Disclaimer: Copyright infringement not intended.

Over the past two years, Indian solar module makers have rapidly expanded capacity to around 100 gigawatts (GW).

India has rapidly scaled up solar module production to around 100 GW, signaling its ambition to achieve its clean energy targets. However, a recent SBI Capital Markets report warns of looming oversupply risks, especially as US export incentives dwindle, potentially straining domestic industry dynamics amid falling international demand.

|

Category |

Waiver Eligibility & Duration |

|

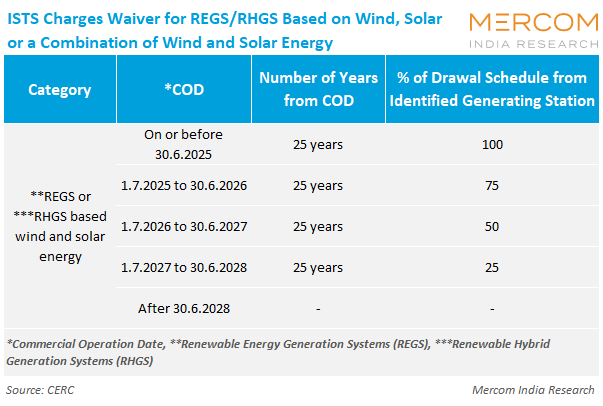

Solar/Wind/Hybrid Projects |

Commissioned on or before 30 June 2025 → 100% ISTS waiver for 25 years. Commissioned after 30 June 2025 up to 30 June 2028 → Graduated waiver: 75%, then 50%, then 25%. Commissioned after 30 June 2028 → No waiver. |

|

Battery Energy Storage Systems (BESS) |

Co-located with renewables, commissioned on or before 30 June 2028 → 100% waiver. Non-co-located BESS → Graded waiver, phased out by 30 June 2028. |

|

Pumped Storage Hydropower (PSP) |

Construction awarded on or before 30 June 2028 → 100% waiver. |

|

Hydropower (New projects) |

Projects with PPAs or construction awards between Dec 2022 and Jun 2028 → 18-year waiver, percentage depending on date. No waiver after 30 June 2028. |

|

Offshore Wind Projects |

Commissioned up to 31 December 2035 → Waiver gradually declines from 100% to 25% depending on commissioning year. No waiver after 31 Dec 2035. |

|

Green Hydrogen & Ammonia |

Projects commissioned up to 31 December 2033 → Waivers from 100% to 25%, based on commissioning year. Waiver applies if ≥ 51% power is from renewables/hydro/ESS. |

|

Force Majeure Extensions |

Projects facing uncontrollable delays can get up to two extensions of 6 months each, preserving waiver eligibility. |

|

Compliance via Self-Declaration |

BESS projects can self-declare 51% renewable usage; compliance verified annually. Non-compliance → billing without waiver. |

|

Terminal Bay Charge Clause |

If the terminal bay is energized but generation is delayed, the connectivity guarantor bears associated transmission charges. |

|

Dimension |

Details |

|

Global Status |

- 3rd in Solar, 4th in Wind, 4th in total RE capacity. - Solar: 2.63 GW (2014) → 108 GW (2025). - Wind: 51+ GW. - Targets: 500 GW non-fossil by 2030; 1,800 GW by 2047. |

|

Reforms Undertaken |

- Market-driven bidding replaced feed-in tariffs → tariffs fell from ₹10.95/unit (2010) to ₹1.99/unit (2021). - Waiver of Inter-State Transmission System (ISTS) charges → barrier-free RE flow across states. |

|

- PLI Scheme: Solar module capacity doubled (38 GW in Mar 2024 → 74 GW in Mar 2025). - PM Surya Ghar Yojana: 30 GW decentralized rooftop solar; 10 lakh households onboarded. - PM-KUSUM: 60% subsidy for solar pumps; farmer income + daytime power. - National Green Hydrogen Mission (NGHM): 5 MMT green hydrogen by 2030; supported by Green Energy Corridors. - Ethanol Blending Programme (EBP): Blending rose from 1.5% (2013) → 15% (2024); saved ₹1.26 lakh crore forex. - SATAT Initiative: 100+ CBG plants; 5% blending mandate by 2028. |

|

|

Emerging Frontiers |

- Offshore Wind: 37 GW tenders by 2030; pilots in Gujarat & Tamil Nadu. - Hybrid & RTC Power Policy: Wind-solar hybrids + FDRE for 24/7 clean energy. |

|

Investment & Global Leadership |

- International Solar Alliance (ISA): 100+ countries under One Sun, One World, One Grid. - FDI in RE: ~8% of inflows in FY25 (up from 1% in FY21). - RE-Invest 2024: Global investors committed ₹32.45 lakh crore by 2030. |

|

Dimension |

Current Scenario & Concern |

Suggested Course of Action |

|

Domestic Demand |

Strong, but capacity may exceed absorption by 2027 |

Maintain policy support while balancing production speed |

|

Export Markets |

Slowing, especially in the US |

Diversify exports (Africa, South America), invest in upstream |

|

Structural Weakness |

Weak domestic cell ecosystem |

Fast-track ALMM-II and incentivize upstream investments |

|

Global Oversupply |

Price pressures and volatility |

Strengthen trade defense, build cost efficiencies |

|

Strategic Policy |

Facing policy uncertainty globally |

Focus on infrastructure, credit access, ease of doing business |

India’s climb in solar module manufacturing is a vital step towards energy independence and achieving the 500 GW RE by 2030 goal under Paris commitments. But unchecked, this growth may transform into a glut—undermining profitability and long-term sustainability. Policy focus must now shift to building a resilient ecosystem: scaling up cells, diversifying markets, and enhancing trade defenses. Smart, balanced policymaking will ensure India harnesses solar power not just quantitatively, but sustainably.

READ- SOLAR POWER IN INDIA - IAS Gyan

Source: DOWN TO EARTH

|

PRACTICE QUESTION Q. India has rapidly expanded solar module manufacturing to 100 GW. Critically analyze the opportunities and challenges of this growth in the context of domestic energy goals and global market risks. (250 words) |

India scaled up to ~100 GW within two years due to policy support, rising demand, and private sector investment by firms like Waaree and Reliance.

The report warns of oversupply risks as US export incentives shrink, global demand slows, and India’s weak cell ecosystem adds cost pressures.

By diversifying export markets, strengthening domestic cell manufacturing via ALMM-II, and implementing trade defense measures to stabilize pricing.

© 2026 iasgyan. All right reserved