions.

- Sovereignty Risks: Excessive reliance on foreign borrowing can limit a country’s policy autonomy.

- Credit Ratings: High debt may lower credit ratings, increasing borrowing costs and affecting foreign investment.

Challenges:

Fiscal Deficit Targets and Borrowing

- FY25 Fiscal Deficit: India's fiscal deficit was approximately 4.8% of GDP, slightly above the target of 4.7%–4.8% due to reduced capital expenditure and an unexpected ₹2.1 lakh crore dividend from the Reserve Bank of India. (Source: Reuters)

- FY26 Target: The government aims to reduce the fiscal deficit to 4.4% of GDP. However, challenges such as slower economic growth and potential external shocks may hinder this goal. (Source: Business Standard)

Revenue Shortfalls and Expenditure Pressures

- Revenue Shortfalls: As of February 2025, the government had achieved 80.9% of the full-year revenue target, indicating potential shortfalls in tax receipts and capital receipts. (Source: India Infoline)

- Expenditure Pressures: The government reduced its total expenditure target for FY25 to ₹47.16 trillion, reflecting efforts to control spending amidst revenue shortfalls. (Source: India Infoline)

State-Level Debt Concerns

- State Debt Growth: The combined public debt of all Indian states tripled from ₹17.57 lakh crore in 2013–14 to ₹59.6 lakh crore in 2022–23, increasing from 16.66% to nearly 23% of Gross State Domestic Product (GSDP). (Source: Reddit)

- High Debt States: States like Punjab (40.35% of GSDP), Nagaland (37.15%), and West Bengal (33.70%) exhibit particularly high debt burdens. (Source: Reddit)

Risks to Fiscal Consolidation

- Economic Growth Risks: External factors, such as increased U.S. tariffs on Indian goods, could slow economic growth and reduce revenue collection, complicating fiscal consolidation efforts. (Source: Reuters)

- State-Level Fiscal Health: States like Rajasthan have overspent by 16% over revenue in 2023–24, leading to a fiscal deficit of ₹31,491 crore, primarily due to expansive welfare schemes. (Source: The Times of India)

Government Measures:

|

Measure

|

Details

|

Objective / Impact

|

Source

|

|

Fiscal Deficit Reduction

|

Targeting 4.4% of GDP in FY26; focus on lowering debt-to-GDP ratio to 50% by FY31

|

Reduce debt burden and improve fiscal sustainability

|

Business Standard

|

|

Tax Reforms

|

New tax regime with 100% rebate up to ₹12 lakh; corporate tax incentives for MSMEs & startups

|

Stimulate consumption, investment, and revenue growth

|

Reddit

|

|

Expenditure Management

|

Prioritizing capital expenditure; rationalizing subsidies

|

Ensure efficient allocation of resources; stimulate infrastructure growth

|

General Govt. Budget Reports

|

|

Debt Management

|

Bond switch operations worth ₹32,000 crore for longer-tenure securities

|

Reduce redemption pressure; manage fiscal deficit efficiently

|

Economic Times

|

Way Forward:

Fiscal Deficit Reduction

- Target: Reduce fiscal deficit to 4% of GDP in FY26, down from 4.8% in FY25.

- Strategy: Shift focus from annual fiscal targets to a debt-to-GDP ratio, aiming to lower it to 50% by FY31 from the current 1%. (Source: CNBC)

Revenue Enhancement

- Tax Reforms: Implement a new tax regime with a 100% rebate up to ₹12 lakh, aiming to increase household disposable income and stimulate consumption. (Source: Reddit)

- Corporate Tax Incentives: Enhance tax incentives for MSMEs and startups to encourage investment and economic activity.

Expenditure Optimization

- Capital Investment: Prioritize capital expenditure to stimulate economic growth, with a focus on infrastructure development.

- Subsidy Rationalization: Revised subsidy allocations to ensure targeted and efficient use of resources.

Debt Management

- Bond Switch Operations: The Reserve Bank of India plans to switch ₹32,000 crore worth of bonds for longer-tenure securities to ease redemption burdens over the next three fiscal years, thereby helping to better manage the government's fiscal deficit. (Source: Reuters)

Global Confidence

- Credit Rating: Moody's has affirmed India's sovereign ratings, reflecting confidence in India's robust and fast-growing economy, substantial foreign reserves, and dependable domestic funding for its budget deficits. (Source: Reuters)

Source: Indian Express

|

Practice Question

Q. India’s public debt is rising steadily, with a debt-to-GDP ratio of around 57% in FY25. Critically examine the economic, social, and fiscal implications of high public debt. Suggest measures that the government can adopt to ensure fiscal sustainability while supporting growth (250 words)

|

Frequently Asked Questions (FAQs)

Public debt is the total amount borrowed by the government from domestic and external sources to finance budget deficits. It includes both central and state government borrowings.

As of FY25, India’s debt-to-GDP ratio is approximately 57%, including both central and state government debt.

- Persistent fiscal deficits (spending > revenue)

- Increased expenditure on welfare, subsidies, and infrastructure

- Rising interest costs on existing debt

- External shocks and economic slowdown