The GST reform aims to simplify the indirect tax regime, reduce compliance costs, and address the inverted duty structure. Despite potential inflation and revenue concerns, this reform is crucial for tax administration, formalization, and cooperative federalism.

Copyright infringement not intended

Picture Courtesy: Financial Times

Context

Recent GST 2.0 reforms are aimed at simplifying the tax structure, boosting compliance, and impacting various sectors differently depending on specific changes to rates, exemptions, or administrative processes.

|

Read All About: |

Key Outcomes of GST 2.0 Reforms

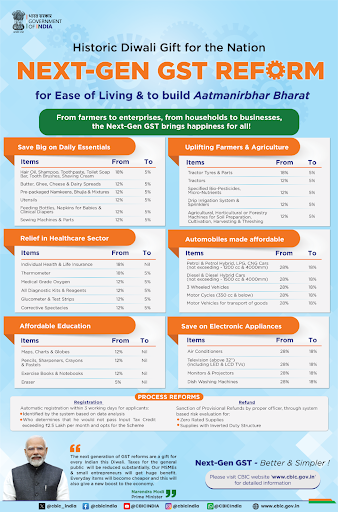

The 56th GST Council introduced a simplified tax structure and targeted reliefs to make goods and services more affordable while enhancing business efficiency.

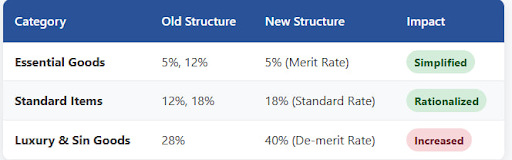

Two-Tier Tax Structure

Tax Relief for Essentials

Consumer Goods and Automotive

Healthcare Boost

Agricultural Support

Trade and Compliance Ease

Inverted Duty Structure Fix

Significance of GST 2.0 for Indian Economy

GST 2.0 builds on the GST, launched in 2017 via the 101st Constitutional Amendment Act, which unified multiple indirect taxes into a single, destination-based tax.

Economic Growth: A State Bank of India report estimates that GST 2.0, combined with income tax relief, will increase household disposable income by ₹5.31 lakh crore (1.6% of GDP), boosting consumption.

Simplified Compliance: The two-tier structure reduces disputes over product classification, saving businesses time and costs.

Sectoral Impact: Lower taxes on consumer goods, vehicles, and renewables drive demand in manufacturing and retail. MSMEs benefit from simplified registration and the composition scheme.

Cooperative Federalism: GST Council’s consensus-driven decisions, involving the Centre and all states, showcase India’s federal strength, though revenue concerns persist.

Global Resilience: By reducing reliance on external trade through stronger domestic demand, GST 2.0 counters global economic shocks, such as US tariffs.

Challenges in Implementing GST 2.0

Revenue Loss: The reforms may cause a ₹48,000–93,000 crore annual revenue shortfall, with states like Jharkhand (₹2,000 crore loss) and Jammu & Kashmir (10–12% reduction) hit hardest. Opposition-ruled states like Kerala and Tamil Nadu demand compensation.

State Resistance: States fear fiscal strain on social programs due to reduced revenue, complicating consensus. Past reforms, like the 55th meeting’s Invoice Management System, faced delays due to similar issues.

Implementation Gaps: Technical glitches in the GST Network (GSTN) during peak filing periods and disparities in digital literacy among MSMEs could delay benefits.

Lagged Economic Impact: Consumption benefits may take months to materialize, while tariff shocks hit immediately, risking short-term economic strain.

Excluded Sectors: Petroleum, alcohol, and real estate remain outside GST, causing cascading taxes and limiting input tax credit benefits.

Way Forward

Revenue Compensation: Create a transitional loan or revenue-sharing mechanism to support states, ensuring fiscal stability for social programs.

Include Excluded Sectors: Bring petroleum and alcohol under GST to eliminate cascading taxes and harmonize prices, as recommended by the 15th Finance Commission.

Strengthen GSTN: Upgrade GSTN infrastructure to handle peak loads and integrate with platforms like Customs ICEGATE for seamless data sharing.

Fast-Track GSTAT: Fully operationalize the GST Appellate Tribunal by December 2025 to clear the backlog of 8,100+ cases, ensuring faster dispute resolution.

Public Awareness: Launch campaigns via the Sahyog Portal to educate MSMEs on simplified compliance, drawing from Singapore’s real-time tax clarification model.

Policy Integration: Align GST reforms with trade policies and free trade agreements to boost exports, supporting “Make in India” goals.

Conclusion

GST 2.0 marks a bold step toward a simpler, citizen-centric tax system, reducing costs for essentials, boosting consumption, and easing business compliance. However, addressing revenue shortfalls, state concerns, and technical gaps is critical to realizing the vision of “One Nation, One Tax.”

Source: Financial Times

|

PRACTICE QUESTION Q. Analyze how the new GST tax slabs are likely to affect the Indian Economy. 150 words |

GST is an indirect, destination-based consumption tax levied on the supply of goods and services. It replaced multiple central and state taxes to create a unified national market.

The GST Council is the apex decision-making body on all matters related to GST. It is a constitutional body chaired by the Union Finance Minister and includes state finance ministers.

GSTN is a non-profit, non-government organization that provides the IT infrastructure and services for the GST portal, which is used for all GST-related activities, including registration and return filing.

© 2026 iasgyan. All right reserved