The IEA’s warning highlights India’s import-driven vulnerability but also a chance for transformation. By strengthening fossil fuel security, accelerating clean energy, and ensuring resilience, India can pursue Viksit Bharat 2047 with autonomy, sustainability, and leadership in a multipolar energy world.

Copyright infringement not intended

Picture Courtesy: DOWNTOEARTH

The International Energy Agency (IEA) report warns that faster global oil and gas declines threaten India’s import-heavy energy security, urging diversification, domestic exploration, and clean energy adoption to curb rising supply risks and price volatility.

|

International Energy Agency (IEA) Origin: It is an autonomous intergovernmental organization based in Paris, founded in 1974 within the framework of the Organisation for Economic Co-operation and Development (OECD) in response to the 1973–1974 oil crisis. Members: 32 member countries. Full members of the IEA must also be members of the OECD and are required to hold 90 days worth of oil imports as emergency stocks Association Countries: Created in 2015 to engage major non-members, this category includes large energy consumers and producers. There are 13 association countries, including India, China, and Brazil. Key publications: World Energy Outlook (WEO), Oil Market Report, Global EV Outlook |

Global oil and gas fields are depleting at faster rates than ever, due to the industry's shift toward resources like shale oil, tight oil, and deep offshore fields.

Accelerated Decline Rates

The average natural decline rate has increased. Without new investments, global oil production would drop by 5.5 million barrels per day (mb/d) annually. Natural gas output would fall by 270 billion cubic meters (bcm) per year, compared to 180 bcm in 2010.

Investment Dynamics

Nearly 90% of annual investments (exploration and production) are now required just to offset declines in existing fields, leaving little for expanding supply to meet growing demand.

This trend highlights supply-side pressures, with long development timelines (up to 20 years from licensing to production) amplifying risks of future shortages.

Supply and Price Risks

With existing fields declining, disruptions in key suppliers (e.g., Middle East, Russia) increase import costs.

India's crude import bill already exceeds $120 billion annually, and faster shale/offshore depletions could exacerbate volatility, pushing retail fuel prices higher and fueling inflation.

Energy Security Threats

Over 85% crude and 45% gas import dependency leaves India exposed to geopolitical tensions (e.g., Red Sea disruptions) and production delays.

The IEA warns that without new global projects, supply gaps could emerge in the 2030s-2040s, straining India's 5 million barrels per day (mb/d) consumption, projected to rise with economic growth.

Economic Ripple Effects

Higher energy costs could widen the current account deficit, deter manufacturing investments, hinder net-zero emissions by the 2070 goal, and targets under the Paris Agreement.

Events, like the 2022 Russia-Ukraine conflict, demonstrated how such shocks can add to inflation.

High Import Dependence

Sourcing 85%+ of needs from volatile regions limits bargaining power and exposes USA sanctions (Over Russia oil Import) and West Asia conflicts.

Domestic Exploration Barriers

Regulatory delays, environmental clearances, and low success rates hinder output growth. India's production is 540,000 bpd, a fraction of demand.

Investment Gaps

Upstream funding is constrained by global capital shifts to renewables; In 2024, global investment in energy and gas supply fell by 28%. (Source: World Investment Report 2025)

Geopolitical and Climate Risks

Strict global emission norms (eg. EU's Carbon Border Adjustment Mechanism) could restrict exports of India's refining surplus, while climate events disrupt supply chains.

Domestic Resource Push

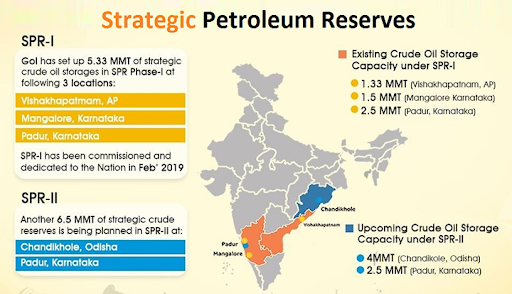

Reviving auctions under OALP (Open Acreage Licensing Policy) could unlock more output from untapped basins like KG Basin, reducing imports. Expand Strategic Petroleum Reserves to manage short term supply gaps.

Policy and Tech Reforms

Implement AI-driven predictive analytics for demand forecasting and ease-of-doing-business in upstream sectors.

Renewable Acceleration

Leverage 500 GW non-fossil target by 2030; solar/wind costs have fallen 80% since 2010, to enable import savings.

Green Tech Leadership

Opportunities in biofuels (20% ethanol blending by 2025) and green hydrogen (5 MT production target by 2030) position India as an exporter.

Diversify Sources

Negotiate long-term contracts with diverse suppliers (e.g., Africa/US) and integrate with International North–South Transport Corridor (INSTC) for faster logistics.

Expanding Liquefied natural gas (LNG) ties with West Asia/Australia and biofuels from Brazil could evade risks.

Global Partnerships: SCO/Quad collaborations for supply chain resilience, G20 advocacy for equitable transitions, push for WTO-compliant subsidies in clean tech to enhance India's voice in energy governance.

IEA’s warning highlights India’s energy vulnerability but also a chance to secure Viksit Bharat 2047 through resilient fossil strategies, clean energy transitions, and strategic autonomy in a multipolar world.

Source: DOWNTOEARTH

|

PRACTICE QUESTION Q. The accelerating decline in global oil and gas fields poses significant risks to India's energy security. Critically analyze. 150 words |

Global oil and gas fields are depleting faster due to reliance on shale and offshore resources, which have higher natural decline rates than conventional fields.

Without fresh investments, global oil production could drop by 5.5 million barrels per day annually, and natural gas by 270 billion cubic meters each year.

Rising import bills and price shocks can strain fiscal health, increase inflation, and affect industrial competitiveness without energy diversification.

© 2026 iasgyan. All right reserved